Regulate for What? A Closer Look at the Rationale and Goals of Digital Competition Regulations

For more on this topic, see the ICLE Issue Spotlight “Digital Competition Regulations Around the World.”

Executive Summary

Inspired by the European Union’s Digital Markets Act (DMA), a growing number of jurisdictions around the globe either have adopted or are considering adopting a framework of ex-ante rules to more closely regulate the business models and behavior of online platforms.

These digital competition regulations (“DCRs”) share two key features. The first is that they target so-called “gatekeepers” who control the world’s largest online platforms. Such regulations assume that these firms have accumulated a degree of economic and political power that allows them to harm competition, exclude rivals, exploit users, and possibly inflict a broader range of social harms in ways that cannot be adequately addressed through existing competition laws. Typically cited as examples of gatekeepers are the main platforms of Google, Amazon, Facebook/Meta, Apple, and Microsoft.

The second common features of these DCR regimes is that they impose similar, if not identical, per-se prohibitions and obligations on gatekeepers. These often include prohibitions on self-preferencing and the use of third-party party data, as well as obligations for interoperability and data sharing. These two basic characteristics set DCRs apart from other forms of “digital regulation”—e.g., those that concern with AI, privacy, or content moderation and misinformation.

This paper seeks to understand what digital competition regulations aim to achieve and whether a common rationale underpins their promulgation across such a broad swatch of territories.

A. Multiple and Diverging Goals?

We find that DCRs pursue multiple goals that may vary across jurisdictions. Some DCRs are guided by the same goals as competition law, and may even be embedded into such laws. Such is the case, e.g., in Germany and Turkey. Other regulations address competition concerns under differing or modified standards. Examples here include the “material-harm-to-competition” standard in the United States and, arguably, digital competition regulation in the UK and Australia—where traditional competition-law goals such as the protection of competition and consumer welfare comingle with an increased emphasis on “fairness.”

DCRs sometimes pursue a much broader set of goals. For instance, a prospective digital competition regulation in South Africa seeks greater visibility and opportunities for small South African platforms and increased inclusivity of historically disadvantaged peoples, along with other more competition-oriented objectives (this duality is a common feature of South African legislation). Similarly, a bill proposed in Brazil attempts to reduce regional and social inequality, as well as to widen social participation in matters of public interest, alongside its stated effort to protect competition.

In the United States, apart from protection of competition, proponents of the (now-stalled) DCR bills have invoked a broad set of potential benefits, including fairness; fair prices; a more level playing field; reduced gatekeeper power; protections for small and medium-sized enterprises (“SMEs”); reduced costs for consumers; and boosts to innovation.

Some DCRs, however, are not promulgated in pursuit of competition-oriented objectives at all—at least, not explicitly or not in the sense in which such objectives are understood in traditional competition law. The clearest example is the EU’s DMA itself, which openly eschews traditional competition-related goals and instead seeks to make digital markets “fair” and “contestable.”

B. A New Form of Competition Regulation

Regardless of the overarching goals, it is evident that DCRs incorporate themes and concepts familiar to the competition lawyer, such as barriers to entry, exclusionary conduct, competitive constraints, monopolistic outcomes, and, in some cases, even market power. This may, at first blush, hint at a close relationship between digital competition regulation and competition law. While not entirely incorrect, that assessment must come with a number of caveats.

DCRs diverge in subtle but significant ways from mainstream notions of competition law. We posit that DCRs are guided by three fundamental goals: wealth redistribution among firms, the protection of competitors of incumbent digital platforms, and the “leveling down” of those same digital platforms.

C. Rent Redistribution Among Firms

The notion of “gatekeepers” itself presumes asymmetrical power relations between digital platforms and other actors, which are further presumed both to lead to unfair outcomes and to be insurmountable without regulatory intervention. Thus, the first commonality among the DCRs we study is that they all seek to transfer rents directly from gatekeepers to rival firms, complementors, and, to a lesser extent, consumers. This conclusion follows inexorably from the DCRs’ stated goals, the prohibitions and obligations they promulgate, and the public statements of those who promote them.

While the extent to which various groups are intended to benefit from this rent re-allocation might not always be identical, all DCRs aim to redistribute rents generated on digital platforms away from gatekeepers and toward some other group or groups—most commonly the business users active on those platforms.

D. Protection of Competitors

Another important feature that DCRs share is the common goal not just to protect business users, but to directly benefit competitors—including, but not limited to, via rent redistribution. DCRs are concerned with ensuring that competitors—even if they are less efficient—enter or remain on the market. This is evidenced by the lack of overarching efficiency or consumer-welfare goals—at the very least, for those regulations not based on existing competition laws—that would otherwise enable enforcers to differentiate anticompetitive exclusion of rivals from those market exits that result from rivals’ inferior product offerings.

This focus on protecting competitors can also be seen in DCRs’ pursuit of “contestability.” As defined by DCRs, promoting contestability entails diminishing the benefits of network effects and the data advantages enjoyed by incumbents because they make it hard for other firms to compete, not because they are harmful in and of themselves or because they have been acquired illegally or through deceit. In other words, DCRs pursue contestability—understood as other firms’ ability to challenge incumbent digital platforms’ position—regardless of the efficiency of those challengers or the ultimate effects on consumers.

E. ‘Leveling Down’ Gatekeepers

The other way that DCRs seek to balance power relations and achieve fairness is by “leveling down” the status of the incumbent digital platforms. DCRs directly and indirectly worsen gatekeepers’ competitive position in at least three ways:

- By imposing costs on gatekeepers not borne by competitors;

- By negating gatekeepers’ ability to capitalize on key investments; and

- By facilitating third parties’ free riding on those investments.

For example, prohibitions on the use of nonpublic (third-party) data benefit competitors, but they also negate the massive investments that incumbents have made in harvesting that data. Similarly, data-sharing obligations impose a cost on gatekeepers because data-tracking and sharing is anything but free. Gatekeepers are expected to aid and subsidize competitors and third parties at little or no cost, thereby diminishing their competitive position and dissipating their resources (and investments) for the benefit of another group. The same can be said, mutatis mutandis, for other staples of digital competition regulation, such as prohibitions on self-preferencing and sideloading mandates.

F. The Perils of Redistributive and Protectionist Competition Regulation

It should be noted, of course, that direct rent redistribution among firms is generally not the goal of competition law. Rent redistribution entails significant risks of judicial error and rent seeking. Regulators may require firms to supply their services at inefficiently low prices that are not mutually advantageous, and may diminish those same firms’ incentives to invest and innovate. Those difficulties are compounded in the fast-moving digital space, where innovation cycles are faster, and yesterday’s prices and other nonprice factors may no longer be relevant today. In short, rent redistribution is difficult to do well in traditional natural-monopoly settings and may be impossible to do without judicial error in the digital world.

Protecting competitors at the expense of competition, as DCRs aim to do, is equally problematic. Competition depresses prices, increases output, leads to the efficient allocation of resources, and encourages firms to innovate. By facilitating competitors—including those that may have fallen behind precisely because they have not made the same investments in technology, innovation, or product offerings—DCRs may dampen incentives to strive to become a so-called gatekeeper, to the ultimate detriment of consumers. Protecting competition benefits the public, but protecting competitors safeguards their special interests at the public’s expense.

This is not only anathema to competition law but also to free competition. As Judge Learned Hand observed 80 years ago in his famous Alcoa decision: “the successful competitor, having been urged to compete, must not be turned upon when he wins.” Critiques of digital competition regulation’s punitive impulse against incumbent platforms flow from this essential premise—which, we contend, is the cornerstone of good competition regulation. The multiplicity of alternative justifications put forward by proponents of such regulations are generally either pretextual or serve as a signal to the voting public. To paraphrase Aldous Huxley: “several excuses are always less convincing than one.”

We end by speculating that digital competition regulation could signal more than just a digression from established principles in a relatively niche, technical field such as competition law. If extended, the DCR approach could mark a new conception of the roles of companies, markets, and the state in society. In this “post-neoliberal” world, the role of the state would not be limited to discrete interventions to address market failures that harm consumers, invoking general, abstract, and reactive rules—such as, among others, competition law. It would instead be free to intercede aggressively to redraw markets, redesign products, pick winners, and redistribute rents; indeed, to function as the ultimate ordering power of the economy.

Ultimately, however, we conclude that it is too early to make any such generalizations, and that only time will tell whether digital competition regulation was truly a sign of things to come, or merely a small but ultimately insignificant abrupt dirigiste turn in the zig-zagging of antitrust history.

Introduction

Inspired by the European Union’s Digital Markets Act (“DMA”),[1] a growing number of jurisdictions around the globe either have adopted or are considering adopting a framework of ex-ante rules to more closely regulate the business models and behavior of online platforms.

