Abstract

A bill recently introduced in the U.S. Senate would fundamentally remake the online digital-display advertising market by forcing the physical separation of a vertically integrated market, and by imposing fiduciary-like duties on those buying and selling online ads for others. Proponents of this legislation—previously called the Competition and Transparency in Digital Advertising Act (CTDA), although the current version is known as the Advertising Middlemen Endangering Rigorous Internet Competition Accountability (AMERICA) Act—have pointed to rules allegedly used in the regulation of securities markets as the basis for the legislation. According to the academic and political proponents of the legislation, these two principles—physical separation and a best-interests rule—are effectively used in stock-market regulation. This article demonstrates that these claims are false. Stock markets are not physically separate from brokers, either in law or fact, as the backers of the AMERICA Act claim. Moreover, rules about best-price execution are (1) utilized only because vertical integration is permitted and common, (2) are nevertheless not a significant limitation on trading behavior, and (3) yet require a massive federal and private apparatus to support them. But more importantly, this article shows that, whatever the facts on the ground in stock markets, any analogy to them is misplaced, because it fails to appreciate the purpose of stock-market regulation. The sale of stocks is regulated in the way that it is because of the centrality of stocks to the savings and investments of everyday Americans, as well as the various vital roles stocks and stock markets play in the capitalist economy. Stock-market regulation protects the nerve center of the economy. Ads are not stocks, and any claim that they should be regulated as stocks is deeply misleading.

I. Introduction

On May 19, 2022, “the most significant change to antitrust law in a generation” dropped on Capitol Hill.[1] Bipartisan groups of lawmakers in both houses of Congress introduced companion bills to regulate online or digital advertising.[2] The “Competition and Transparency in Digital Advertising Act” (CTDA) would amend the Clayton Act as it applies to online advertising. In March 2023, several of the CTDA’s U.S. Senate sponsors reintroduced the legislation in the 118th Congress under a new name: the “Advertising Middlemen Endangering Rigorous Internet Competition Accountability Act” (AMERICA Act).[3]

Both bills include two major reforms that would completely remake the way online advertising is bought and sold. These reforms are premised on an analogy between online advertising and stock markets. As Matt Stoller of the American Economic Liberties Project put it in a press release announcing the introduction of the AMERICA Act:

No one would accept Goldman Sachs running the New York Stock Exchange, representing buyers of stock, and sellers of stock at the same time, just as no one would accept a lawyer representing both sides in a trial. Neither should Congress let corporations run all sides of a transaction in online ad markets.[4]

This article argues that this analogy is false and does not justify the proposed reforms.

The legislation has two major pieces. First, companies with more than $20 billion in digital-ad revenue (that is, Google) cannot own an “exchange,” a place where online ads are bought and sold, if it also provides services to buyers and sellers of ads, or it sells advertising space itself.[5] As discussed below, Google (and other “adtech” companies) vertically integrate across the adtech stack, providing tools to buyers and sellers (known as demand-side or sell-side platforms), as well as operating the market in which these buyers and sellers come together. Google also buys and sells its own advertising for its properties, like YouTube. There are, as set out below, good, socially regarding reasons for adtech companies to provide all these functions under one roof. But AMERICA Act would ban them from doing so. As discussed below, it is based on a misunderstanding of and deeply misleading analogy to financial-market regulation.

Second, companies with more than $5 billion in digital-advertising revenue (such as Google, Facebook, Amazon, Verizon, Comcast, Microsoft, Yahoo, and others) that provide services to buyers and sellers of digital advertising would have a legal duty to act in a customer’s “best interest” and would have to comply with various transparency requirements, among other things.[6] This reform is also based on a misplaced analogy to financial-market regulation. A best-interests rule would add significant costs to the system and require a massive bureaucracy to enforce, despite there being little to no evidence that it would do any good.

The ideas of physical separation (reform #1) and of imposing fiduciary duties on ad brokers (reform #2) are inspired by financial regulation. In a fact sheet accompanying the original CTDA, primary Senate sponsor Mike Lee (R-Utah) stated: “These restrictions and requirements mirror those imposed on electronic trading in the financial sector— an industry to which Google itself has compared its technology.”[7] In related antitrust litigation against Google brought by the State of Texas,[8] this inspiration was made explicit: an analogy was made between Google’s vertical integration in the adtech stack and a hypothetical vertical integration on Wall Street—it is as “if Goldman Sachs . . . owns the NYSE.”[9] As Sen. Lee noted in the Wall Street Journal the day the CTDA was introduced: “When you have Google simultaneously serving as a seller and a buyer and running an exchange, that gives them an unfair, undue advantage in the marketplace, one that doesn’t necessarily reflect the value they are providing.”[10] In the stock market, the argument goes, brokers (who provide services to buyers and sellers of stocks) are legally separate from owners of exchanges (who provide the venue where trades happen), and strict duties police the boundaries, as well as the behavior of participants to ensure deals are fair.

As this article shows, this is mostly myth. It is founded on a deep misunderstanding of the way that stock markets work and, more importantly, on the purpose of securities regulation. If one understands the mechanics of stock markets and the reasons they are regulated as they are, the analogy completely falls apart.

