ICLE Response to the FTC’s Cloud Computing RFI

Introduction

The cloud-computing industry has undergone a transformation in recent years, driven by innovation, competition, and unprecedented demand for information-technology (IT) services. These comments assess the state of competition in this burgeoning field, and we thank the Federal Trade Commission (FTC) for the opportunity to respond to this request for information (RFI).

Competition among industry players within cloud computing is intense. It is crucial, however, to remember that, as ubiquitous as cloud-service providers might be, they must compete not just with each other but also with the internal IT capabilities of large enterprises. In other words, while the cloud-computing sector has been growing in importance within the IT ecosystem, it remains just one aspect of that ecosystem. Traditional, on-premises IT infrastructure continues to hold sway within many businesses, with internal IT teams designing solutions uniquely tailored to the specific needs of their organizations.

In this context, cloud providers present an attractive proposition. They offer companies the opportunity to take advantage of gains from specialization to outsource some or all of their IT services to expert entities. This decision between outsourcing and maintaining in-house operations is a typical business consideration, and its outcome will vary depending on a particular company’s individual capabilities. Nonetheless, it is clear that the advent of cloud computing has significantly expanded the range of available IT options.

While both the fast-moving nature of the cloud-computing industry and its intense competition have catalyzed numerous benefits, there are also some reasons for concern. For example, the shortage of computer chips has affected many segments of IT, including cloud computing. Despite this slowdown in the immediate term, the market’s general trends are mostly optimistic. These include an explosion in the variety of available software services and breakthroughs in hardware, both accompanying a dramatic fall in prices.

Given this energetic landscape, it is crucial that regulatory bodies like the FTC exercise caution in any potential interventions. After all, this vibrant and rapidly evolving industry stands as testament to the power of competitive forces to drive progress and deliver value.

I. The Evolving Landscape of Cloud Computing

The digital landscape is undergoing a profound transformation, as businesses around the globe increasingly transition from on-premises IT solutions to cloud services. This shift represents a significant evolution in the way that organizations manage their data, execute their operations, and leverage technology to gain competitive advantage. The market’s competitive dynamics are frequently misunderstood, however, which often leads to misconceptions about the role and impact of cloud computing in the broader IT ecosystem.

Traditionally, cloud computing has been divided into three “layers”:

- Infrastructure as a Service (IaaS) offers virtualized computing resources via the internet. It comprises the essential components of computing infrastructure, such as virtual machines (VMs), storage, and networking. In an IaaS environment, organizations retain greater control and responsibility for managing operating systems, runtime environments, and applications that run on the infrastructure.

- Platform as a Service (PaaS) provides developers with a platform and environment for the development, testing, and deployment of applications. PaaS encompasses a runtime environment, development tools, and various services like databases, messaging queues, and identity management. By abstracting the underlying infrastructure, PaaS allows developers to focus on building applications without the burden of infrastructure management.

- Software as a Service (SaaS) delivers software applications over the internet. SaaS enables users to access and use applications directly, without the need for installation or maintenance. The service provider assumes responsibility for managing the underlying infrastructure, platform, and application stack, providing users with a hassle-free experience. This is the most common way that users interact with the cloud, even if they are unaware of it.

One misconception about cloud computing is that it is a novel technology dominated by the “big three” companies of Amazon, Google, and Microsoft. In fact, cloud computing is merely one component of IT services, which used to be provided exclusively on-premises. Investments in cloud computing still represent a relatively small portion of global IT spending, with one report putting the total at 7%,[1] while another suggests it may be as much as 12%.[2] Whatever the precise figure, there clearly remains a sizeable opportunity for the sector to grow.

It’s also important to remember that before the advent of cloud computing, the IT landscape was dominated by a different set of players, some of which—including IBM, Hewlett-Packard, and Oracle—remain prominent today. It is therefore critical to acknowledge that cloud services have not replaced these entities, but have instead expanded the market and introduced new competitors and service offerings.