These “digital competition regulations”[2] (“DCRs”) share two key features. The first is that they target so-called “gatekeepers” who control the world’s largest online platforms. Such regulations assume that these firms have accumulated a degree of economic and political power that allows them to harm competition, exclude rivals, exploit users, and possibly inflict a broader range of social harms in ways that cannot be adequately addressed through existing competition laws.[3] Typically cited as examples of gatekeepers are the main platforms of Google, Amazon, Facebook/Meta, Apple, and Microsoft.

The second common feature these DCR regimes share is that they impose similar, if not identical, per-se prohibitions and obligations on gatekeepers. These often include prohibitions on self-preferencing and the use of third-party party data, as well as obligations for interoperability and data sharing. These two basic characteristics set DCRs apart from other forms of “digital regulation”—e.g., those dealing with AI,[4] privacy,[5] or content moderation and misinformation.[6]

It is not, however, always entirely clear what DCRs aim to achieve. A cursory survey suggests that these rules pursue different goals, without an immediately apparent unifying theme. For example, some DCRs have been integrated into existing competition laws and ostensibly pursue the same goals: the protection of competition and consumer welfare. Others aim for a range of goals—including, but not limited to, competition—such as the protection of small and medium-sized enterprises (“SMEs”); regional equality; social participation; and improving the lot of business users who operate on online platforms. Some DCRs purposefully and explicitly sidestep competition-oriented considerations, aiming instead for such adjacent but ultimately distinct goals as “fairness” and “contestability.”[7]

What emerges is a seeming patchwork of goals and objectives. In this paper, we seek to assess those disparate goals and objectives, drawing on many of the major proposed and enacted DCRs.

Part I examines the goals that DCRs claim to pursue. It takes those goals at face value and offers a largely descriptive account of the objectives offered. Where necessary (such as, for example, where those goals are cryptic or not clearly articulated), reference is made to public statements by those who promulgated them.

Part II argues that DCRs are best understood as a new form of law, grounded in ideas that have found limited success in competition law itself. To some extent, DCRs are based on a common narrative that has transformed some of the core principles and themes of antitrust law. As such, DCRs partially jibe with antitrust law, but ultimately diverge from it in subtle but consequential ways.

Part III argues that, despite superficial differences, DCRs share three common goals. The first is a desire to redistribute rents from some companies to others. At the most fundamental level, DCRs all seek to address what are perceived to be extreme power imbalances between digital platforms and the rest of society—especially business users and competitors. Thus, they seek to redistribute rents away from so-called “gatekeepers” and toward the business users that operate on those platforms, and to promote competitors (including, but not limited to, via rent redistribution).

DCRs are particularly concerned with ensuring that competitors, even if they are less efficient, enter or remain in the market. This is evidenced by a lack of overarching efficiency or consumer-welfare goals—even in those regulations that are based on existing competition laws—that would otherwise enable enforcers to differentiate between anticompetitive exclusion of rivals and market exit that results from rivals’ inferior product offerings. The focus on protecting competitors also stems from DCRs’ pursuit of “contestability.” In this context, promoting contestability entails diminishing the benefits of the network effects and the data advantages enjoyed by incumbents on the theory that they make it difficult for other firms to compete—not because they are harmful to consumers or because they have been acquired illegally or through deceit.

The third way that DCRs seek to balance power relations and achieve fairness is by “leveling down” the status of the incumbent digital platforms. DCRs worsen the competitive position of gatekeepers in at least three ways:

- By imposing costs on gatekeepers not borne by competitors;

- By negating their ability to capitalize on key investments; and

- By helping third parties to free ride on those investments.

Essentially, gatekeepers are expected to aid and subsidize competitors and third parties at little or no cost. This, in turn, diminishes their competitive position and dissipates their resources (and investments) for the benefit of another group.

Part IV concludes. It speculates that DCRs might signal the advent of a new paradigm in political economy: a redrawing of the existing lines and roles between states, markets, and firms, with greater emphasis on the role of the state as the ultimate ordering power of the economy. In hindsight, one expression of this could turn out to be the overturning (if only partial) of the essential principles of modern competition policy: the protection of competition rather than competitors, a policy emphasis on maximizing economic output rather than rent redistribution among firms, and a commitment to merit, rather than fairness and equity. It is difficult to overstate how deeply at loggerheads this conception of the role of competition is from the existing, predominant paradigm long found in competition law.

I. A Cacophony of Goals in Digital Competition Regulation

Most DCRs pursue multiple overlapping objectives. The global picture is even more complex, as there is only partial overlap among the various goals pursued by DCRs in different jurisdictions.

Some DCRs are an extension of competition-law frameworks and are sometimes even formally embedded into existing competition laws. In principle, this means that the standard goals and rationale of competition law apply. Germany, for instance, recently amended its Competition Act, emphasizing the need to “intervene at an early stage in cases where competition is threatened by certain large digital companies.”[8] According to the Bundeskartellamt:

The newly introduced Section 19a probably represents the most important change as the Bundeskartellamt will now be able to intervene at an early stage in cases where competition is threatened by certain large digital companies. As a preventive measure the Bundeskartellamt can prohibit certain types of conduct by companies which, due to their strategic position and their resources, are of paramount significance for competition across markets.[9]

Similarly, Turkey currently is looking to amend the Turkish Competition Act with the objectives of promoting competition and innovation in digital markets; protecting consumer and business rights; and ensuring that gatekeepers do not engage in anticompetitive practices.[10] Proponents argue that the current Turkish Competition Act is not adequately equipped to address anticompetitive conduct in digital markets—such as, e.g., that the process of defining relevant markets is inappropriate for dynamic and global digital ecosystems and that specific regulations are needed due to the network effects that digital platforms confer.[11] These are all nominally competition-related concerns.[12] Other proposed changes to the Turkish Competition Act similarly reflect an increased emphasis on competition. For instance, in merger analysis, the current “dominance test” would be substituted with a “significant impediment to effective competition test,” similar to that in the EU merger-control regime. A “de minimis” rule would also be added to Article 41 to exempt agreements “that do not significantly impede competition.”

Other DCRs appear, at least to some extent, to pursue competition-law-inspired goals, despite not being formally incorporated into existing competition laws. In South Korea, for example, the Korean Fair Trade Commission (“KFTC”) recently proposed a draft DMA-style bill, the Platform Competition Promotion Act, whose purpose is establish ex-ante rules to restore competition rapidly in designated markets “without the tedious process of defining a relevant market through economic analysis.”[13] According to the KFTC, digital competition regulation is necessary to combat monopolization in digital markets, where monopolies tend to become entrenched.[14] As some observers have noted,[15] the Platform Competition Promotion Act covers conduct already addressed by South Korea’s existing Monopoly Regulation and Fair Trade Act.[16] Thus, while the draft bill is likely to be passed as a separate piece of legislation, there appears to be a continuum between it and South Korean competition law.

In the United Kingdom, the 2023 Digital Markets, Competition, and Consumer Bill (“DMCC”) is in the final stages of legislative approval.[17] The DMCC aims to “provide for the regulation of competition in digital markets” and, in theory, dovetails with goals pursued by competition law (it even invokes familiar competition-law themes, such as market power).[18] The DMCC would grant the UK antitrust enforcer, the Competition and Markets Authority (“CMA”), power to take “pro-competition interventions” where it has reasonable grounds to believer there may be an adverse effect on competition.[19]

The DMCC has, however, also been touted as a tool to “stamp out unfairness in digital markets.”[20] This could refer to the bill’s consumer-protection provisions, which would prohibit, inter alia, unfair commercial practices.[21] But it may also suggest that the DMCC goes beyond the remit of traditional competition law, in which “unfairness” is generally not central, except within the relatively narrow confines of the abuse-of-dominance provision under S.18 of the Competition Act.[22]

Further, in a press release welcoming the DMCC draft, the CMA enumerated the bill’s benefits as falling into the three categories of “consumer protection,” “competition,” and “digital markets.”[23] The second category grants the CMA increased powers to “identify and stop unlawful anticompetitive conduct more quickly.”[24] The third, however, proposes that the bill will “[enable] all innovating businesses to compete fairly.”[25] This could imply that competition rules in “digital markets” would be governed by different principles than those that apply in “traditional” markets—that is, those that do not involve the purchase or sale of goods over the internet, or the provision of digital content.[26] The DMCC’s provisions on “digital markets” are also formally separate from those on “competition.”[27]

In Australia, the Australian Competition and Consumers Commission (“ACCC”) is conducting a five-year digital-platform-services inquiry (“DPS Inquiry”), set to be finalized in March 2025.[28] The ACCC recommended, as part of the inquiry’s fifth interim report, service-specific obligations (similar to the UK’s proposed ex-ante rules) for “designated” digital platforms.[29] These would serve to address “anticompetitive conduct, unfair treatment of business users and barriers to entry and expansion that prevent effective competition in digital platform markets.”[30] Thus, alongside competition law’s traditional concerns (e.g., harms and benefits to consumers, innovation, efficiency, and “effective competition”), the ACCC would also incorporate concerns over “fairness” and, especially, the protection of business users.