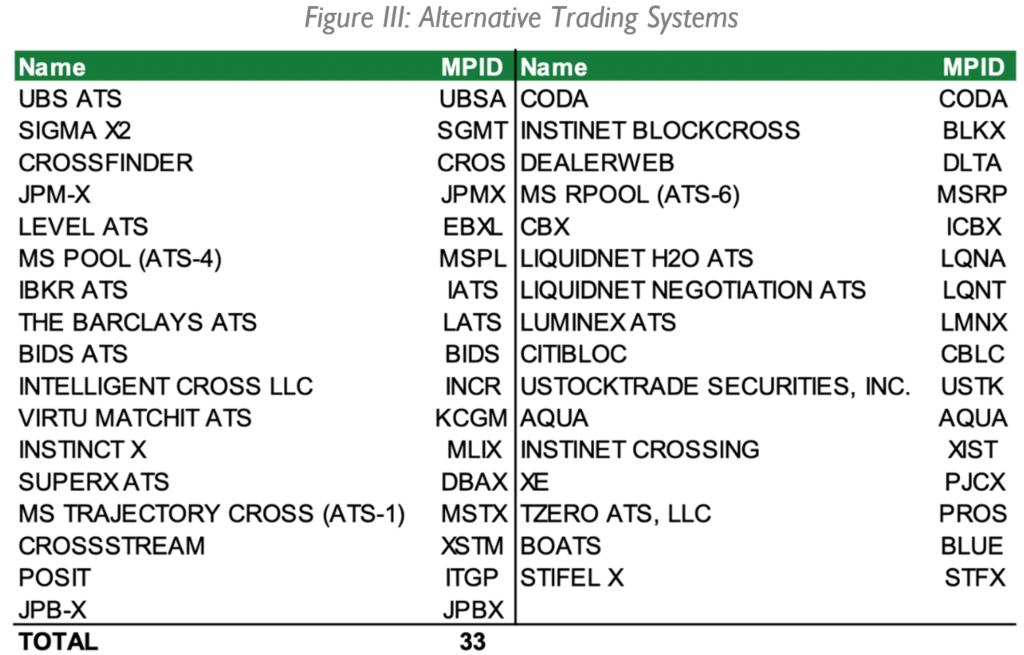

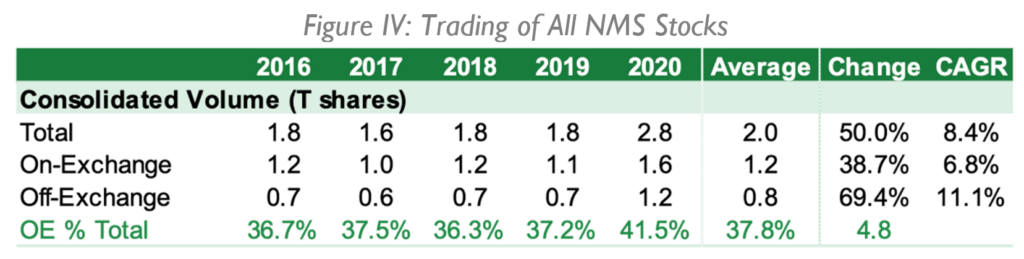

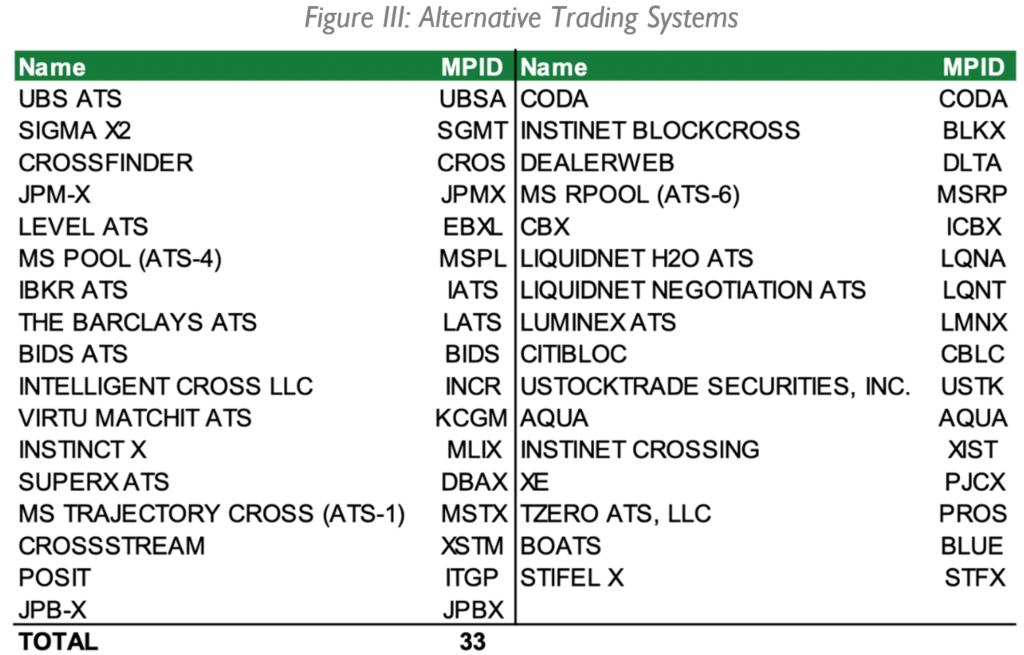

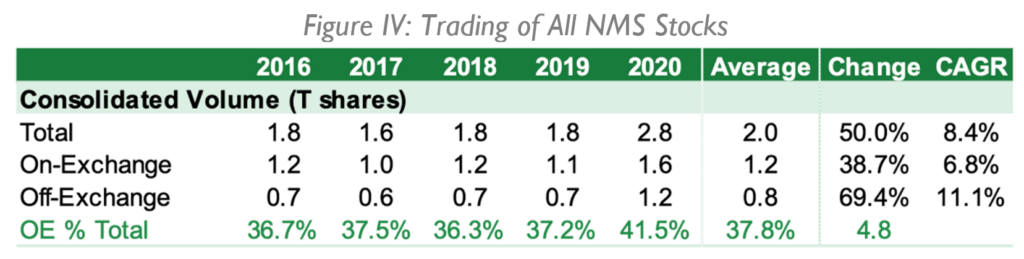

Defenders of the new regulations argue that brokers like Goldman Sachs are prohibited from owning the exchange on which stocks are traded. While it is true that Goldman Sachs (a broker) does not own the NYSE (an exchange), it does own a different stock exchange, called SigmaX2, where the same stocks sold on the NYSE are bought and sold.[11] In fact, about half of all stock trades occur on trading venues (i.e., exchanges by a different name) owned by brokers.[12] If an investor hires Goldman Sachs to buy a share of stock of Google, Goldman can execute this transaction on the NYSE (or other public exchanges), on its own exchange (SigmaX2), or, remarkably, from shares of Google stock that it owns, through a process called “internalization.”[13] In this last case, there is not a potential conflict of interest, as if Goldman did the transaction on an exchange it owned, but a direct one.

The AMERICA Act would ban Google from acting as a broker on its own ad exchange, but securities law, on which the law is purportedly founded, permits exactly this same conduct. Moreover, the NYSE is a publicly traded company (owned by many investors, including, likely, Goldman Sachs) and offers many services for buyers and sellers of stocks. Banning Google from owning an exchange because it could not do so if it were in the stock-brokerage business makes no sense, because it could. The bill’s insistence on the centrality of physical separation is not supported by the facts of how markets work.

To put a nail in this particular coffin, here is how the current state of stock-market regulation on this point is described in a new book-length treatment:

In some cases, the same institution can potentially advise an individual on which stock to buy and then either arrange execution of the order on that person’s behalf on a trading venue or act as counterparty on the other side of the order. Moreover, in the case where it arranges execution, the trading venue can be one owned by the broker dealer.[14]

There is simply no support for the claim that stock markets must be physically separated in the way proposed by the AMERICA Act.

The second part of the bill—creating a legal duty to act in a client’s best interest when helping them buy or sell ads—is (more or less) part of the stock-market world. It is important to note, however, that one of the reasons there are duties like this in the securities world is precisely because there is not a general obligation of physical separation in the securities world. The “best interests” rule in securities regulation exists precisely because brokers may own exchanges and otherwise act on behalf of clients when there are real or potential conflicts of interest. In short, the AMERICA Act takes a belt-and-suspenders approach that offers more supposed protection for advertisers and ad buyers than stock traders, even though the potential mischief and consequences are greater in the securities world. Ordinary Americans have their savings and their futures bet in the stock markets, not in ad markets, which are merely places where commodities are bought and sold. There is no investment or speculation in ad markets.

Even more fundamentally, the “best interests” obligations in the securities world have much less bite than the proposed rules under the AMERICA Act. To be sure, when Goldman executes a transaction for a client (on its exchange or elsewhere), it is required by a complex set of regulations to execute the trade at the best available price. This is the inspiration for the fiduciary duty part of the AMERICA Act.

But even this is not exactly as it seems. As discussed in detail below, there are several reasons why the best-price obligation nevertheless permits most trades to happen at something other than the best available price. While everyone in the chain for a particular transaction (retail broker, wholesale broker, exchange) is required to execute trades at the best price (called the “national best bid offer” or NBBO price), there is some discretion baked into the system, especially since price is not the only factor customers care about. Moreover, even U.S. Securities and Exchange Commission (SEC) rules permit trades to be made at inferior prices, so long as some of the trade is made at the NBBO.[15] A recent empirical study found that only about 43% of trades were made at the NBBO price, because of the impact of various discounts and other factors paid by exchanges.[16]

To sum up, neither of the two proposed reforms is supported by the analogies that their proponents have made to financial regulation. Brokers and exchanges are not physically separated, and best-interests rules (which are premised on them not being physically separated) are effective less than half the time, due to the complexities of stock markets. On this last point, ad markets are many times more complicated than stock markets, meaning the vast regulatory bureaucracy necessary to support such rules in stock markets will have to be many times larger for ad markets.

Although the way in which the stock market works and is regulated does not provide any support for the proposed reforms to ad markets, there is a much more fundamental problem with the analogy. The biggest difference between the example of Goldman buying a share of stock on various exchanges for its customers and Google buying advertising on various exchanges for its customers is founded in the purpose of stock-market regulation. The stock market is regulated as it is because of the profound social importance of accurate stock prices, not because of overriding concerns about conflicts of interests in general. Stocks are regulated as they are because they are stocks. Ads are not stocks, and thus, regulating them like stocks makes no sense.

Plenty of markets involve vertical integration with conflicts of interest, but do not require physical separation or impose fiduciary duties. Auction houses provide a venue where buyers and sellers come together to bid on art and antiquities, while also providing services and advice to buyers and sellers, as well as sometimes bidding on items themselves. Or consider the local drug store. One can think of CVS or Walgreens as a place where buyers and sellers of various products come together, and where the owner of the market offers various services to buyers and sellers (e.g., placement, data, and inventory management for sellers; discounts, loyalty programs, information, and credit for buyers), as well as offering its own goods (that is, generic brands) for sale. Or, moving online, think about eBay or Amazon, or frankly any platform. eBay runs auctions for buyers and sellers; it also provides ancillary services. Amazon runs an “exchange,” provides numerous services for buyers and sellers, and sells its own products on its website. Potential conflicts of interest abound. We do not look to financial regulation for how to think about resolving these potential conflicts, because stocks are fundamentally different for the reasons set out below.

The analogy between online-advertising markets and the stock market originated in a law review article—“Why Google Dominates Advertising Markets: Competition Policy Should Lean on the Principles of Financial Market Regulation”—published in 2020.[17] The subtitle plainly reveals the analogy. In the article, Dina Srinivasan explains how Google “engag[es] in conduct that lawmakers prohibit in other electronic trading markets,” namely, stock markets. The article identifies several practices that are allegedly banned in financial markets but permitted in the advertising market. In all of these cases, the prohibited activity can be described as a party acting as an agent for another party while serving their own selfish interests. For example, somewhat imprecise analogies are made to “front running” (the practice of a stockbroker receiving an order from a customer and buying or selling ahead of it to earn a profit at the expense of the customer), to “insider trading,” and to other nefarious practices.[18]

More compelling points are made where the article compares various common features of online auctions for ads and stocks, such as the advantages of speed and the potential for steering transactions in selfish ways. At the end of the day, Srinivasan recommends that regulators use the “toolbox” of securities regulation to “provide[] a framework for understanding and addressing competition problems in advertising.”[19]

Srinivasan’s article, which appears to be the wellspring of the Lee bill, alleges that Google’s exchange gives speed and information advantages to Google ad tools; that Google favors its own properties (YouTube and Search) for placement of ads (and, by implication, that advertising on other sites would be better in some unexplained way); and that (vaguely) “Google abuses its access to inside information.”[20] Whether or not these things are true is a factual question, of course, and one beyond the scope of this article. The point here is not to challenge the allegations or to defend Google or any other business. Rather, the point is to assert that, even if true, the AMERICA Act does not necessarily follow as a logical response. There is a large leap made from the facts to the law.

Srinivasan points to “the market for electronically traded equities,” which she asserts bans these practices, as the proper analogy. The rhetorical move is powerful: society has banned these practices in one area of the economy, and so it is illogical that we would allow them in another, similar area of the economy. The problem with this is two-fold: first, the claims about how equity markets are regulated are somewhere between naïve and untrue; and second, the reason we regulate securities markets as we do is because they involve the socially vital trading of securities, not because of the problems she identifies. Srinivasan asks whether “[b]ecause ads now trade on electronic trading venues too, should we borrow these three competition principles to protect the integrity of advertising?”[21] Although the question of whether to regulate online ad sales is beyond the scope of this article, the upshot of is that regulating based on analogy to securities regulation is deeply flawed, both in theory and in fact.

II. Some Adtech Basics

The Internet changed everything, including how advertisers reach potential customers. Before the world went online, advertisers used radio, television, magazines, and billboards to convey information about their products to the public. There were two significant characteristics of this pre-Internet market that are germane to the current regulatory push. First, these advertisements were bought and sold using ad agencies and other brokers through person-to-person direct sales. Second, advertising was largely depersonalized. To be sure, when Gatorade implored you to “Be Like Mike,” (as in, Michael Jordan) it did so in Sports Illustrated, not Barron’s. But by and large, ads were not tailored to individual people based on their prior actions, but rather to the preferences of groups using, at best, rough proxies. Thus, Gatorade targeted readers of Sports Illustrated but not, as it does today, Joe who just searched the Internet for “best electrolyte replacement.”