If we narrow our focus from all cloud-computing services to one of its three layers, such as IaaS, we can see that it is teeming with competition. Numerous competitors—including Amazon, Google, Alibaba, Microsoft, IBM, OVHcloud, Digital Ocean, Oracle, Deutsche Telekom, Huawei, and others—all vie for consumers. According to industry reports, in 2021 alone, these competitors showcased remarkable growth, with Microsoft growing 51%, Alibaba 42%, Google 64%, and Huawei 56%.[3]

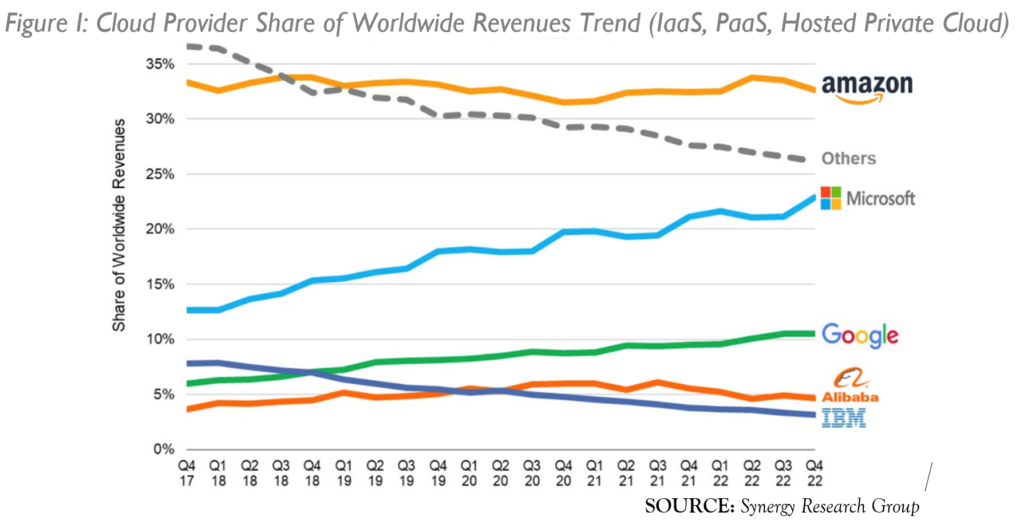

Amid this robust competition, the dominance of established players like Amazon’s AWS has been declining. According to Gartner data for IaaS, AWS’s market share dipped from 45% in 2019[4] to 39% in 2021,[5] signaling a continuing evolution in the industry’s competitive dynamics. If we expand the market and look at IaaS, PaaS, and hosted private-cloud services (which is a subset of IaaS), Amazon’s market share has been steady, while Microsoft and Google have made huge gains in the past few years (see Figure 1 below).[6] This is exactly the sort of dynamics we would expect from a vibrant industry: some firms succeeding in one part but not in another, and market shares shifting around.

It is important to note that these “shares” are for the broad, colloquial sense of “a market,” and not for a relevant market in the antitrust sense. But even assuming, for the sake of argument, that it was a relevant market, concentration would not appear to be a concern. According to Synergy Group’s Q1 2023 numbers for IaaS, Amazon had a 32% market share, with Microsoft at 23%, Google at 10%, Alibaba at 4%, and IBM at 3%.[7] If we consider all other firms in the market to be a single entity, the highest possible Herfindahl-Hirschman Index (HHI) for this market (a proxy for all cloud computing) would be 2462.

Even though that is a large overestimate of the true market concentration, it still produces an HHI that is in the “moderately concentrated” range, according to the 2010 Merger Guidelines.[8] If the remaining 28% of the market were divided up among 28 firms, the HHI would drop to 1706. And neither of these figures account for the vast swath of IT spending that occurs outside the cloud, which suggests that competition in the market is far more vigorous than the HHI would imply.