In the United States, several bills have been put forward that are formally separate from existing antitrust law, but cover some of the same conduct as would typically be addressed under U.S. antitrust law—albeit with seemingly different goals and standards. Some of these new goals and standards represent only slight variations on the usual goals of competition law. Three main pieces of legislation have so far been put forward: the American Innovation and Choice Online Act (“AICOA”),[31] the Open App Market Act (“OAMA”),[32] and the Augmenting Compatibility and Competition by Enabling Service Switch Act (“ACCESS Act”)[33] (together, “U.S. tech bills”).

Although the U.S. tech bills largely fail to describe their underlying goals, the titles of the bills and statements made by their sponsors suggest a set of overlapping concerns, such as preventing “material harm to competition,”[34] reducing “gatekeeper power in the app economy,”[35] and “increasing choice, improving quality, and reducing costs for consumers.”[36] These goals appear to fall relatively well within the traditional remit of antitrust law.

But there are others. According to U.S. Sen. Amy Klobuchar (D-Minn.), the primary sponsor or cosponsor of several of the U.S. tech bills, AICOA is intended to “restore competition online by establishing commonsense rules of the road,” “ensure small businesses and entrepreneurs still have the opportunity to succeed in the digital marketplace,” and “create a more even playing field,” all “while also providing consumers with the benefit of greater choice online.”[37] “Fairness,” “fair prices,” and “innovation” all have also been invoked by the bills’ supporters.[38]

At the same time, for three out of the 10 types of challenged conduct, AICOA would require demonstrating “material harm to competition,” which would suggest that one of that bill’s goals is to protect competition. As the American Bar Association’s Antitrust Section has observed, however, there is no “material harm to competition” standard in U.S. antitrust law.[39] This suggests that AICOA may posit a different interpretation of what it means to protect competition, or of what sort of competition should be protected, than does traditional U.S. antitrust law.

OAMA, on the other hand, aims to open competitive avenues for startup apps, third-party app stores, and payment services in existing digital ecosystems.[40] Its title reads: “to promote competition and reduce gatekeeper power in the app economy, increase choice, improve quality, and reduce costs for consumers.” Unlike AICOA, however, OAMA would not require a showing of harm to competition—material or otherwise—to establish liability, which appears to suggest that competition might be less of a concern than the bill’s title implies.

Finally, the ACCESS Act is intended to “promote competition, lower entry barriers and reduce switching costs for consumers and businesses online.”[41] U.S. Sen. Mark Warner (D-Va.), the bill’s primary sponsor, has said that the ACCESS Act will promote competition, allow startups to “compete on equal terms with the biggest social media companies,” and “level the playing field between consumers and companies” by giving them more control over who manages their privacy.[42] Again, these are antitrust-adjacent objectives, but with a flavor (“equal terms,” “level playing field,” etc.) that is largely foreign to U.S. antitrust law.

Other DCRs pursue a mix of competition and noncompetition goals. The South African Competition Commission’s (“SACC”) Final Report on the Online Intermediation Platforms Market Inquiry, for example, found that remedial actions similar to the ex-ante rules contemplated in the DMA and elsewhere are needed to grant “[g]reater visibility and opportunity for smaller South African platforms” to compete with international players; “[e]nabl[e] more intense platform competition,” offer “more choice and innovation”; reduce prices for consumers and business users; “[p]rovid[e] a level playing field for small businesses selling through these platforms, including fairer pricing and opportunities”; and “[p]rovid[e] a more inclusive digital economy” for historically disadvantaged peoples.[43]

In a similar vein, Brazil’s proposed law PL 2768/2022 (“PL 2768”) pursues an expansive grab-bag of social and economic goals.[44] Article 4 states that targeted digital platforms must operate based on the following principles: freedom of initiative, free competition, consumer protection, a reduction in regional and social inequality, combatting the abuse of economic power, and widening social participation in matters of public interest.[45] In addition, PL 2768 also states as objectives that it will enable access to information, knowledge, and culture; foster innovation and mass access to new technologies and access models; promote interoperability among apps; and enable data portability.[46]

Finally, there are those DCRs that claim not to pursue competition-oriented goals at all. The DMA has two stated goals: “fairness” and “contestability,”[47] and explicitly denies being bound by, or even pursuing, the traditional goals of competition law: protecting competition and consumer welfare.[48] According to the DMA, competition, consumer welfare, and efficiency considerations such as those that underpin antitrust law are not relevant under the new framework. This is, according to the DMA’s text, because the goals of competition law and the DMA “are complimentary but ultimately distinct.”[49]

Interestingly, however, few other DCRs have so steadfastly disavowed competition considerations, even those that copy the DMA’s provisions verbatim. India is a case in point. In 2023, a report by the Standing Committee on Finance argued that, if digital competition regulation was not passed, “interconnected digital markets will rapidly demonstrate monopolistic outcomes that prevent fair competition. This will restrict consumer choice, inhibit business users, and prevent the rise of dynamic new companies.”[50] These concerns jibe with traditional antitrust goals, as indicated inter alia by the report’s title (“anti-competitive practices by big tech companies”). Later, another report—the Report of the Committee on Digital Competition Law (“CDC Report”)—proposed a Draft Digital Competition Bill (“DCB”).[51] According to the CDC Report, DMA-style digital competition regulation was needed to supplement the 2002 Indian Competition Act (“ICA”),[52] which—and here is the interesting part—supposedly also aims to promote “fairness and contestability.”[53]

But the ICA’s stated aims were the protection of competition, the interests of consumers, and free trade.[54] The Report of the High-Powered Expert Committee on Competition Law and Policy (“Raghavan Committee Report”),[55] which served as the basis for the ICA, modernized Indian competition law by moving it away from the structure-based paradigm of the earlier Anti-Monopolies and Restrictive Trade Practices Act of 1969 and toward an economic-effects-based analysis. The Raghavan Committee Report was unequivocal in its support of consumer welfare as the system’s ultimate goal.[56] Moreover, the report advised against a plurality of goals, including, specifically, “bureaucratic perceptions”[57] of equity and fairness, which, it argued, were mutually contradictory, difficult to quantify, and potentially opposed to the sustenance of free, unfettered competition.[58] It is therefore curious, to say the least, that the CDC Report would now, in hindsight, recast the ICA’s goals to support essentially the opposite idea.

The multiplicity of goals and their unclear, partially overlapping relationship with competition law raises questions about how we should think about these laws and, indeed, whether we can even think of them as a coherent, unified group. In the next section, we seek to untangle the nature and classification of digital competition regulation.

II. A New Form of Competition Regulation

DCRs are likely best understood as a new form of competition regulation. As some authors have noted, the precise relationship between competition law and the EU’s DMA is difficult to pinpoint.[59] In a similar vein, it is evident that many DCRs incorporate themes and concepts familiar to the competition lawyer, such as barriers to entry, exclusionary conduct, competitive constraints, monopolistic outcomes, and, in some cases, even market power. At first blush, this may suggest a direct relationship between digital competition regulation and competition law. While not entirely incorrect, that assessment comes with considerable caveats.

In this section, we argue that DCRs are a new form of competition regulation that diverges in subtle but definitive ways from mainstream notions of competition law. In essence, DCRs take plausible competition-law themes and alter and subvert them in fundamental ways, creating what could be described as sector-specific[60] or enforcer-friendly[61] competition laws. Due to their blend of competition principles and prescriptive, top-down regulatory provisions, we have opted for the term “digital competition regulation.” To understand their nature, we must start with their underlying assumptions and the ills they claim to address.

A. The DCR Narrative

A starting assumption of all DCRs is that there is an extreme imbalance of power between large digital platforms and virtually every other stakeholder with whom they deal—from other industries to the businesses that operate on digital platforms to their competitors to, finally, end-users.[62] Even governments are often presumed to be virtually powerless in the face of the depredations of so-called “Big Tech.”[63] The adage that “big tech has too much power” has been almost universally endorsed by proponents of DCRs and strong antitrust enforcement;[64] is explicitly or implicitly embedded into those DCRs;[65] and now also permeates popular discourse, media, and entertainment.[66] The corollary is that asymmetric regulation is needed to help those other actors that have been “dispossessed” by big-tech platforms.

This notion is widespread and underpins a range of other policy proposals, not just DCRs. For example, the EU is considering a “Fair Share” regulation that would address the supposed power imbalance between tech companies and telecommunications operators, by forcing the former to pay for the infrastructure of the latter.[67] Similarly, various “bargaining codes” either already have been adopted or are currently under consideration to force tech companies to pay news publishers. In Australia, the Treasury Laws Amendment (News Media and Digital Platforms Mandatory Bargaining Code) Act 2021 (“Bargaining Code”) was put in place to address the supposed bargaining-power imbalance between digital platforms and news-media businesses.[68] According to the ACCC, digital-advertisement regulation was necessary to support the sustainability of the Australian news-media sector, “which is essential to a well-functioning democracy.”[69] Laws with a similar rationale have also been passed or are under consideration in other jurisdictions.[70]

All these initiatives originate from the same foundational assumption, which is that tech companies are more powerful than anyone else, and are therefore able to get away with imposing draconian conditions unilaterally that allow them to benefit disproportionately at the expense of all other parties, business users, complementors, and consumers. While it is not always easy to identify a coherent thread running through the rules and prohibitions contained in DCRs and other initiatives to regulate “Big Tech,” a good rule of thumb to understand the unifying logic behind these initiatives is that digital platforms should have less “power,” and other stakeholders should have more “power.”