The movement of media online changed advertising radically along both these dimensions. As to the way in which advertising is sold, computers permitted publishers (those with advertising space to sell) and advertisers (those looking to raise awareness of their products) to find each other and do deals in much more efficient ways. Third parties developed computerized tools to help buyers and sellers of advertising to optimize their online spending. These tools—and thus, this industry—is known as “adtech.” If you are a publisher, like the Wall Street Journal, you might build or buy a software package that helps list your virtual real estate for sale to the highest bidder. Such bids may also be subject to any restrictions you want, such as banning certain ads, whether they be lewd or from a competitor. If you are an advertiser—again, like the Wall Street Journal—you might build or buy a software package that helps you target the best audience for your product. This relates to the second dimension of change. As an advertiser, the Wall Street Journal may be interested in sending ads to people who live in financial centers, who search for stock tips online, or who read other business publications. The Internet permits tailoring ads to individual consumers in ways unimaginable just decades ago.

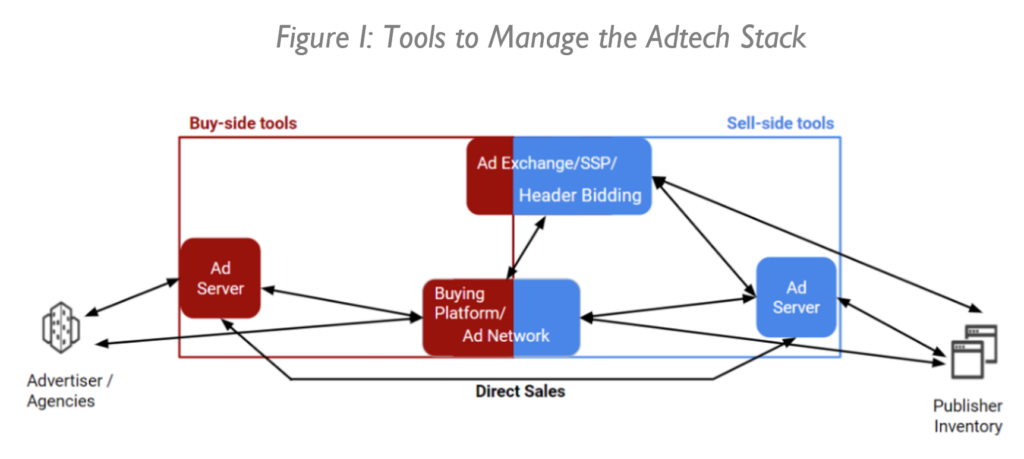

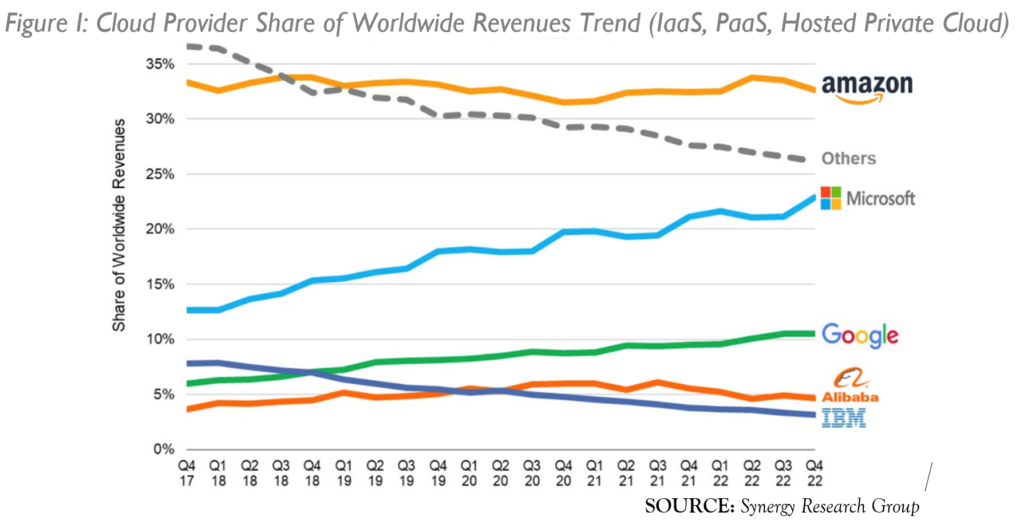

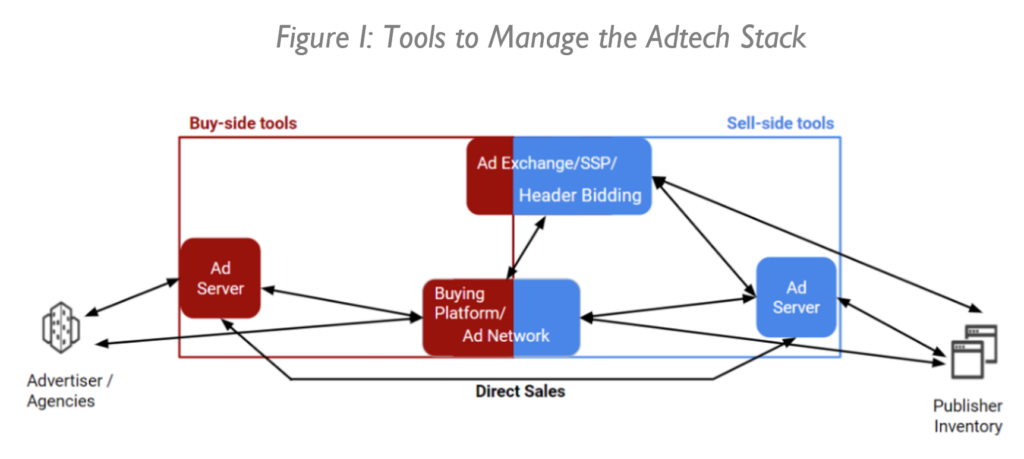

The early 2000s saw a proliferation of new companies offering ad-optimization and placement services. Existing ad agencies developed and bought some of these new services, or built their own. New entrants, such as DoubleClick, developed standalone services for managing online advertising. A publisher or advertiser could purchase a software tool that would help buy or sell online advertising in a way that efficiently met the buyer’s or seller’s objectives. A familiar diagram used in this literature is shown below in Figure I.

SOURCE: Bitton & Lewis

This diagram shows the several ways in which buyers and sellers of online advertising come together. The largest by volume and revenue is through direct sales or programmatic direct deals.[22] According to an investigation by the UK Competition and Markets Authority (CMA), more than 80% of online display ads were direct sales in which the publisher and advertiser have a pre-existing relationship.[23] These transactions mimic ad sales of the pre-Internet days, with deals done between ad agencies and sales teams at major online sites, and computers used merely to make the process more efficient. This means the use of various “sell-side tools” and “buy-side tools,” such as an ad server that optimizes inventory management and price for sellers, and allocation and cost per impression for advertisers. This type of online advertising is not the object of the AMERICA Act or antitrust litigation efforts by the states.

Another way in which buyers and sellers of online ads come together is through auctions on ad exchanges, a process known as real-time bidding or indirect programmatic sales. An ad exchange is simply a marketplace in which publishers offer their online inventory, and advertisers can bid for that inventory in “real time.” This means that, when an individual person opens a web page, the ad exchange lists this event—the right to display one’s ad in a particular location on a web page to a particular visitor to that site—for sale to the highest bidder. Remarkably, the auction happens while the web page loads.

Importantly for purposes of this article, these auctions are highly individualized, finding a market-clearing price to place a particular message in a particular location in view of a particular person at a particular time. Compare this with a billboard. The owner of the billboard charges one price—say, a monthly fee—for the billboard, with that price depending on the number of cars likely to see it during that period. For online advertising sold through auction, it is as if the price for showing an ad on the billboard were different for every car that passes. This has significant ramifications for the fitness of any analogy to securities markets. At any moment, the value of a share of stock in, say, Google represents the market’s best guess at the value of Google in all future periods, divided by the number of shares outstanding, and discounted back to the present. Although individuals may have different estimates of this value, the price of Google sold at auction is the same (more or less) for everyone. The securities market is not individualized, but generalized. It is more like billboards, not online auctions.

But there is another way in which securities also differ from even billboards. As discussed below, there is an intrinsic value for a stock that represents the cash the stock will generate over time in present value. By contrast, a billboard advertisement or online auction is worth only what someone will pay for it. Ad prices are set by the forces of supply and demand, whereas stock prices reflect the actual value in terms of the cash flows of owning a security.

The online-auction process for advertisements can be simple or complex. In the simple version, publishers add a few lines of code to their website and set up an account with one of dozens of companies (like Google’s AdSense or Amazon’s Native Shopping Ads) that provide various tools to help the publisher achieve their goals.[24] This approach is generally used by less-sophisticated advertisers. It is a service, like any other.

In more complex versions, publishers and advertisers use a variety of tools—known as demand-side platforms (DSPs) and sell-side platforms (SSPs)—to process bids from multiple parties on a single ad-display option for a particular user. In its simple form, the process works something like this. First, when someone opens a webpage (either through a browser or an application), the publisher’s ad-server tool sends a request to an SSP for advertising options available on a particular webpage for that particular user. Second, the SSP sends requests to DSPs for advertising. Third, the DSPs then determine whether and how much to bid for the particular online real estate, based on their advertisers’ campaign objectives and information about the particular viewer of the webpage. Fourth, the SSP determines the winner of the auction, based on the price or other factors programmed by the publisher. Fifth, the SSP sends the winning bids to the publisher. Finally, the publisher’s ad server compares the winning bids from the SSP (and potentially multiple SSPs) with any direct deals that may exist, and ultimately decides what ad to serve at the particular location for the particular user.