By contrast, it is difficult even to conceive of the SaaS layer of cloud computing as a “market” in any meaningful sense. SaaS comprises an extremely varied set of productivity and collaboration tools, such as Microsoft Office 365, Google Workspace (formerly G Suite), and Slack; content management systems (CMS) like WordPress, Wix, and Squarespace; video-conferencing and communication platforms, such as Zoom, Microsoft Teams, and Slack; and cloud-gaming platforms like Microsoft xCloud and PlayStation Now. Like IaaS, SaaS has experienced dramatic expansion, with more than 30,000 providers in operation. Major players include most of the already mentioned companies, as well as industry giants like Cisco, Dell, Salesforce, Databricks, Heroku, Snowflake, Adobe, and Atlassian, among others.

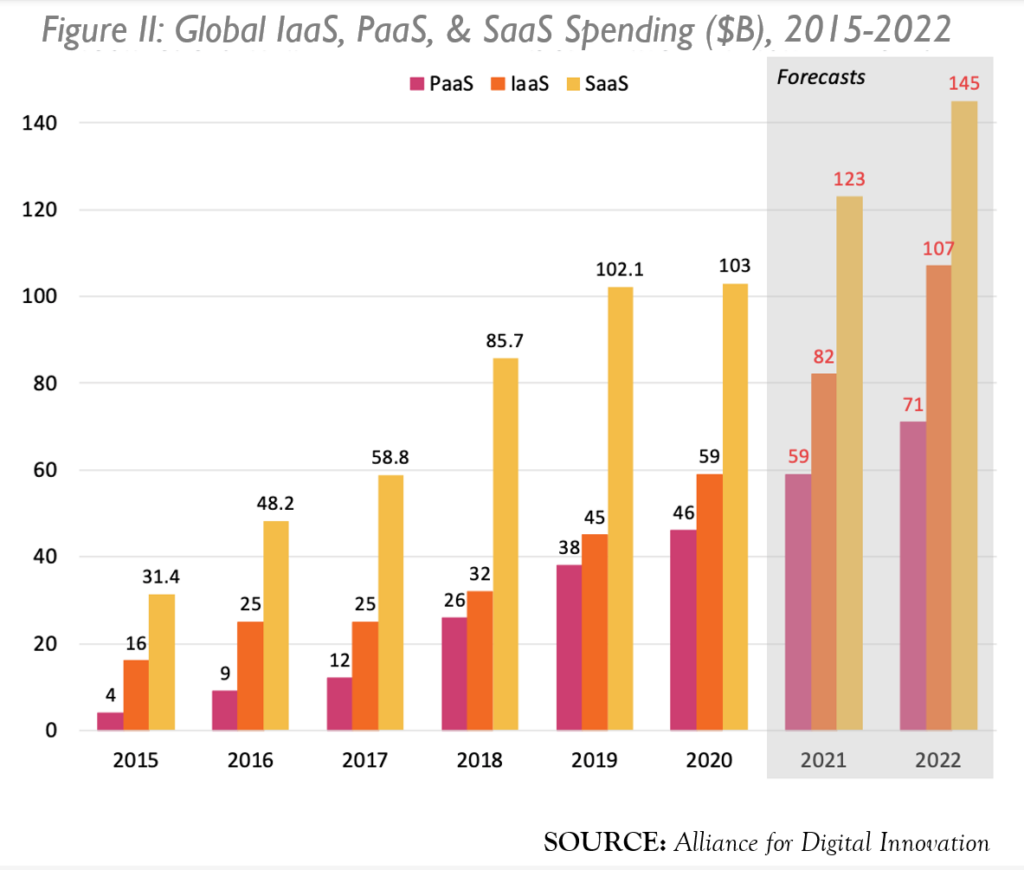

To answer RFI Question #1 regarding the extent to which cloud providers specialize within a layer or operate at multiple layers, all of the major players in IaaS and PaaS (Amazon, Microsoft, Google, etc.) also offer SaaS, but not the other way around. SaaS is a much larger layer, in terms of both the number of companies and amount of revenue. It is the largest cloud-computing segment and has experienced exponential growth, with cloud-software sales escalating from $31 billion in 2015 to an impressive $103 billion in 2020 (see Figure 2 below).