Sometimes—but by no means always—this also encompasses familiar notions of “market power,” i.e., firms’ ability to profitably raise prices because of the absence of sufficient competition. In fact, in most DCRs, “power” stems from the fact that an online platform is an important gateway for business users to reach consumers.[71] This is considered manifestly evident by the platform’s size, turnover, or “strategic” importance.[72] As Bundeskartellamt (the German competition authority) President Andreas Mundt has put it: “we shouldn’t talk about this narrow issue of price, we should talk about power.”[73]

DCRs embody this principle. They seek to extract better deals for the party or parties that are considered to suffer from an imbalance of bargaining power vis-à-vis digital platforms—such as, for instance, through interoperability and data-sharing mandates. As we argue in Section III, these beneficiaries are intended to be the platform’s business users and competitors.

The reasoning is as follows. The asymmetrical power relations between digital platforms and other actors are presumed to lead to unfair outcomes in how these stakeholders are treated and the ways that rents are allocated across the supply chain. As the DMA explains in its preamble:

The combination of those features of gatekeepers is likely to lead, in many cases, to serious imbalances in bargaining power and, consequently, to unfair practices and conditions for business users, as well as for end users of core platform services provided by gatekeepers, to the detriment of prices, quality, fair competition, choice and innovation in the digital sector.[74]

Once it is accepted that power relations between digital platforms and other stakeholders are unfairly skewed, any outcome resulting from the interaction of the two groups must also, by definition, be “unfair.” For example, under the DMA, “unfairness” is broadly defined as “an imbalance between the rights and obligations of business users where the gatekeeper obtains a disproportionate advantage.”[75] A “fair” outcome would be one in which market participants—including, but not limited to, business users—“adequately” capture the benefits from their innovations or other efforts, something the DMA assumes is currently not taking place due to gatekeepers’ superior bargaining power.

In the world of digital competition regulation, “unfairness” is a foregone conclusion. And, sure enough, the concept of “fairness” is the central normative value driving these regulations. Proponents liberally invoke it[76] and it features prominently in DCRs.[77] This narrative, however, is built on premises that differ markedly from those of antitrust law. We discuss these below.

B. Key Differences in First Principles

The DMA is the original blueprint for all digital competition regulation that has followed in its wake. The DMA’s text states that it is distinct from competition law:

This Regulation pursues an objective that is complementary to, but different from that of protecting undistorted competition on any given market, as defined in competition-law terms, which is to ensure that markets where gatekeepers are present are and remain contestable and fair, independently from the actual, potential or presumed effects of the conduct of a given gatekeeper covered by this Regulation on competition on a given market. This Regulation therefore aims to protect a different legal interest from that protected by those rules and it should apply without prejudice to their application.[78]

Other DCRs are rarely so candid about their break with competition law. On the contrary, some are even outwardly couched in competition-based terms. But in the end, DCRs replicate all or most of the prohibitions and obligations pioneered by the DMA.[79] DCRs also apply largely to the same companies as the DMA or, at the very least, use the same thresholds to establish which companies should be subject to regulation.[80]

This leads to a curious “Schrödinger’s DCR” scenario, where the same substantive rules simultaneously are and are not competition law. In the EU, for example, they are not; but in Turkey and Germany, they are. India’s DCB is a verbatim copy of the DMA, yet it is presented as a specific competition law.[81] This apparent contradiction is salvageable only if one thinks of digital competition regulation neither as competition law, strictu sensu, nor as an entirely separate regulation, but rather, as a partially overlapping tool that regulates competition and competition-related conduct in a different—and sometimes fundamentally different—manner.

Consider the example of the EU. EU competition law seeks to protect competition and consumer welfare. The DMA, on the other hand, is guided by the twin goals of “fairness” and “contestability.” As such, under the DMA (as under all other DCRs) the relevant standards are inverted. Under most DCRs, market power—understood as a firm’s ability to raise praises profitably—is either immaterial or not essential to establish whether a firm is a gatekeeper.[82] The competition-law practice of defining relevant markets on a case-by-case basis to determine whether a company has market power is, therefore, likewise moot.[83]

That approach is instead substituted for a list of pre-determined “core platform services,” which are thought to be sufficiently unique that they necessitate special and more stringent regulation.[84] Notably, and unlike in competition law, this presumption admits no evidence to the contrary. Once a good or service is marked as a core platform service, all a company can do to escape digital competition regulation is to argue either that it is not a gatekeeper, or that its services do not fall into the definition of a core platform service.

A corollary of this is that it is typically irrelevant whether a firm is dominant, or even a monopolist. Instead, DCRs apply to companies with high turnover and many business- or end-users—in other words, to “big” companies or companies people currently rely on or like to use.

Lastly, consumer-welfare considerations, which are central under competition law,[85] play only a marginal role in digital competition regulation, both in imposing prohibitions and mandates and in exempting companies from fulfilling those prohibitions or obligations.[86] While DCR supporters applaud this shift toward a broader conception of power,[87] it is important to understand how this approach differs from competition law.[88]

Competition law generally does not engage companies for being big or “important”—even if they are of “paramount importance”—except in very narrow instances, such as those prescribed by the essential-facilities doctrine.[89] Rather, antitrust targets conduct that restricts competition to the ultimate detriment of consumers. To establish whether a company has the ability and incentive to restrict competition, an assessment of market power is typically required, and definitions of relevant product and geographic markets are instrumental to that end.

Even the concept of dominance in competition law eschews crude arithmetic in favor of evidence-based analysis of market power, including the dynamics of the specific market; the extent to which products are differentiated; and shifts in market-share trends over time.[90] As one leading EU competition-law textbook puts it:

The assessment of substantial market power calls for a realistic analysis of the competitive pressure both from within and from outside the relevant market. A finding of a dominant position derives from a combination of several factors which, taken separately, are not necessarily determinative.[91]

Well-established competition-law principles—such as the prevention of free-riding,[92] the protection of competition rather than competitors,[93] and the freedom of even a monopolist to set its own terms and choose with whom it does business[94]—all preclude the imposition of hard-and-fast prohibitions and obligations without a robust case-by-case analysis or consideration of countervailing efficiencies. The narrow exceptions are those few cases where (substantive) experience shows that per-se prohibitions are warranted. But note that even cartels, “the cancers of the market economy,”[95] can generally be exempted under EU competition law.[96]

There exists no such consensus about the harms inflicted by the sort of gatekeeper conduct covered by DCRs.[97] Yet in digital competition regulation, strict (often per-se) prohibitions and obligations based on a company’s size are the norm.

C. The Transformation of Familiar Antitrust Themes

Even those DCRs that explicitly allude to competition-related objectives—such as the protection of competition and consumers—modify those objectives in subtle, but important ways. The U.S. tech bills are a case in point. AICOA would introduce a new “material harm to competition” standard. This facially sounds like it could be an existing standard under U.S. antitrust law, but it is not.[98]

DCRs also combine traditional competition-law objectives with considerations that would not be cognizable under antitrust law. For example, Brazilian competition law is guided by the constitutional principles of free competition, freedom of initiative, the social role of property, consumer protection, and prevention of the abuse of economic power.[99] PL 2768, however, would add two exogenous elements to these relatively mainstream antitrust goals: a reduction in regional and social inequality and increased social participation in matters of public interest.[100]

Other DCRs—like the UK’s or Australia’s prospective efforts to regulate digital platforms—also combine “fairness” goals with consumer welfare and competition considerations.[101] India’s DCB even offers an ex-post rationalization of competition law that brings it in line with the “fairness and contestability” goals of the new digital competition regulation.[102]

It is also questionable whether the protection of consumers and business users under DCRs accords with antitrust notions of “consumer welfare.” It should be noted that competition law, unlike consumer-protection law, protects consumers only indirectly, through the suppression of anticompetitive practices that may affect them through increased prices or decreased quality. Thus, antitrust law is generally uninterested in a company’s deceptive practices, unless they stem directly from a competitive restraint or the misuse of market power.[103] In this scenario, market power acts as a filter to determine where a company’s conduct can be corrected by market forces, and where intervention may be necessary.[104]

By contrast, most DCRs that claim to protect consumers[105] seek to do so through mandates of increased transparency, explicit consent, choice screens, and the like, imposed independently of market power.[106] While some of the focus on consumers remains (at least nominally), the ways in which DCRs protect consumers are more in line with consumer-protection law than competition law.