An alternative to the auction method run by Google and others for this narrow segment of the market debuted in about 2015. Known as “header bidding,” it was developed as a mechanism to increase price competition across multiple SSPs, leading to higher prices for publishers. Header bidding is an “alternative to the Google ‘waterfall’ method” that “offers publishers a way to simultaneously offer ad space out to numerous SSPs or Ad Exchanges at once.”[25] Here is how one service provider describes the advantage of header biding:

[W]hen a publisher is trying to sell advertising space on its site, the process for filling inventory goes something like this: First, your site reaches out to your ad server. In general, direct-sold inventory takes precedence over any programmatically sold options. Next, available inventory is served through the site’s ad server, such as Google DoubleClick in a waterfall sequence, meaning unsold inventory is offered first to the top-ranked ad exchange, and then whatever is still unsold is passed along to the second ad exchange, and so on. These rankings are usually determined by size, but the biggest ones aren’t necessarily the ones willing to pay the highest price. (For publishers, this means lower overall revenue if the inventory isn’t automatically going to the highest bidder.) To further complicate the process, sites using Google’s DFP for Publishers has a setting that enables them to outbid the highest bidder by a penny using Google Ad Exchange (AdX). And since AdX gets the last bid, they are generally in a position to win most of these auctions. Publishers end up feeling like they aren’t making quite as much money as they would without Google meddling in the bids.[26]

Header bidding permits simultaneous auctions managed by the publisher: “By placing some JavaScript on their website, when a particular page is loaded, it reaches out to all supported SSPs or ad exchanges for bids before its ad server’s own direct-sold inventory is called. Publishers can even choose to allow the winning bid to compete with pricing from the direct sales.”[27] According to proponents, header bidding allows for increased control, increased revenue, improved yield, and reduced reporting discrepancies, when compared to the Google alternative.[28] Header bidding proved a popular alternative to the Google approach, with about 80% of large websites using it within a few years.[29]

III. Analogies and the Role of Purpose

Lawyers reason by analogy.[30] New cases are compared with old ones, and where there is a fit, decided by reference to the way things have been done in other instances. As Edward Levi noted in his canonical text, “An Introduction to Legal Reasoning,” “[t]he finding of similarity or difference is the key step in the legal process.”[31] Analogies are appealing because they build on what has worked, permitting accretive (but not revolutionary) change. It forces decision makers, be they judges or legislators, to offer some proof that their proposal is likely to work. And it can help convince outsiders that the result is justified. What worked over there might work over here, as long as here and there are similar problems.

Ad tech is a new case; financial regulation is an old one, and thus it serves as a potential analogy. The main body of securities regulation dates to the New Deal,[32] and its several statutes and vast body of rules and regulations has helped to create the most liquid capital markets in history. Although there are many critics and criticisms of the efficacy of securities regulation,[33] its widely perceived success makes it a fertile ground for analogy to adtech markets. After all, both involve “exchanges,” brokers, auctions, and concerns about speed, misuse of information, and conflicts of interest.

The surficial similarity between stock markets and ad markets is not just made by critics of the big players. Google itself describes ad exchanges by reference to stock exchanges. In describing its buy-side services to potential customers, Google stated: “imagine the Ad Exchange as a stock exchange.”[34] Google’s competitors have made the analogy, too. One rival described itself as “the eTrade to Google’s NYSE.”[35] As noted above, academics first pressed this analogy,[36] while lawmakers and regulators subsequently seized upon it.[37]

But is the analogy on point? The question matters a lot. If the analogy sticks, the online-advertising world may come to look more like the securities world, which is one of the most heavily regulated industries on earth. Thousands and thousands of regulators—public, private, and internal—walk the beat of securities markets. Billions are spent to comply with securities laws. These include the public enforcement costs (e.g., the SEC, the Financial Industry Regulatory Authority); private compliance costs (internal to firms, including issuers, brokers, investment funds, and banks); and the social impact of regulatory costs (e.g., how regulation benefits large firms compared with smaller ones).

The AMERICA Act’s direct and indirect costs will be large enough to matter, but it is the camel’s nose under the tent. As discussed below, something like the “best interests” standard that the AMERICA Act would impose simply cannot be meaningful without something akin to the massive regulatory apparatus that exists in securities regulation. It takes many thousands of people and many millions of dollars in compliance and lawyers and regulators to try to enforce the best-interests standard in securities law. If anything, as discussed below, many times this amount would be required to enforce it in ad markets—which, along this dimension, are far more complex. There is one single price for a stock, and it reflects an intrinsic value, while online display ads are particular to individuals, times, and places, and represent merely the interplay of supply and demand. These differences will make determining and enforcing a best-interests rule orders of magnitude more costly.

In light of the significant consequences that flow from analogizing ad markets to securities markets, such analogies needs to be ironclad. The similarities between markets, to use Levi’s language, must be fundamental and vastly outweigh the differences. But a problem with basing a massive governmental intervention into the economy and private ordering on an analogy like this is that there are innumerable similarities and differences between any set of extremely complex industries. The online advertising and securities markets are easily two of the most complex industries in history. There is the risk that there are too many variables that cut in different directions, which could therefore give government too much wiggle room to make its case.

In making any analogy, there are several important questions.

First, there is the choice of which market to compare the ad market to. As noted below, instead of comparing the ad market to the stock market, academics could have analogized it to the market for corporate bonds or the foreign-exchange market, both of which are as similar, if not more so, and yet are regulated nothing like the stock market, or the ad market as imagined under the AMERICA Act. The market for auctioning off valuable art or antiquities shares many of the same characteristics, as well, but is regulated largely by common-law fraud. Why didn’t critics use these analogies instead? The choice of market is likely not random or based on which of all possible markets is most related or most logical from a regulatory purpose perspective. Rather, the choice of market was influenced by the end goal. If one wants to regulate, choose a regulated market as an analogy.

Second, there is the question of what level of abstraction is appropriate for making the analogy. Any complex industry can be viewed at numerous levels of detail, revealing different complexities in each. Things that appear similar at one magnification may be vastly different when magnifications are increased. The analogy that has been made to financial markets is made at the highest, most generic level, referencing popular works of general interest, such as Michael Lewis’s book “Flash Boys,” which has been widely criticized by securities-law scholars.[38] As discussed in the next section, the actual workings of the stock market bear little resemblance to the description in “Flash Boys” or in Srinivasan’s article. The complexity of the stock market frustrates any attempt to draw direct lines from it, and its regulatory structure, to the ad market. It is simply too easy to cherry-pick examples or similarities along a few dimensions, while ignoring the underlying the stock market’s complexity or other aspects that point in different directions, regulatorily speaking.

It is for this reason that analogies here, and in general, must be founded not on surficial similarities between the markets, but first and foremost on the reason that stock markets are regulated as they are. Analogies are fundamentally founded on purpose. One cannot compare the regulation of A to the potential regulation of B, unless one knows why A is regulated the way that it is. What is the point of the regulation? This is where every analogy must begin. Only from purpose can one find an answer to the question of whether to apply A’s regulation to B. After all, law is about achieving public purpose, not simply increasing the power of government.

For stock markets, the why of regulation can be stated simply: because stock markets involve stocks. After all, there are many types of markets (or, even, markets involving “exchanges”), but they are not all regulated with the same methods or intensity as the stock market. The reason that there are several comprehensive federal statutes; hundreds of rules promulgated by multiple federal, state, and private regulatory bodies; and thousands of pages of detailed regulations covering every aspect of buying and selling securities is because of the central importance of stocks to our society. If one is selling fish or antique furniture, even on an online exchange, the stakes are completely different, and the justification for regulation different, as well.

Drilling down, there are two purposes of stock-market regulation that must be the basis on which any analogies to securities laws are grounded. First, stocks and stock markets are regulated as they are because they largely involve investments of savings and retirement money by individuals. The stock market is the primary means of wealth creation in the United States and, as such, is the place where every-day Americans safeguard their income and hope to grow familial wealth. These investments are susceptible to fraud because of the relatively small amounts invested in any company (making monitoring by individuals inefficient); the agency costs inherent in hiring managers to be in charge of one’s money; the speed and complexity of modern trading markets, and because stock prices reflect nothing more than promises about the distant future. As such, there are enormous social stakes implicated in ensuring that stock markets are well-regulated.

Second, stocks and stock markets are regulated as they are because of their central role in determining how scarce resources are allocated in our capitalist economy. As discussed below, stock prices dictate where capital, labor, and raw materials are invested in the economy. If prices are “wrong”—that is, stocks in industry A are overvalued and those in industry B are undervalued—then resources will inefficiently flow to industry A instead of industry B, where it would be more productive. High prices are our best evidence of value, and equivalent to a giant flashing sign saying to everyone in the economy, “Do this!” If the this is not worth doing, we are all worse off.

Accurate prices, in turn, depend on liquid markets, which attract numerous traders and reward those investments that uncover information and truth about companies’ prospects. If prices are wrong over extended periods of time—for one stock or for many—the knock-on effects transcend losses to individual investors. Every investor, entrepreneur, employee, and supplier in the economy makes decisions based, in part, on where the most value can be created, and the best proxy for that is the stock market.

These two purposes are explored in the next section.