Other research finds similar numbers regarding the dominance of SaaS within cloud computing. Grand View Research finds: “The SaaS segment dominated the industry in 2022 and accounted for the highest share of more than 53.95% of the overall revenue.”[9] Other research finds similar divisions among the layers. [10]

II. Competitive Dynamics and Innovation in Cloud Computing

RFI Question #3 asks: “What are the competitive dynamics within and across the different layers of cloud computing?” These will vary by layer. In particular, any analysis of competition within SaaS would have to examine a particular subset of the layer. The subset of personal-storage services, for example, sees competition among Dropbox, Apple’s iCloud, Microsoft’s OneDrive, Google Drive, and many others. For video conferencing, we have competition among Zoom, Microsoft’s Teams, Google Meet, Apple’s FaceTime, Cisco’s Webex, and more.

Question #3 continues: “How does service quality vary between providers operating at one layer vs. providers operating at multiple layers?” While we cannot say much about the competitive dynamics within SaaS overall, as it is not a single, coherent market, we can work through the implications between SaaS and the other layers. Some of the major players in SaaS also provide IaaS and PaaS. They are not the norm, however. For example, Zoom (like most SaaS companies) does not provide the other layers, so it may not exert direct influence in those layers. SaaS is simply much broader. To the extent there is a competitive connection between SaaS and the other layers, it is indirect and manifests through demand for other services. In the other direction, falling prices for IaaS and PaaS increases competition among SaaS providers.

A. Price Trends for Cloud Services

Beyond the newsworthy stories of big companies switching cloud providers, we see aggregate-level outcomes that indicate competition. Prices are dropping (with a recent exception that we discuss below) and quantity is increasing, both at rapid rates. We have already documented the rapid rise in revenue generated by these markets. Industry forecasts continue to predict significant growth in the coming years. Gartner, for example, forecasts 23% growth for 2023 alone.[11] These revenue-growth trends are particularly remarkable in the face of rapidly falling prices.

RFI Question #7 asks: “What are the trends in pricing practices used by cloud providers?” According to Amazon’s blog, the company reduced prices 107 times between AWS’s launch in 2006 and 2021.[12] For one comparison, in November 2010, the cost of Amazon’s “Simple Storage Service” (S3) was cut to $0.140 per-GB per-month.[13] In May 2023, the monthly cost was $0.023 per-GB, a drop of more than 80% in roughly 12 1/2 years.[14] Over the same period, the consumer price index rose nearly 40%.[15] Google Cloud’s standard storage prices are similarly at $0.020-$0.023 per-GB per-month.[16]

Byrne, Corrado, & Sichel conduct the most systematic study of AWS prices, but only for the period 2009-2016.[17] Looking at storage (S3), database management (RDS), and computing services (EC2), they found:

prices for S3 storage fall at an average annual rate of more than 17 percent over the full sample. Over sub-periods, the pattern is that same as that for EC2 prices. Prices fell at an annual average rate of about 12 percent from the beginning of 2009 to the end of 2013. Then, in early 2014, just as Microsoft had entered the market to sufficient degree that they were posting their cloud prices on the Internet, AWS began cutting prices more rapidly. That started with the big price drop in early 2014, and over the period from the start of 2014 to the end of 2016, S3 prices fell at an average annual rate of about 25 percent.[18]

The timing and magnitude of price drops was similar for Amazon’s RDS, a data-management system that involves both storage and computing abilities. Overall, “quality-adjusted prices for RDS instances fall at an average annual rate of more than 11 percent over the full sample.”[19]

RFI Question #4 asks: “What practices do cloud providers use to enhance or secure their position in any layer of cloud computing?” Lowering prices, especially for storage, is a major way that cloud providers compete. Examining the timing of the most extreme drops in AWS’s prices, it is clear that competition from Microsoft pushed down prices at AWS.