As for the protection of business users, according to some interpretations, antitrust law protects both consumers and other trading parties (customers).[107] This could, in principle, also include “business users.” Unlike digital competition regulation, however, antitrust law does not generally protect a predetermined group of businesses such that, for example, business users of online platforms would be afforded special protection. Any trading party—regardless of size, industry, or position in the supply chain, and whether a small developer or a large online platform—could theoretically benefit from the protection afforded by antitrust law to those harmed by the misuse of market power.

D. Partial Conclusion: When Failed Antitrust Doctrine Becomes ‘Groundbreaking’ New Regulation

While digital competition regulation’s approach to competition diverges from that of mainstream competition law, and may even be anathema to it, the arguments it espouses are not new. To the contrary, digital competition regulation, in many ways, codifies ideas that have been repeatedly tried and spurned by competition law.

The fountainhead of these ideas is that size alone should be the determining factor for antitrust action and liability.[108] On this historically recurring view—which is championed today most fervently by American “neo-Brandeisians” and European “ordoliberals”—big business inherently harms smaller companies, consumers, and democracy. It is therefore the role of antitrust law to combat this pernicious influence through structural remedies, merger control, and other interventions intended to disperse economic power.[109]

In a similar vein, digital competition regulation targets companies that, a priori, have little in common. Digital competition regulation applies to information-technology firms that specialize in online advertising, such as Google and Meta, but also to electronics companies that focus on hardware, such as Apple.[110] It covers voice assistants and social media, which are vastly different products. Cloud computing, another “core platform service,” is arguably not even a platform; yet, it was included in the DMA at the 11th hour.[111] In the end, what these “gatekeepers” have in common is that they all enjoy significant turnover, large user bases, are disruptors of legacy industries (such as, for example, news media), and are—possibly for these precise reasons—politically convenient targets.[112]

One corollary of this school of thought is that antitrust law should abandon (or, at least, drastically reduce) its reliance on the consumer-welfare standard as the lodestar of competition.[113] The law’s fixation on consumer welfare, the argument goes, has turned a blind eye to rampant economic concentration and to any form of abuse or exploitation that does not result in decreased output or higher prices.[114] Instead of this “myopic” focus on economic efficiency, proponents argue, antitrust law should strive to uphold a pluralistic market structure, which necessarily implies protecting companies from more efficient competitors.[115] This, they claim, was the Sherman Act’s original intent, which was subverted, in time, by the Chicago School’s emphasis on economic efficiency.[116]

Shunning consumer welfare also has implications for the role of market power in antitrust analysis. At the most fundamental level, competition law is concerned with controlling market power.[117] However, on the neo-Brandeisian view, antitrust’s historical concern with delineating efficient and inefficient market exit gives way to the unitary goal of controlling size and maintaining a certain market structure, regardless of companies’ ability to restrict competition and profitably raise prices.[118] This disenfranchises market power or, at the very least, redefines it as synonymous with size and market concentration.[119] This is familiar ground for digital competition regulation, which, as we have seen, generally does not target companies with market power, but companies with a certain size and “economic significance.”

Throughout antitrust law’s storied history, it has often been argued that antitrust law pursues, or should pursue, a plurality of goals and values.[120] Today, these arguments posit that antitrust law must look beyond a “narrow focus” on consumer welfare,[121] which is still enshrined as the dominant paradigm in most jurisdictions. Some of the alternative goals posited to inform the adjudication of competition-law cases include, but are not limited to, democracy, protection of competitors (especially SMEs), pluralism, social participation, combating undue corporate size, and equality. In turn, many of these goals are mentioned in digital competition regulation. In Section III, we argue that wealth redistribution (equality), the protection of competitors, and combatting size are truly shared goals of DCRs.

Digital competition regulation is a bridge between competition law and regulation. That bridge is built on old but persistent ideas that have found limited success in antitrust law and that have largely been precluded by decades of case-law and the progressively mounting exigencies of robust, effects-based economic analysis.[122] It is therefore perhaps unsurprising that digital competition regulation spurns both in favor or new legislation and per-se rules.

Its break with antitrust law, however, is not total, and was arguably never intended to be. Instead, digital competition regulation revises modern competition law to bring it in line with the regulatory philosophy it seeks to resuscitate, selectively plucking those bits and pieces that conform to that vision, and discarding those that do not.

The partial continuity between competition law and digital competition regulation is not merely hypothetical, either. Consider the example of the DMA. According to EU Commissioner of Competition Margrethe Vestager, “the Digital Markets Act is very different to antitrust enforcement under Article 102 TFEU. First, the DMA is not competition law. Its legal basis is Article 114 TFEU. Therefore, it pursues objectives pertaining to the internal market.”[123]

But observe that the DMA covers conduct identical to that which the Commission has pursued under EU competition law. For instance, Google Shopping is a self-preferencing case that would fall under Article 6(5) DMA.[124] Cases AT.40462 and AT.40703, which related to Amazon’s use of nonpublic trader data when competing on Marketplace, and its supposed bias when awarding the “Buy Box,” would now be caught by Articles 6(2) and 6(5) DMA.[125] The fine issued against Apple for its anti-steering provisions, which would be prohibited by Article 5(4) DMA, mere days before the law’s entry into force, is another case in point.[126]

This casts doubt on the assertion that the DMA and EU competition law are two distinctly different regimes. It suggests instead that the DMA is simply a more stringent, targeted, and enforcer-friendly form of competition regulation, intended specifically to cover certain products, certain companies, and certain markets. Or, as some have put it, “the DMA is just antitrust law in disguise.”[127] Indeed, Australia’s ACCC may have said the quiet part out loud when it contended that its proposed DCR would be both a “compliment to, and an expansion of, existing competition rules.”[128]

Or consider the example of India. In India, digital competition regulation would also be implemented though separate legislation. According to a 2023 report of the Standing Committee on Finance, a “Digital Competition Act”[129] is needed to prevent monopolistic outcomes and anticompetitive practices in “digital markets,” which are thought to differ in important ways from “traditional” markets:

India’s competition law must be enhanced so that it can meet the requirements of restraining anti-competitive behaviours in the digital markets. To that end, it is also necessary to strengthen the Competition Commission of India to take on the new responsibilities. India needs to enhance its competition law to address the unique needs of digital markets. Unlike traditional markets, the economic drivers that are rampant in digital markets quickly result in a few massive players dominating vast swathes of the digital ecosystem.[130]

But it seems that, based on the relevant Report of the Standing Committee on Finance, this new regime would be inspired by goals similar to Indian competition law. One important difference is that, according to Indian ministers, the new Digital Competition Act would adopt a “whole government approach.”[131] Pursuant to the Digital Competition Act, the government would have the power to override any decisions taken by the Competition Commission of India on public-policy grounds. This, again, underscores the “subtle” but significant differences between the competition regimes that would essentially apply in parallel to digital platforms and all other companies, as India’s Competition Act does not otherwise adopt a “whole government approach” to anticompetitive conduct.[132]

A separate question, beyond the scope of this paper, is whether the sui generis logic of digital competition regulation will eventually be transferred to standard competition law. Now that they have the weight of the law—in jurisdictions like Turkey and Germany, even formally incorporated into competition law—ideas that have hitherto remained at the fringes of mainstream competition law may start to be seen as more respectable. Further, the goals of competition law may even be reconfigured, a posteriori, in accordance with the rationale of digital competition regulation.

This possibility cannot be discarded as entirely hypothetical. For example, Andreas Mundt recently remarked that competition law “has always been about fairness and contestability,”[133] thus de facto extrapolating the logic of the DMA’s sector-specific competition regulation to all competition law.

When populist arguments about equality, fairness, and “anti-bigness” previously have reared their head in competition law, they have largely (though not entirely) failed. It is thus somewhat ironic that such ideas should now be spurred by passage of the DMA, a regulation that is—by its own terms—not even a competition law, sensu proprio.

III. The Real Goals of Digital Competition Regulation

Notwithstanding certain differences, DCRs are largely animated by a common narrative and seek to achieve, on the whole, similar goals. At the most basic level, DCRs seek to tip the balance of power away from digital platforms (see Section IIA); to scatter rents, especially toward app developers and complementors; and to make it easier for potential competitors to contest incumbents’ positions. In this context, traditional antitrust conceptions of competition and consumer welfare are afforded, at best, a ceremonial role.

A. Redistributing Rents Among Firms

Despite the apparent discrepancies identified in Section I, it becomes evident on closer examination that DCRs share a common set of assumptions, rationales, and goals. The first of these goals is direct rent redistribution among firms.

The central conceit of DCRs is that asymmetrical power relations between digital platforms and virtually everyone else produce “unfair” outcomes where, in a zero-sum game, “big tech” gets a big slice of the piece of the pie at the expense of every other stakeholder.[134] Thus, DCRs must step in to reallocate rents across the supply chain, so that other actors receive a share of benefits in line with regulators’ understanding of what constitutes a “fair” distributive outcome.