A. The Dual Purposes of Stock Market Regulation

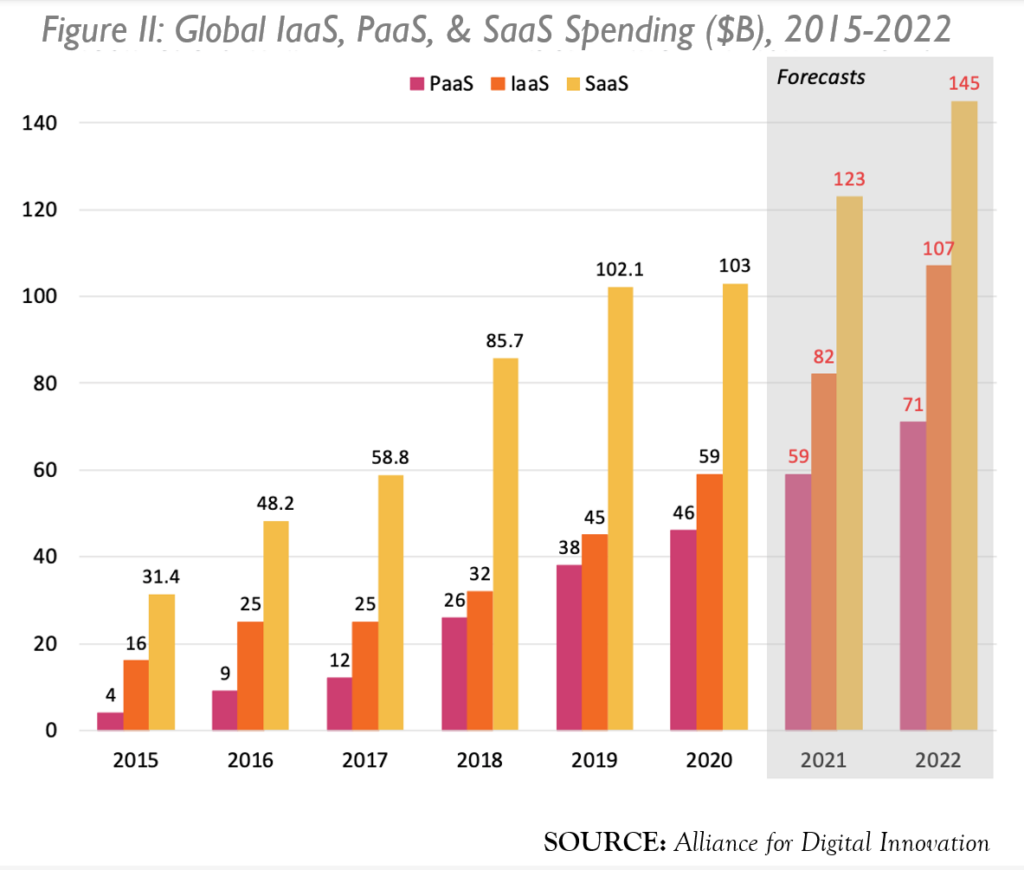

The U.S. stock market is the most important market on earth; nothing else comes close. More than $134 trillion in U.S. equities were traded in 2021, making it among the largest global markets by volume.[39] The market for stocks in the United States is almost 700 times larger than the market for online advertising, which was about $200 billion in 2021.[40] More than two-and-a-half times as much stock—about $532 billion—is traded every day.[41]

It is not just the size of the market that makes stock markets fundamentally different from advertising markets, and much more essential from a social perspective. While ads can help get information about goods and services to potential customers, stock markets have two features that are essential to a functioning economy. At the most basic level, the stock market is where individuals with money come together to meet individuals with business ideas. The money invested in stocks is used by businesses of all sizes to make investments in projects that generate wealth, employment, and the goods and services that make people happy. On the other side of the equation, participation in the securities market is the primary way in which individuals save and invest money for retirement. Stock markets are profoundly forward-looking, not about the moment.

These two aspects of securities are what make the entire economy function efficiently, but they present several special problems. Most obviously, stocks are different than other things bought and sold in markets, like apples or advertisements. Stocks are just promises about the future, not something that is consumed immediately. They are intangible. You cannot kick the tires on a stock. A stock isn’t consumed, but rather is just the right to receive cash that might or might not appear at some unknown point in the future. As such, there is a huge informational asymmetry between the people with the money and the people with the business idea. In general, the former turn over their money to the latter, who promise to, sometime in the future, turn it into more money. But the whole magic-box part (where the money becomes more money) is entirely within the latter’s control. Without a regulatory apparatus to force truthful disclosure of certain things, the risk may be too great to justify an efficient investment. Finally, investors in a stock rarely go it alone, meaning that any bargaining about information disclosure or attempts to exert control over those running the business will be beset with collective action problems. Regulations about disclosure, voting, liquidation rights, control rights, and other matters are essential to ensure the system operates efficiently.

At their core, securities laws and regulations are about both sides of this capitalist market—about protecting investors and about ensuring businesses can raise money at the lowest possible cost. These are the dual purposes of securities regulation. Without them, there would be little need for regulation.

1. Protecting Investors

There is about $50 trillion invested in U.S. public companies.[42] Almost all of this is money that is owned (directly or indirectly) by individual Americans. From the investor’s perspective, the goal is to turn money into more money long into the future, whether this is called savings, investment, or income smoothing. The stock market is the best place to do this.

Since 1928, valuation levels in the stock market have increased, on average, about 10% annually.[43] This means $100 invested in the stock market in 1928 would be worth more than $760,000 today. (Adjusting for inflation, the return is still more than 7%.[44]) Alternative investments—corporate bonds, government debt, and real estate—perform much worse. The same $100 invested in 1928 in corporate bonds would have yielded only around $54,000; in government debt, it would have yielded about $8,500; and, in a real estate portfolio, it would have returned just about $4,700.[45]

a. The centrality of individual investors

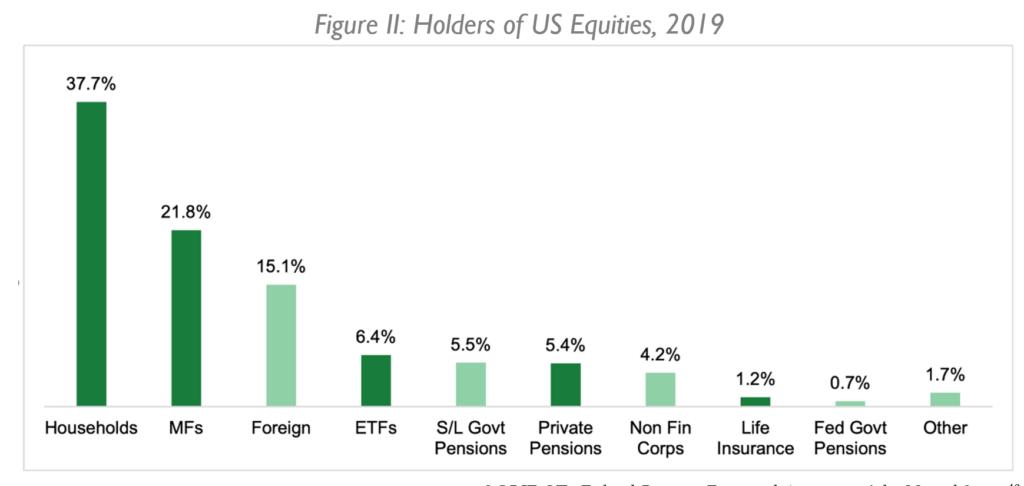

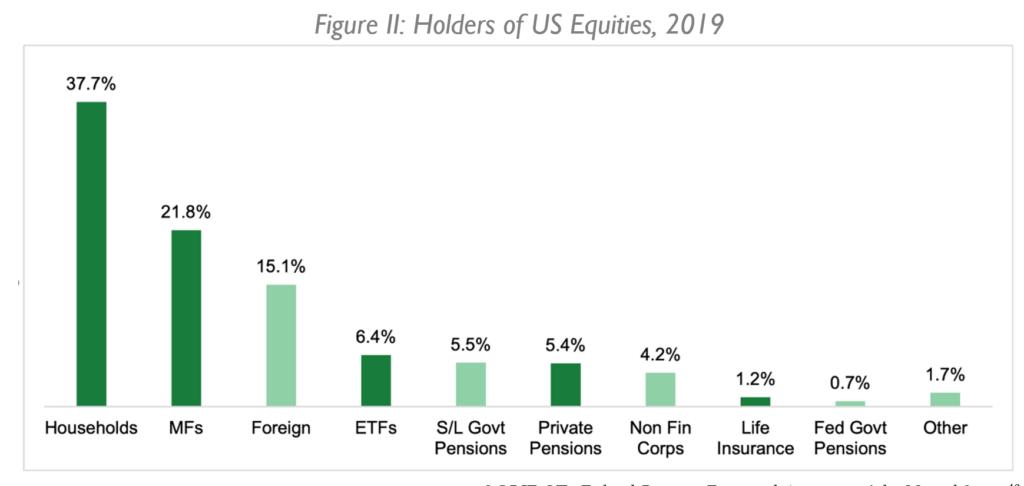

U.S. households are the largest holders of the $50 trillion in stocks. As shown in Figure II, about 38% of stocks are owned directly by individuals. The next largest bucket (22%) is mutual funds, which represent stocks owned indirectly by individuals saving for retirement. Most of the other categories—including exchange-traded funds (ETFs) and private and public pensions—likewise represent mechanisms that allow individuals to smooth their incomes over time—that is, save for retirement.

These stock investments are the largest single category of liquid assets (that is, excluding real estate and personal possessions) for U.S. households. According to data from the Federal Reserve, stocks represent about 42% of liquid assets for individuals, compared with 23% held in bank accounts.[46] Stocks are vital to the economic health of millions of families. This is true not just insofar as the stock market enables capital raising that produces employment and the things we want, but also insofar as it is the primary mechanism of personal wealth creation.

Importantly, stock ownership is not limited solely to wealthy individuals. The Federal Reserve estimates that, in 2019, about 53% of households owned stocks (about 65 million households).[47] The median value of holdings is about $40,000. According to analyses done by the Securities Industry and Financial Markets Association (SIFMA), which used data from the Federal Reserve and the U.S. Census Bureau, the median stock ownership is associated with “an income range of $77.2 thousand to $126.6 thousand and therefore shows a wide universe of Americans own stocks, not just the 1%.”[48] Many typical Americans are heavily invested in securities, whether it is through individual accounts at E-Trade or similar services, or through mutual funds, ETFs, 401(k) plans, or private or government pension plans. Protecting the best source of wealth creation for American families is why we have securities regulation.