The story is more complicated when it comes to on-demand compute instances. Each cloud-computing provider offers many different tiers of instances, depending on the customer’s needs for memory, network performance, operating systems, and other criteria. Moreover, those tiers and offerings have changed over time, so any price comparison needs to be quality-adjusted.

Again, the systematic analysis by Byrne, Corrado, & Sichel for 2009-2016 shows a longer-term decline in prices.[20] They find:

quality-adjusted prices for EC2 instances fall at an average annual rate of about 7 percent over the full sample. Interestingly, prices fell at an annual average rate of about 5 percent from the beginning of 2009 to the end of 2013. Then, in early 2014, just as Microsoft had entered the market to sufficient degree that they were posting their cloud prices on the Internet (and shortly before Google started doing the same), AWS began cutting prices more rapidly. That started with the big price drop in early 2014, and over the period from the start of 2014 to the end of 2016, EC2 prices fell at an average annual rate of 10.5 percent.

More recently, some industry reports suggest that computing prices might not have fallen. For example, Liftr Insights estimates there was a 2.5% increase in 2022 for cloud-instance prices—though their methodology is unclear, especially around adjusting for quality improvements and the introduction of new products over time. In any case, this number should be taken with a pinch of salt. The study shows significant variation by provider.[21] For example, there was a 23.0% increase in 2022 for average prices of on-demand compute instances at AWS, while Azure saw a 9.1% decline.[22] These price variations suggest there may be significant price dispersion in the market, or that there were important and asymmetrical product quality variations during the observed time period. In either case, the diverging price paths suggest the report may be missing important parameters or competition or simply that its price measures are not accurate.

Even on its own terms, the Liftr report does not paint an unambiguously negative picture of cloud competition over recent years. First, AWS still has lower prices than competitors. As Liftr Insights writes in their news release, “despite all these increases and decreases in prices, Azure prices have been higher (on average) than AWS prices for three years.”[23] This suggests that AWS may have dropped prices at an unsustainable pace, as competitors did not go that low, and later decided to reverse course.

A more important factor to keep in mind is that the recent period of flat or rising prices is not unique to cloud computing. A January 2022 report that calculated the cost of computations by looking at the price of computing hardware found:

The price of computations in gigaFLOPS has not decreased since 2017. Similarly, cloud GPU prices have remained constant for Amazon Web Services since at least 2017 and Google Cloud since at least 2019. Although more advanced chips have been introduced in that time—with the primary example being Nvidia’s A100 GPU, released in 2020—they only offer five percent more FLOPS per dollar than the V100 that was released in 2017.[24]

For all of its success, the cloud-computing industry is not immune from the widespread demand for chips, combined with more recent supply shortages. The supply of the chips needed to run computations has barely kept up with demand, which has caused prices to remain flat.

B. Customer Exit Options

While falling prices are evidence of strong competitive pressures within an industry, one may be concerned about barriers to switching service providers that, as RFI Question #10 suggests, may serve as a form of customer lock-in.

The major SaaS companies can still exert competitive pressure on the other layers through entry and exit. For example, Dropbox decided in 2017 to leave AWS and build its own infrastructure,[25] illustrating two things that matter for thinking about customer lock-in. First, it shows that exit is an option for customers. As explained above, cloud companies always compete with on-premises servers. Second, there is real harm to Amazon’s bottom line when it does not satisfy customers. Dropbox is a company with $2 billion in annual revenue.[26] While we do not know the nature of the Dropbox-Amazon negotiations, it seems implausible that Dropbox’s IT managers simply went on the AWS website to buy storage. Companies of Dropbox’s size will negotiate on price and quality/reliability terms. In this case, Dropbox decided its own servers would be superior.

On the flip side, cloud providers also attract large customers by convincing them that increased reliability and decreased costs justify a switch from on-premises servers to the cloud. Netflix migrated some services to AWS after originally having only its own servers. It partnered with Amazon despite Amazon Prime Video being a competitor to Netflix in the streaming-video space.[27] Importantly, Netflix was able to partially exit and to mix and match its own Open Connect with AWS to ensure that its streaming “never goes down,” as The Verge put it.