Indeed, as the OECD has noted, the concept of “fairness” is strongly tied to redistribution.[135] As Pablo Ibanez Colomo wrote of the then-draft DMA: “the proposal is crafted to grant substantial leeway to restructure digital markets and re-allocate rents.”[136] This notion is accepted even by DCR proponents, who have admitted that “the regime is not designed to regulate infrastructure monopolies, but rather to create competition as well as to redistribute some rents.”[137]

As to whom should benefit principally from such interventions, the answer varies across jurisdictions, and may depend on the effectiveness of various groups’ rent-seeking efforts, or the particular country’s political priorities.[138] In countries like Korea and South Africa, there has been an explicit emphasis on SMEs, with attempts made to “equalize” their bargaining position vis-à-vis large digital platforms.[139] Other jurisdictions, such as the EU, emphasize competitors (see Section IIIB) and companies that “depend” on the digital platform to do business—such as, e.g., app developers and complementors that “depend” on access to users through iOS; logistics operators that “depend” on Amazon to reach customers; and shops that “depend” on Google for exposure.[140] Granted, these companies may also be SMEs, but they need necessarily not be.[141] In fact, many of the DMA’s expected beneficiaries, including Spotify, Booking.com, Epic, and Yelp,[142] are not small companies at all.[143]

Elsewhere, it is explicitly recognized that DCRs seek to abet the market position of national companies. Prior to the DMA’s adoption, many leading European politicians touted the act’s text as a protectionist industrial-policy tool that would hinder U.S. firms to the benefit of European rivals. As French Minister of the Economy Bruno Le Maire stated:

Digital giants are not just nice companies with whom we need to cooperate, they are rivals, rivals of the states that do not respect our economic rules, which must therefore be regulated…. There is no political sovereignty without technological sovereignty. You cannot claim sovereignty if your 5G networks are Chinese, if your satellites are American, if your launchers are Russian and if all the products are imported from outside.[144]

This logic dovetails neatly with the EU’s broader push for digital and technology sovereignty, a strategy intended to reduce the continent’s dependence on technologies that originate abroad. This strategy has already been institutionalized at different levels of EU digital and industrial policy.[145] In fact, the European Parliament’s 2020 briefing on “Digital Sovereignty for Europe” explicitly anticipated an ex-ante regulatory regime similar to the DMA as a central piece of that puzzle.[146]

The fact that no European companies were designated as gatekeepers lends credence to theories about the DMA’s protectionist origins.[147] But while protectionism is not explicitly embedded in EU law, it likely will be in South Africa’s digital competition regulation. The understanding of “free competition” that underpins the SACC’s DCR proposal hinges on forcing large, foreign digital platforms to elevate local competitors and complementors, even if it means granting them unique advantages.[148] Moreover, unlike other DCRs, SACC’s proposal explicitly notes that its proposed remedies are designed to redistribute wealth from the targeted digital companies or downstream business users toward certain social groups—namely, South African companies, historically disadvantaged peoples (“HDPs”), and SMEs, especially those owned by HDPs.

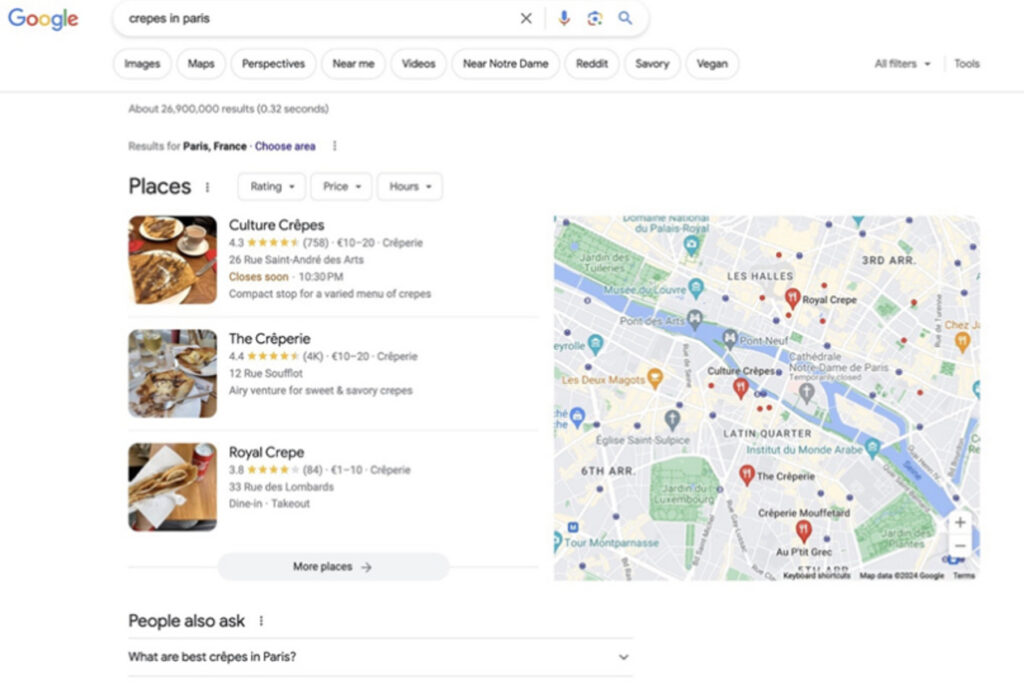

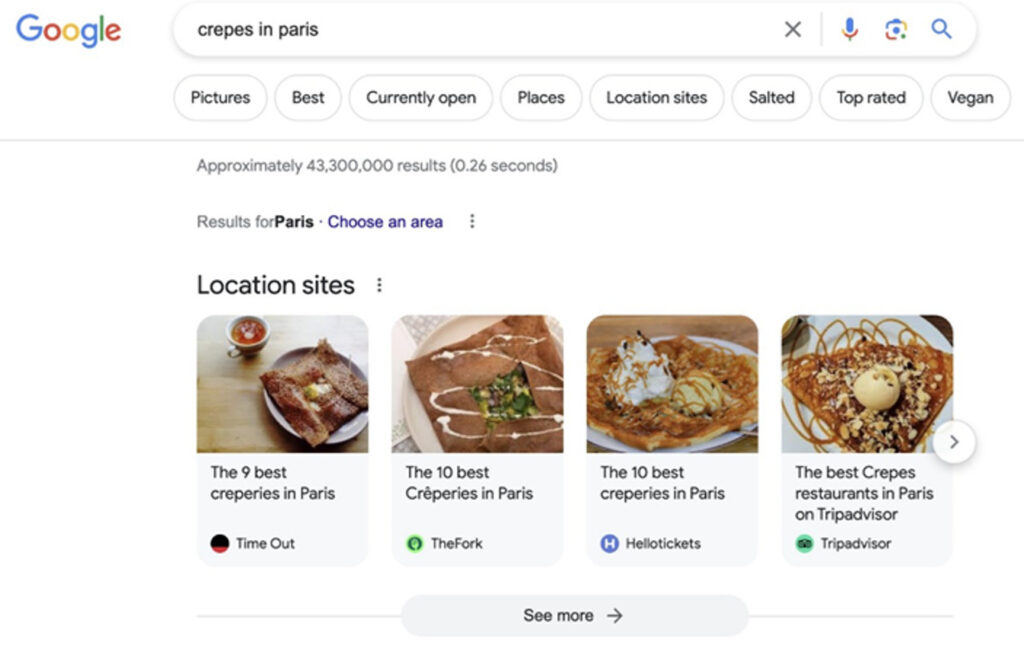

For instance, to address the “unfair” advantage enjoyed by larger competitors who are displayed more prominently in Google’s search results and are able to invest in search-engine optimization,[149] the SACC would oblige Google to introduce “new platform sites unit (or carousel) to display smaller SA platforms relevant to the search (e.g., travel platforms in a travel search) for free and augment organic search results with a content-rich display.”[150] In addition, Google would be forced to add a South African flag identifier and South African platform filter to “aid consumers to easily identify and support local platforms in competition to global ones.”[151]

The SACC’s proposal is chock full of similar, blatantly redistributive policies that—despite being formally integrated into competition law—flip its logic on its head by requiring distortions of competition in order to (putatively) preserve undistorted competition. Thus, the SACC’s proposal would require gatekeepers to give free credit to South African SMEs; offer promotional rebates; waive fees; provide direct funding for the identification, onboarding, promotion, and growth of SMEs owned by HDPs; force app stores to have a “local curation of apps” aimed at circumventing “automated curation based on sales and downloads for the SA storefronts, and some geo-relevance criteria”; and ban both volume-based discounts that benefit larger companies (relative to SMEs) and promotions that would otherwise “decimate” local competitors.[152]

One reading is that the SACC’s report deviates from the “standard” in digital competition regulation. Another is that the SACC is simply more forthright about accomplishing the goals implicit in the DMA. Indeed, the SACC targets the same types of digital platforms as the DMA, includes many of the same prohibitions and obligations (e.g., self-preferencing, interoperability, cross-use of data, price parity clauses), and openly references the DMA.[153]

In conclusion, despite some distributional differences, the overarching implication of digital competition regulation is generally the same: competitors and business-users (e.g., app store and app developers in the case of Apple’s iOS; sellers and logistics operators in the case of Amazon’s marketplace; competing search and service providers in the case of Google search) should be propped up by gatekeepers. These parties, DCR proponents argue, should get more and easier access to the platforms, feature more prominently therein, be entitled to a larger slice of the transactions facilitated by those platforms,[154] and pay gatekeepers less (or nothing at all).