SOURCE: Federal Reserve, Financial Accounts of the United States[49]

It is for this reason that the SEC’s unofficial moto is “We are the investor’s advocate.”[50] The approximately 4,500 staff at the SEC have a variety of jobs and areas of focus, but the mission is squarely focused on protecting individual investors, especially vulnerable, unsophisticated, poorer, and informationally disadvantaged investors.[51] Concerns about these individuals motivated the securities laws passed during the New Deal, and have animated every major SEC action over the past century.[52]

There are two specific worries. First, that investors will lose part or all of their savings by investing in businesses that are not what they appear to be. As noted above, buying a stock is a bet on the future based solely on promises, not something that will be consumed immediately. One can inspect an automobile or taste an apple; a stock is just a prediction about future cash flows. Since the future is uncertain and fully outside of the investor’s control, there is significant risk of fraud, or of simple mistakes. This risk is far greater than in the purchase of goods, including advertising. If stock prices do not (as best as possible) reflect the intrinsic value of companies, then individual investors will not be saving for the future. They instead will suffer or have to rely on alternatives, such as less-efficient government-welfare programs.

This problem occurs in both the primary market for stocks, when buying from a company issuing stock—as in an initial public offering (IPO)—and in the secondary market, when buying from other investors on an exchange, such as the New York Stock Exchange (NYSE).

In the primary market, companies have information about their prospects that may not get out to investors. Companies have incentives to disclose positive information to investors voluntarily, but they are run by individuals who may privately gain from withholding full disclosure even of positive information. Overcoming these agency costs to ensure IPOs are accurately priced is a core function of securities markets. With regard to bad news, companies have much weaker incentives. If they raise money repeatedly, the incentive to have a reputation for fair dealing might do some work. But although mature companies do come back to the capital markets on occasion, the possibility of a one-and-done offer is significant.

If investors cannot distinguish these two types ex ante, then they will pay less for a security with a given intrinsic value as a means of self-insurance. This raises the costs of capital for all firms. Regulation in the form of mandatory disclosure, regularized disclosure, and strict anti-fraud rules can help to reduce the uncertainty, and thus the cost of capital. This has massive spillovers to the economy as a whole, since capital costs are a significant determinant of the amount of wealth creation possible in the system.

There are similar concerns in secondary markets. Although issuing firms are not directly involved in trades on securities exchanges, which happen among investors who are strangers both to each other and to the issuer of the securities, problems of information asymmetry remain significant. If companies do not keep information about their future prospects current, this will decrease the accuracy of the stock price at any moment, and therefore reduce the number of trades that happen. After all, if one is less certain about the value of the stock, and if the person on the other side has better information, then the range of offers and bids will increase, which in turn will decrease the chance that a deal can be reached. The net effect will be to reduce the liquidity of an investment in a particular company. Shares will be worth less, all else being equal, because they will be harder to move in and out of, ultimately reducing the amount that investors are willing to pay for shares in the primary market. The result is higher capital costs, and therefore less economic activity.

Although there exist incentives for voluntary disclosure by companies, mandatory disclosure is justified on the grounds that the amount of voluntary disclosure, especially regarding bad news, will be suboptimal.[53] The goal is to provide traders with assurances that they are trading on reasonable terms and can exit their investment as easily as possible. This is, in part, about “fairness” for investors, but the ultimate goal is price accuracy and thus, efficient capital allocation.

The same logic that justifies mandatory disclosure also supports ancillary trading rules. Rules about trading on “inside information,” “front running,” and the like are all about ensuring that traders freely come to the market and can expect to get a fair deal. If they do not expect to get a price that reflects the fair value of the stock, they will not come or will apply a risk-adjustment to the price they are willing to take. The result will be more illiquid markets, less-accurate prices, and higher capital costs for firms. Concerns about fairness for the investors may sound like first-order issues, but they are not. After all, every stock trade has a winner and a loser, and the net social effect is zero. What motivates regulation is, instead, the impact that systematic biases about who wins and who loses might have on the market’s liquidity, and thus on capital efficiency.

The second concern follows from this possibility. If individual investors cannot confidently invest in stocks as a means of savings and building wealth, they may resort to alternatives that are riskier and less socially valuable. As noted above, the stock market is the place where individuals with ideas come together with individuals with money to cooperate to create valuable goods and services. If individuals looking to build wealth do not trust this system, they may bet their income in speculative assets like gold or cryptocurrencies; gambling on sports or horses; or any number of get-rich-quick schemes. This not only exposes them to greater risks (without offsetting increases in returns), but is also less socially valuable, since scarce economic resources are devoted to gambling instead of productive economic activity.

b. Special problems for intermediaries

Even when individuals’ investments in stocks are intermediated by professionals—either investment advisors or investment funds (such as mutual funds)—there are potential issues. The biggest one is the cost of trading. Institutional investors, such as pension funds or mutual funds, are generally not terribly concerned about the value of an individual stock. After all, if the fund holds a diversified portfolio, what matters is whether the market as a whole is up or down. What does matter for investment funds, however, is the cost of buying and selling stocks, as they purchase and sell countless stocks each day, as investors move in and out of their funds. The costs of trading include implicit costs based on information asymmetries in the market. This begets regulation to reduce these costs, since they are passed on to individual investors saving for retirement.

The costs arise because of the unique ways in which stocks are bought and sold. In general, buyers and sellers of stock come together in a market, be it on an exchange like the NYSE or through a variety of off-exchange markets. In each of these, liquidity (the existence of many buyers and sellers) is provided by high-frequency traders (HFTs), which are companies that are continuously entering buy orders and sell orders for all stocks. Some of these orders clear at market prices, meaning a buy order at a particular price from an HFT will intersect with a sell order from an investor at that price. The goal of the HFT is not to buy and hold that particular stock, however, but rather to turn around quickly and sell it to a different investor willing to own it. If the price at which the HFT buys is less (usually less than a penny less) than the price at which the HFT sells, then this is a profitable business to be in. The HFT is not an investor, but rather, a firm that makes the market happen—a “market maker.”

A problem for HFTs can arise, however, if in the period after they buy a stock and before they resell it, the price moves in a way that makes the trade unprofitable. Imagine the HFT buys at $10, and is hoping to resell it at $10.25, in order to cover its costs of operation with a small profit for investors. But suppose that, after it buys, negative news is revealed about the company’s prospects, and the stock drops to $9.75. The HFT can now only resell at a loss.

There are several ways in which an HFT can protect itself. Most obviously, it can demand more than 250 basis points compensation for the round-trip in and out of the stock. After all, its margins—the difference in the price to acquire the stock and the price to sell it (known as the bid-ask spread)—represent the profit it needs to make the business work. Any amount above its costs and reasonable allowances for profit is a form of insurance against trading against those with better information. If the HFT suspects it may be trading against investors with better information, it will widen the spread (to insure against this possibility). But if the HFT widens the spread, this means less liquidity for investors (like pension funds and individual investors), who are looking to move in or out of a stock. Less liquidity means higher risk, which translates into a greater cost of capital for companies, which reduces the number of profitable projects, which in turn reduces wealth and economic growth for everyone.

Others buying and selling stocks, like pension funds, can also find themselves bitten by informational asymmetries. They can address this by trying to time their trades so that they do not trade against an investor with an informational advantage. After all, if the pension fund systematically trades at inferior prices, it earns less returns for its beneficiaries, who are investing for retirement. Regulation of stocks and stock trading is designed to address all of these ways in which individual investors can be harmed in their pursuit of retirement savings.

2. Capital Allocation, Efficiency, and Economic Productivity

The other side of the stock market (from investors) consists of firms seeking to raise money. The stock market is one of the primary mechanisms by which firms raise capital, which is then used to invest in projects that provide employment and most of society’s goods and services. Although more money is raised in debt markets than in stock markets, there is another way in which the stock market is vital to the market economy: the stock market produces price signals that investors and entrepreneurs use to direct their activities.

Therefore, from the firm’s perspective, efficient stock markets are about two things. First, ensuring that businesses can raise money at the lowest possible cost. And second, the vital role that stock-price signals play in allocation of scarce capital (both financial and human) in the economy. These features make the stock market one of the, if not the, most important social institutions. As discussed below, while advertising is also important—in that it conveys information about products to consumers—the advertising market is trivial in comparison to the stock market, along just about any social dimension.

The price of a share of stock is not just what willing buyers and sellers are willing to accept, but a collective judgment about the intrinsic value of something. Specifically, a stock is not a thing to be consumed, like an apple or an advertisement, but rather the right to future cash flows, voting rights, and the full bundle of other rights (such as access to books and records or litigation claims for breach of duty) that arise from ownership.

In terms of economic rights, stock prices represents the market’s estimate of the future value that will be produced by the company that issued the stock, divided by the total number of outstanding shares.[54] In this way, the price is society’s best guess about the value of devoting scarce resources (that is, capital, labor, and raw materials) to this particular economic endeavor. Stock-price accuracy is therefore the foundation of resource allocation in the economy. If a stock is mispriced for a significant period, scarce resources will be misallocated.

For instance, from January 2000 through July 2001, the share price of Enron traded above $50, reaching peaks of about $90. During this period, money flowed into Enron’s businesses, in the form of investments and loans. Workers chose Enron over alternative employers. Customers inked deals with Enron, and entrepreneurs started new businesses in the fields of energy trading that Enron touted as the key to its success. Countless people invested in Enron as a source of retirement funds or wealth enhancement. All of this was utterly wasted. By the fall of 2001, Enron was worth nothing.[55]

Although thousands of individuals lost money betting on Enron stock, it is important to note that these losses were mostly offset by individuals on the other side of these trades. Stock trades are generally a zero-sum game. If A sells B a stock for $100, and the stock drops to zero, A has avoided $100 in losses, which offsets the $100 lost by B. Without belittling B’s losses, the true social harm arises from the fact that, for 18 months, if not longer, enormous numbers of decisions regarding allocation of scarce resources were influenced in whole or in part by the incorrect valuation of Enron stock. Getting Enron’s stock price, and the stock price of every other company, as accurate as possible ensures efficient capital allocation. This cascades across every economic decision at every level of the economy and society.