In some countries, the beneficiaries are intended to be primarily national companies or SMEs. Ultimately, like many other questions surrounding digital competition regulation, the question of cui bono—who benefits?—is not an economic, but a political one, hinging on whatever parties lawmakers want to favor, and at the expense of whatever parties they wish to disfavor.[155] The bottom line, however, goes back to the same, simple idea: gatekeepers should get less, and other businesses should get more.

Consider, for example, the reaction to Apple’s DMA-compliance plan.[156] Most of the backlash concerned the (frustrated) expectations that Apple would, as a result of the obligations imposed by the DMA, take a smaller cut from in-app payments and paid downloads on its platform.[157] If one strips away the rhetoric, the reaction was not about competitive bottlenecks, competition, fairness, contestability, or any other such lofty ambitions, but about the very simple arithmetic of rent seeking, whereby those who invest in lobbying legislators expect a return on their investments.[158]

Or consider the UK’s DMCC. The DMCC includes a “final offer mechanism” that the CMA can use in some cases where a conduct requirement relating to fair and reasonable payment has been breached, and where the CMA considers other powers would not resolve the breach within a reasonable time period.[159] A key aspect of the mechanism is that the two parties to a transaction (at least one of them being a gatekeeper, or a firm with “strategic market status”) submit suggested payment terms for the transaction. The CMA then decides between the two offers, with no option to take a third or intermediate course.

Under the DMCC, however, this mechanism could be applied to any SMS business relationship with third parties. While, as the British government says, this does not involve “direct price setting,”[160] it does mean the CMA would be empowered to decide between two alternative offers and, thus, will determine the distribution of revenues between gatekeepers and, potentially, any third party.[161]

B. Facilitating Competitors and the Duality of Contestability

DCRs share a common aim not just to protect business users, but to benefit competitors directly.[162] In contrast with modern notions of competition law, which readily accept that protecting competition often forces less-efficient competitors to depart the market,[163] DCRs are chiefly concerned with ensuring that even inferior competitors enter or remain on the market. Simply put: if a designated digital platform acts “unfairly,” its actions are illegal. But it is generally—save limited exceptions—irrelevant whether its behavior is efficient or if it enhances consumer welfare. These are the very questions that typically serve to delineate pro-competitive from anti-competitive conduct in the context of competition law (and competition on the merits from anti-competitive conduct).[164]

This makes sense if one recognizes that digital competition regulation and competition law have fundamentally different goals: the former seeks to make it easier for nonincumbent digital platforms to succeed and stay on the market, regardless of the costs either to consumers or to the regulated platforms; the latter seeks to protect competition to the ultimate benefit of consumers, which often implies (and requires) weeding out laggard competitors (see Section II).[165]

As former Federal Trade Commission (“FTC”) Commissioner Maureen Ohlhausen has observed:

Some recent legislative and regulatory proposals appear to be in tension with this basic premise. Rather than focusing on protection of competition itself, they appear to impose requirements on some companies designed specifically to facilitate their competitors, including those competitors that may have fallen behind precisely because they had not made the same investments in technology, innovation or product offerings. For example, the Digital Markets Act (DMA) would force a ‘gatekeeper’ company to provide business users of its service, as well as those who provide complementary services, access to and interoperability with the same operating system, hardware, or software features that are available to or used by the gatekeeper. While this would restrain gatekeepers and presumably facilitate the interests of the gatekeeper’s rivals, it is not clear how this would protect consumers, as opposed to competitors.[166]

That is because the two kinds of legislation pursue mutually exclusive goals. DCRs aim to facilitate competitors by making covered digital markets more “contestable.” The assumption is that, because consumers consistently use certain dominant platforms, “digital markets” must not contestable, or not sufficiently contestable.[167] The putative reason for this low level of contestability allegedly lies in certain advantages that have accrued to incumbent platforms and that competitors purportedly cannot reasonably replicate, such as network effects, data accumulation, and data-driven economies of scale. Consumer cognitive biases and lock-in are asserted as further cementing incumbents’ positions. Because digital markets are also said to be “winner-takes-all,” the corollary is that currently dominant firms will remain dominant unless regulators intercede swiftly and decisively to bolster contestability.

DCRs seek to achieve this state of contestability by “equalizing” the positions of gatekeepers and competitors in two interconnected ways: by diminishing incumbents’ advantages and by forcing them to share some of those advantages with competitors. Making digital markets more contestable therefore requires undercutting the benefits of network effects and advantages enjoyed by “data-rich” incumbents,[168] not because data harvesting is inherently bad or because incumbents have acquired such data illegally or through deceit; but because it makes it hard for other firms to compete. Contestability—understood as other firms’ ability to challenge incumbent digital platforms’ positions—is therefore put forward as a goal in itself, regardless of those challengers’ relative efficiency or what effects the contestability-enhancing obligations have on consumers (see Section IIID).

It is not hard to see how the deontological focus on contestability is narrowly connected to the protection of competitors. Many, if not most, of the obligations and prohibitions in DCRs are best understood as attempts to improve contestability by facilitating competitors, while stifling incumbents. For instance, data-sharing obligations—such as those included in Article 19a of the German Competition Act and Art.6(j) DMA—make it harder for incumbents to accumulate data, while also forcing them to share the data they harvest with competitors. The objective is clearly not to tackle data harvesting because it is noxious, but to disperse users and data across smaller competitors and thereby make it easier for those competitors to stay on the market and contest the incumbents’ position.

Similarly, so-called “self-preferencing” provisions seek to prohibit designated companies from preferencing their own products’ position ahead of that granted to competitors, even if consumers ultimately benefit from such positioning (e.g., because the incumbent’s package is more convenient).[169]

Interoperability obligations likewise require incumbents to make their products and services compatible with those offered by competitors, often with very limited scope for affirmative defenses grounded solely in objective security and privacy considerations. The logic is that interoperability reduces switching costs and allows competitors to attract more easily the previously “locked-in” users.

There are also prohibitions on the use of data generated by a platform’s business users, which essentially ignore the potentially pro-competitive cost reductions and product improvements that may result from the cumulative use of such data. Instead, the goal is to preclude gatekeepers from outperforming—including through more vigorous competition, such as better products or more relevant offers—the third parties who have generated such data on gatekeepers’ platforms.

Ultimately, what all these provisions have in common is that they primarily seek to increase the number of competitors on the market and to enhance their ability to gain market share at the incumbent’s expense, regardless of the effects on the quality of competition, end products, or concerns related to free-riding on incumbents’ legitimate business investments, superior management decisions, or product design (all of which are considerations that would be cognizable under antitrust law—on which, see Section II).[170] “Contestability” in digital competition regulation thus means an erosion, through regulatory means, of incumbents’ competitive advantages, regardless of how those competitive advantages have been achieved.

Digital competition regulation is therefore inherently competitor-oriented, regardless of its stated goals, and this focus is often enshrined in law in other, subtler ways. For instance, the DMCC explicitly invites potential or actual competitors to provide testimony to the CMA before it imposes or revokes a conduct requirement. It requires the CMA to initiate consultations on the imposition or removal of such conduct requirements (S. 24), as well as on “procompetitive interventions” (S. 48).

The proposed ACCESS Act in the United States likewise gives competitors a privileged seat at the table.[171] According to Sec.4(e) of the bill, if a covered platform wishes to make any changes to its interoperability interface, it must ask the FTC for permission. In deciding the question, the FTC is to consult with a “technical committee” formed by, among others, representatives of businesses that utilize or compete with the covered platform.[172] Representatives of the covered platform also would sit on the technical committee, but have no vote.[173]

Importantly, the FTC’s decision in these matters would be dependent on whether competitors’ interests have been harmed—i.e., “that the change is not being made with the purpose or effect of unreasonably denying access or undermining interoperability for competing businesses or potential competing businesses.”[174] This is tantamount to asking competitors for permission to make product-design decisions on a company’s own platform, based on the vested interests of those competitors.

Finally, less than a month after the DMA’s entry into force, the European Commission launched investigations into four gatekeepers for noncompliance. Critical to the Commission’s decision to investigate these companies was feedback received from stakeholders,[175] most of whom are competing firms who hoped to benefit from its provisions.