A properly functioning stock market serves several essential social roles, which transcend questions of who wins or loses each trade in the stock market. If an apple or an advertisement is mispriced relative to value, there will be winners and losers. Buyers might suffer (if the price is too high), or sellers might be worse off (if the price is too low); middlemen might take too much of the surplus. But in these typical commodity markets, the harms, such as they are, are relatively limited. They are likely to wash out for people who are just as likely to be buyers as they are sellers. Stock prices are totally different. They have these aspects, but the social stakes are completely different.

First, an efficient stock market provides a signal to corporate managers about the health of and prospects for the corporation. Managing a public company, no matter the size, is a complex endeavor, and the stock price is a single reference point that gives managers a sense of whether things are going well or poorly. The stock price can therefore be thought of as the firm’s slope or vector. If the price is rising, this suggests that the wisdom of the crowd of investors believes the company is going in the right direction. Managers can continue down that path. On the other hand, if the stock price is falling, managers may want to change course in some way.

This handy metric simplifies and distills countless questions or decisions—from human resources to research and development to project choice—into a single number. This massively simplifies management’s role by giving it a scoreboard of its performance. In the absence of the stock market, managers would have to rely on multiple external signals (e.g., from government or banks or consumers) along each key decision point, which would then have to be aggregated in some fashion. A stock price is a far more efficient tool, as it does all the aggregating, while integrating real-time assessments of everyone on earth with an interest in the marginal dollars that will be created or lost by the firm’s activities. All of this depends on the stock price being accurate.

Second, an efficient stock market promotes alignment between shareholders and managers. As Adolph Berle & Gardiner Means noted in their canonical work, the modern corporation is characterized by a separation between those in charge of corporate decision making (known as managers) and those investors who benefit on the margin from each dollar the corporation earns (known as shareholders).[56] Unconstrained managers have incentives to act selfishly, serving their own interests, rather than those of shareholders. This might mean being lazy, taking less risk than shareholders would prefer, or lining their own pockets with money or perks.

Since the social value of corporations is premised on their serving the interests of shareholders (more or less), managerial agency costs are a significant social problem. The stock price, therefore, is an elegant mechanism to reduce agency costs. Just as it is a simple and useful signal to managers about how they are doing and what they should be doing, so too is it a useful signal for shareholders to gauge managerial performance. Shareholders can use the stock price to inform how they vote, whether the question is representation on the board (which picks management) or compensation for managers. In extreme cases, the stock price may fall sufficiently that it triggers a takeover by an investor who wants to replace the incumbent managers. The market for corporate control, enabled by stock-price signals and hostile takeovers, is thought to be a key driver of managerial performance and economic efficiency. It depends entirely on stock price accuracy. If a given company’s stock price is “wrong,” meaning systematically mispriced, then the stock market will send false signals about incumbent management’s performance and the value to be gained from replacing them.

Third, and related to both of the first two points, an efficient stock market provides a mechanism to compensate managers for good performance. Prior to the 1990s, corporate managers were largely compensated with cash, in the form of a salary and bonus determined by the board of directors. Since pay was determined in large part in advance of any performance (salary) and performance pay was discretionary and set by a board largely appointed directly by or with the courtesy of the CEO, the system rewarded risk-averse CEOs of big firms with cozy board relations.

As a famous and influential Harvard Business Review article noted, what matters is not how much CEOs are paid, but how they are paid.[57] If shareholders are worried about managers being insufficiently focused on shareholder value (as discussed above), the solution is to align the interests of shareholders and managers by compensating the latter with stock. This helps to ensure that CEOs make decisions in the interests of shareholders. If the stock price goes up, managers’ pay goes up; if it goes down, managers’ pay goes down. Today, stock represents about 70% of the typical CEO’s pay. This revolution in compensation has dramatically increased the efficiency and value of publicly traded U.S. companies. And, as above, it depends in large part on stock prices being accurate. If stock prices are wrong, then managers will be overpaid or underpaid. This would thus distort managerial decision making, the market for corporate control, and the labor market for CEOs.

Fourth, an efficient stock market can reduce the cost of capital for firms, thereby enabling them to invest in more projects and, consequently, to increase employment and output. Companies are devices for shareholders, creditors, employees, and other stakeholders to collectively engage in certain projects. Managers decide whether to invest in a particular project based on a simple calculation—if the expected cash flows from the projected (discounted to present value) exceeds the cost of raising money to fund the project, then the company will invest. The cost of raising money—called the weighted average cost of capital (WACC)—is the sum of the cost of raising debt and the cost of raising equity to fund the project. All else being equal, the lower the cost of equity, the lower WACC, and the more projects a firm can invest in profitably.

The cost of equity is, in turn, based on a variety of factors, but overwhelmingly on the risk of the investment. An efficient stock market can reduce risk in several important ways. Accurate stock prices for peer firms provide a metric against which the current investment can be measured. Moreover, if a stock market is liquid, risk will be lower, because investors will be able to exit bad or undesirable investments readily. Finally, liquidity depends on intermediaries, known as market makers, being willing to buy or sell at posted prices. Stock markets depend on market makers constantly buying and selling shares, rather than trying to match an investor willing to sell and an investor willing to buy.

In the old days, market makers were individuals who were contractually obligated to buy and sell a particular stock at quoted prices, while today, they are HFT firms that use more sophisticated computer programs to always make liquidity available. In either case, the intermediaries earn a profit for their liquidity-making role by pocketing the difference between the price investors are willing to pay and the price at which investors are willing to sell. This difference, known as the bid-ask spread, depends on whether market makers believe stock prices accurately and efficiently process available information. If a market maker is constantly buying a stock at the market price (say, $10), it may worry that, if it tries to resell moments later, new information may reveal that the $10 price was wrong. If this fear is substantial, the market maker will increase the bid-ask spread as a means of raising its profit on some trades to offset losses on others. Increased bid-ask spreads reduce liquidity, and therefore increase the cost of capital. This raises WACC and therefore reduces the amount of socially useful projects in which companies can engage. In short, accurate stock prices flow through directly to the ability of companies, great and small, to engage in an efficient amount of economic activity.

More could be said about the various ways in which the value of accurate stock prices go far beyond investor protection or even fairness. Books and articles are written on this topic alone. For present purposes, the above should be sufficient to demonstrate the central role that accurate stock prices play in the economy.

B. Why Ads Are Different

None of the foregoing discussion applies to advertising, let alone online advertising. As the title of this article declares, ads are not stocks, and this makes all the difference in the world. The discussion above sets out the importance of looking at the purpose of a regulatory system to form the basis for an analogy to another market. As this section sets out, there are several profound differences between advertisements and stocks that undercut any connection between the purpose of stock-market regulation and any regulation of advertising markets.

Stock markets are regulated as they are because of the peculiar characteristics of stocks—their role as the primary mechanism of savings and investment for individuals and their centrality in allocating capital in the economy. Ads—like packaging, signs, and product quality—are an important means of attracting and retaining customers for individual businesses, but they do not present any of the social problems inherent in the buying and selling of stocks. This can be seen by considering the ways in which stocks are different than ads.

The sale of regular consumer goods, like avocados or antiperspirant, is not subject to the vast federal regulatory regime that the sale of stock is. Advertisements are much more akin to avocados than they are to stocks. There are several reasons for this.

1. High Stakes Versus Low Stakes

The first difference is that the stakes are much lower for the typical consumer good or advertisement, relative to stocks. As discussed above, stocks are the largest source of savings and investment for individual Americans. In addition, they provide an essential function in funding projects that provide most goods and services in the economy, as well as directing almost all economic activity. Accurate stock prices, enabled by various regulations, also enables efficient management, reduces agency costs within firms, provides a socially regarding mechanism of compensation for management, and enables the market for corporate control.

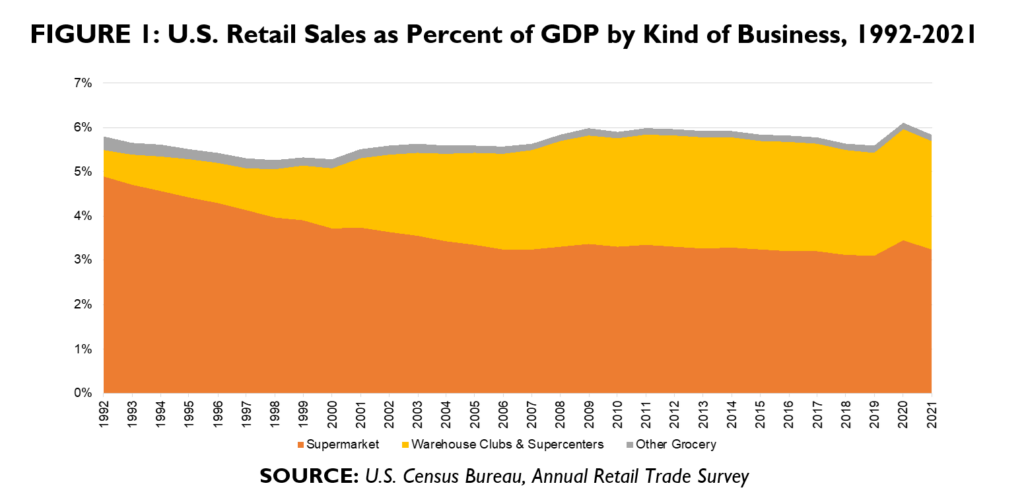

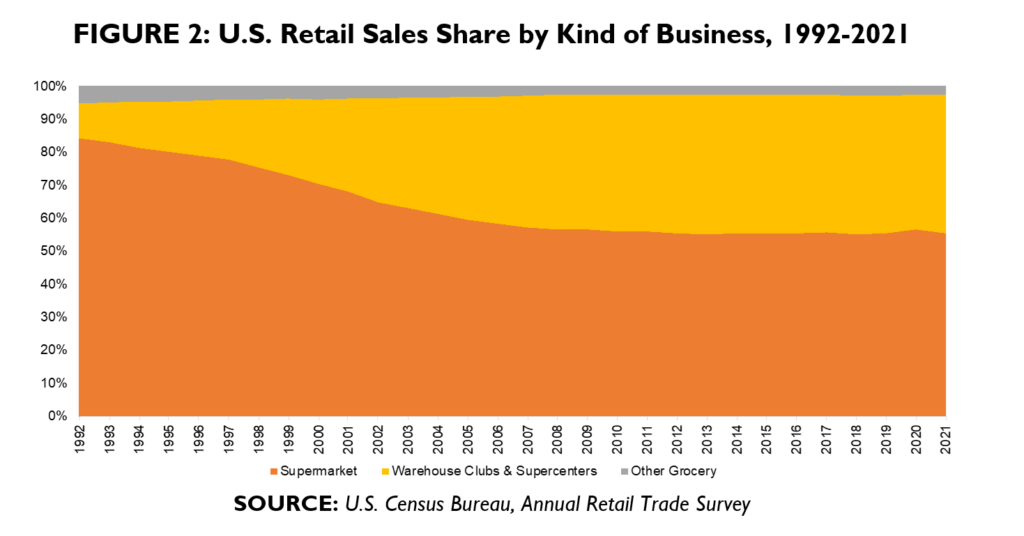

Advertising is also important. It provides consumers with information about goods and services that might not otherwise be available, or only available at a higher cost. It reduces search costs for consumers and producers. Advertising also serves as a bonding mechanism, since money spent developing a brand is a bond against bad performance. But while important, these considerations pale in comparison with the direct and indirect impacts of the stock market. For small businesses, something less than 10% of all sales are devoted to marketing of all kinds, making it an insubstantial business expense.[58] The cost of capital for funding projects is a bigger first-order concern for companies, not to mention the other impacts mentioned above.

The relatively low stakes of advertising can be seen in the ways that advertising is regulated. Under federal law, advertising must generally be truthful. The Federal Trade Commission (FTC) polices false and deceptive advertising, and there are special rules for certain types of specialty products (such as drugs) or certain types of advertisements (such as political endorsements). But there is no giant federal system for regulating billboards, print ads, or television ads, the way there is for securities. In fact, advertising about stocks and stock-related services are among the most heavily regulated advertising fields. Together, the major securities regulators—the SEC, the Financial Industry Regulatory Authority (FINRA), the Municipal Securities Rulemaking Board (MSRB), and the Securities Investor Protection Corporation (SIPC)—have together promulgated more than 30 different rules related to the advertising of brokerage services to the public.[59] These rules (and other stock-market regulations) go so far as to, in some instances, forbid brokers and issuers of securities from making truthful claims to the public, notwithstanding the First Amendment. This kind of speech restriction is typically found only for the most dangerous products, such as cigarettes.

2. Intrinsic Value Versus What Something Will Fetch

The second big difference is that the price of an advertisement is based on supply and demand, while stocks have intrinsic value. Whether an ad was placed at a “fair” price can be difficult to determine in the abstract, since anything set by the forces of supply and demand is worth only “what it will fetch.” An advertisement could be compared with other similar advertisements displayed to other similar people at other similar times, but there are numerous variables that make this comparison challenging. More fundamentally, there is a big difference between the goal of advertising markets (which offer buyers and sellers opportunities to come together at a market-clearing price) and stock markets (which are about price discovery).

The goal of the stock market is to determine, as best as practicable, the intrinsic value of a share of stock. A stock’s value is something that can be determined, and the purpose of the stock market is to determine what that value is. At a base level, the value of a stock can be approximated by the value of all the cash that the company expects to generate in the future, discounted to the present. Although there may be temporary deviations from this, as well as errors in estimating it, a stock is inherently “worth” something in a way that a consumer good is not. As noted above, ensuring a reliable mechanism of wealth creation and the proper allocation of scarce resources in the economy depends on stock markets to function as a mechanism to ascertain this value.

Consider, for instance, the stock of an oil company like ExxonMobil. How much is a share of ExxonMobil worth? Stock-market professionals estimate this value by looking at all the projects and activities of the company—its oil fields in production and its new explorations—as well as the demand for its products and the expected share of the market it is likely to have into the future. This involves complex calculations about the demand and supply of inputs and outputs from ExxonMobil’s sprawling operations. The final calculation involves estimating how much net cash ExxonMobil will generate each year, and then applying a discount rate to bring that value into present-dollar figures. This number, divided by the number of shares outstanding, tells one the approximate intrinsic value of a share of stock. Investors will, at any given moment, be willing to buy ExxonMobil if the price falls below its intrinsic value, and to sell it if it rises above it.

The price of an advertisement, by contrast, is just what someone is willing to pay to alert others to their product. The price is determined solely by the forces of supply and demand. The ad exchanges run auctions to get the ad space to the person who values it the most. That is not what the stock market is doing. The stock market is running an auction to allow people to shift in and out of savings versus consumption, to discover the more “accurate” price to help the real economy operate better.

There is another difference. A particular advertisement is worth something different to different people. Company A might be willing to pay $1 to get the eyeballs of Person X, while Company B might be willing to pay just $0.75. The possibilities are practically infinite, and the auction process in online-advertising markets is designed to elicit the willingness-to-pay and willingness-to-sell prices of particular buyers and sellers for every piece of online real estate exposed to every individual. A share of stock, by contrast, is worth the same (more or less) to everyone.

Returning to the example of ExxonMobil, imagine that some large investors—such as so-called “environmental, social, and governance” (ESG) investment funds and university endowments—start selling their shares because they no longer want to be complicit in contributing to climate change. The influx of sell orders arriving at the stock market may reduce the current price, but any such demand-based reduction will be temporary. After all, what determines the value of a share of ExxonMobil stock is not the meeting of supply and demand for the stock at a given moment, but rather, the value of the cash that a share can expect to generate in the future. This, in turn, depends on how profitable ExxonMobil is at selling its products. If the demand for the stock drops but the demand for oil (and ExxonMobil’s efficiency at delivering it) does not, then the stock price will not change. Any temporary drop owing to the increase in sell orders merely generates profit-making opportunities for investors willing to buy shares at artificially depressed prices.

Nothing even remotely like this happens in advertising markets. An auction for advertising space on a particular website is worth precisely and only what someone is willing to pay for it at that moment. If there is a lot of interest, prices will be high; if little, prices will be low. As soon as the ad space sells, that is the end of it. There is nothing but a one-time shot to reach a potential customer. There is no opportunity to buy up undervalued space or, importantly, sell overvalued space. Prices clear markets, and then the thing—an ad—happens or is consumed. The process starts again for the next opportunity: a combination of real estate, an ad, and a particular set of eyeballs.

In the stock market, by contrast, the thing being auctioned lives on after it is sold. It can be resold. It can also be sold short, betting the price will fall. One can sell shares one does not own in the hopes that the stock price falls, and the borrowed shares can be repaid after being bought at a lower price. Shorting helps process information from pessimistic investors in the market hoping to get the stock price right. You can’t short an ad space because there is no “right” price.

Ads have many (infinite) prices, while there is one price for a particular stock at any time, knowable to everyone. A share of ExxonMobil is worth $30 at this moment, and anyone can buy it for $30. By contrast, in ad markets, the price of every ad is not just for a particular plot of land on every website, but also for a particular viewer of that site. There is not one price; there are effectively an infinite number of prices.

The upshot of this is that stock markets are engaged in the constant evaluation of the intrinsic value of a single thing, which has the same value for every holder, more or less. Finding that intrinsic value is the stock market’s purpose, and the regulation of disclosure and trading activity is centrally about that purpose. Ad markets, on the other hand, are not about finding the intrinsic value of information conveyed on a website to a particular individual, but rather just what someone is willing to pay for it in that instant. This makes ads much more like regular consumer goods, rather than stocks.

3. Consumption Versus Investment or Speculation

A third big difference is that advertisements are consumed after they are sold, while stocks exist forever. Ads are, in this way, just like other consumer goods. This simple fact reduces the need for anything like the vast securities-regulation apparatus.

When one buys a regular good, like a cookie or a computer, the distance between the purchase and the realization of the value from the purchase is relatively close in time and something whose value is easily discernable to the average consumer. You know when you get a bad deal and, as a repeat player, you can choose to take your business elsewhere. Regulation is less necessary because self-help—in the form of an immediate, tangible, familiar experience—is readily and widely available. If the cookie tastes bad, the consumer will know, and will buy one somewhere else in the future. These transactions are consummated and evaluated in an instant. When that instant is gone, the price paid, and the value received vanishes. In economic parlance, it is consumed. And then there will be more opportunities for “consumption” based on that experience.

Stocks are different. As noted above, stocks are bets about the future and are primarily used as a mechanism for saving and investment over many years. The experience of buying stock in a company is completely different than purchasing a consumer good. Whether or not it was a good buy will likely not be revealed for perhaps decades, when the value is cashed out. Moreover, whether or not it was a good deal in the short run will depend on whether the price paid was the correct one, on an intrinsic level.

4. Vulnerability

A fourth significant difference between stock and advertising markets is that the typical participant in the ad market is likely to be far more sophisticated and better able to protect themselves than retail investors in the stock market. Although almost all businesses advertise in one way or another, even the smallest businesses buying or selling advertising are more sophisticated than the average retail investor. Even small businesses hire lawyers, deal with various bureaucracies, engage with suppliers and customers in complex legal and business situations, and must think critically about a range of issues at least as challenging as advertising. Every business must buy services in markets from a range of suppliers, whether it is inputs to the business, labor, or capital.