C. ‘Levelling Down’ Gatekeepers

There are two ways to promote equality: one is to lift up Party A, the other is to drag down Party B.[176] DCRs typically do both, all in service of suppressing the presumably illegitimate levels of gatekeeper power. In the previous subsection, we argued that DCRs facilitate competitors. But it is just as important to note that they also—sometimes concomitantly and sometimes separately—seek to worsen gatekeepers’ competitive position in at least three ways: by imposing costs on gatekeepers that are not borne by competitors, by negating their ability to capitalize on key investments, and by facilitating free riding by third parties on those investments.

For example, prohibitions on the use of nonpublic third-party data benefit competitors, but they also negate the massive investments made by incumbents to harvest that data. They preclude gatekeepers from monetizing the investments made in their platforms by, say, using that data to improve their own products and product lineup in response to new information about users’ changing tastes. This directly undermines gatekeepers’ competitive position, which depends on their ability to improve and adapt their products (see Section IIID). But this is a feature, not a bug, of DCRs. DCRs seek to dissipate gatekeepers’ “power,” where power does not necessarily mean “market power,” but simply their ability to compete effectively. For example, even if allowing gatekeepers to use nonpublic data would improve their products, to consumers’ ultimate benefit, it would also “harm” competitors in the sense that it would make it harder for them to compete with the gatekeeper. In other words, it would not be anticompetitive, but it would be “unfair.” By contrast, in the moral lexicon of digital competition regulation, free riding and effectively expropriating gatekeepers’ investments is not considered “unfair.”

Nor are data-sharing obligations. Data-sharing obligations clearly impose costs on gatekeepers: tracking and sharing data is anything but free. Nonetheless, gatekeepers are expected to aid and subsidize competitors and third parties at little or no cost,[177] thereby diminishing their competitive position and dissipating their resources (and investments) for the benefit of another group.

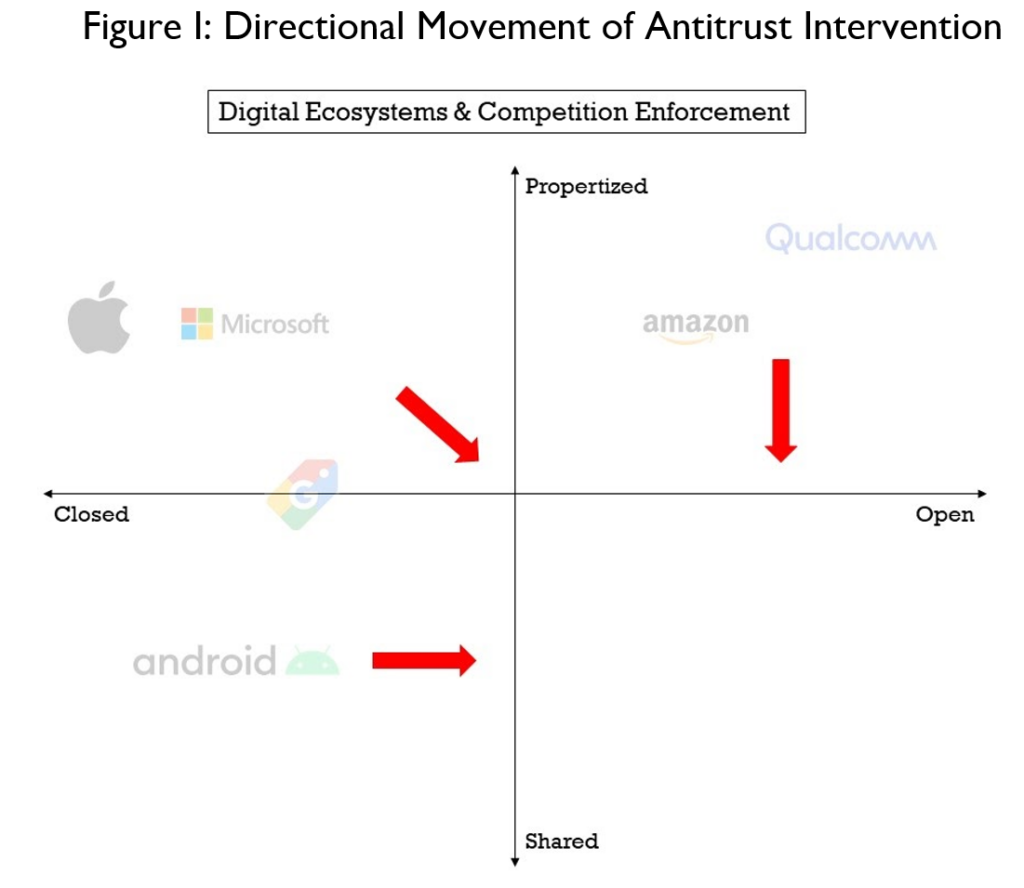

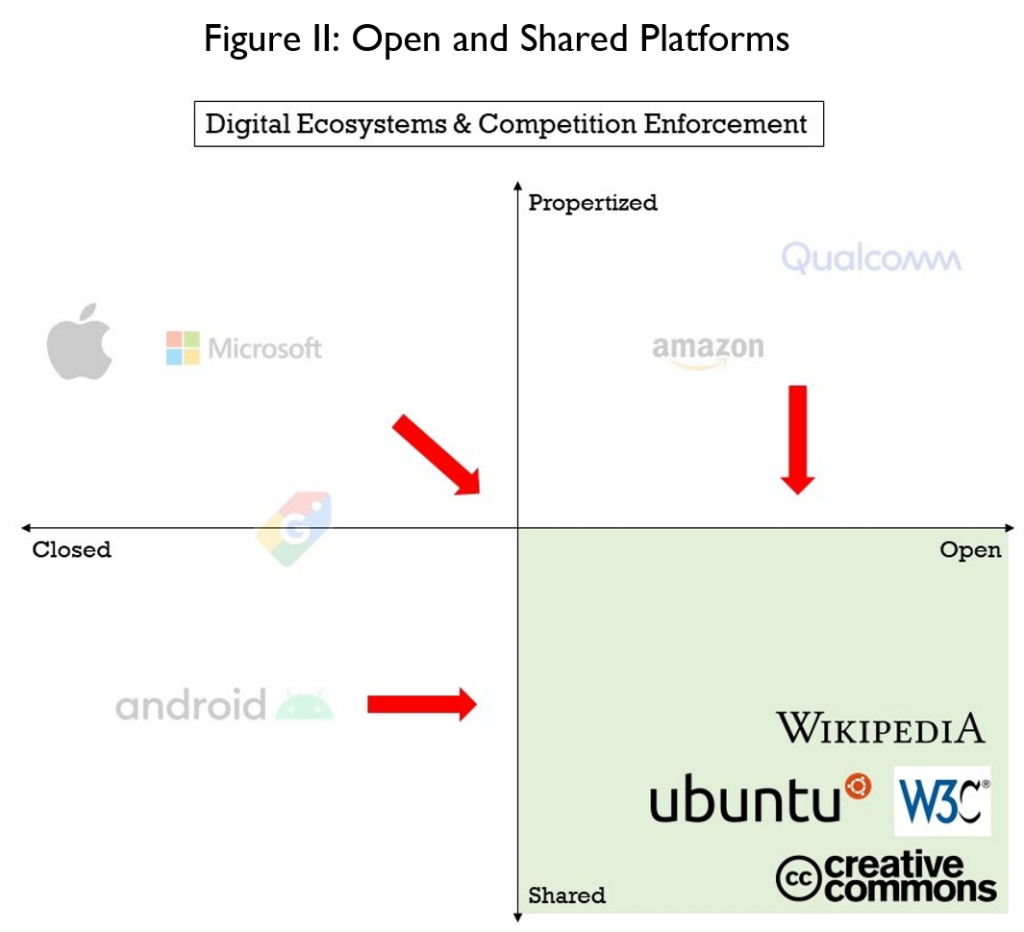

Similar arguments can be made about the other prohibitions and obligations that form part of the standard DCR package. Sideloading mandates allow third parties to free ride on gatekeepers’ investments in developing popular and functioning operating systems.[178] Insofar as they worsen gatekeepers’ ability to curate content and monitor safety and privacy risks, they also deprecate platforms’ overall quality and integrity, thereby potentially harming even the very companies they seek to aid.[179] Sideloading and interoperability mandates also essentially turn closed platforms into open ones (or, at the very least, they bring the two much closer together), thus forcing closed platforms to forfeit their competitive benefits relative to the primary alternatives.[180]

Antitrust law is unequivocal in its preference for inter-brand over intra-brand competition.[181] But under digital competition regulation, this principle gives way to a de-facto harmonization toward the model preferred by regulators—i.e., the one that makes every successful platform as open and accessible to competitors as possible, regardless of tradeoffs.

For example, self-preferencing prohibitions destroy one of the primary incentives for (and benefits of) vertical integration, which is the ability to prioritize a company’s own upstream or downstream products.[182] Such prohibitions also allow third parties that without the foresight to invest in a platform to accrue the same benefits as those that have. They also limit a platform’s ability to offer goods whose quality and delivery it can more readily guarantee,[183] another bane for competitiveness recast as a desirable symptom of “fairness and contestability.”