This sort of user entry and exit is to be expected from a healthy market. The turnover in these contracts also speaks to the influence that the IaaS and PaaS layers can have on SaaS.[28] IaaS can greatly improve SaaS systems’ offerings, but they always have to compete with the option of on-premises servers.

Do these examples illustrate that switching among different cloud providers is as easy as flipping a light switch? No, but moving data is neither immediate nor free. There are serious time costs and financial costs for cloud companies, and we should ultimately expect consumer prices to reflect those underlying costs. Back in 2015, moving 100 terabytes of data from an on-premises server to an AWS server could take 100 days. Amazon subsequently introduced a service called “Snowball” that involved physically shipping servers on trucks. With this service, that same transfer could take only two days.[29]

For many SaaS-storage options, such as Dropbox and Google Drive, the cost of moving data is not explicitly charged, as personal files are usually too small to bother charging for transfers, provided that the data is not moving across the country to a different data center. But for storage offered as part of IaaS, such as Google Virtual Private Cloud and Amazon S3, customers face explicit fees associated with moving data around.

Any transfer of data involves the data leaving one location (“egress traffic”) and entering another location (“ingress traffic”). Amazon,[30] Google,[31] and Microsoft[32] do not charge any fees for ingress traffic, even though incoming traffic is costly. Cloud providers instead recoup the costs of moving data through egress fees, including fees for moving within one provider or to somewhere else on the internet.

The pricing for egress fees varies depending on the type of transfer. For example, Google Cloud charges $0.01 per GiB[33] for an “Egress from a Google Cloud region in the US or Canada to another Google Cloud region in the US or Canada,” but $0.08 for an “Egress to a Google Cloud region on another continent (excludes Oceania).”[34] Amazon offers 100GB of transfer out to the internet each month, but thereafter charges $0.09 per GB for the first 10 TB per month.[35]

Beyond explicit egress charges for switching providers, policymakers may be concerned about other compatibility costs that could generate consumer lock-in. This is not a major issue for pure data storage or computing power. The major cloud providers allow users to run programs on open-source Linux instances. As one moves further from the commodity-like products of storage and computing, however, the switching costs become more real, depending on which precise service customers are using.

For example, for video editing, whether one is using editing software on one’s local machine or through cloud services, all the major editing software will input and output standardized files. If you are in the middle of an edit, however, that file format is often unique. Is that a switching cost? Probably not in any sense that is relevant to the FTC, but it is on par with the switching costs experienced once you enter a grocery store. The competitive pressures are to attract customers to enter the store, or to start using the software.

For less trivial examples, one could worry about the costs to a large company of switching from one cloud SQL-database (part of the PaaS layer) provider to another—e.g., from Amazon RDS to Microsoft Azure. SQL itself isn’t “open source” in the way that a software application or operating system might be. There are, however, numerous database systems that utilize SQL, and many of these are open source. Examples include MySQL, PostgreSQL, and SQLite; all are open-source relational database-management systems that use SQL as their standard language. Conversely, there are also proprietary, closed-source database systems that use SQL, such as Microsoft SQL Server and Oracle Database. No matter the system, again, changing providers is not as easy as flipping a light switch or dragging and dropping files on Google Drive.

But we must always ask, compared to what? Changes to major IT operations have always been costly. Transferring large amounts of data is costly, as noted above. That’s why companies have dedicated, full-time IT staff to handle such issues. Putting something on the cloud does not magically make it free to do whatever one wants, but cloud computing does open up the number of choices for any product that is available to customers.

While the above discussion frames such questions as an either/or decision, many users “multi-home” or use multiple providers. According to one survey, 70% of companies that use cloud providers use multiple providers.[36] This flexibility in selection allows customers to cherry-pick services from various providers and assign different providers for distinct workloads. Such an approach inherently amplifies the level of competition within the cloud industry. Again, it is worth contrasting this with on-premises IT services. The apparent ease of multi-homing suggests that other compatibility issues are not a major hindrance to competitive pressures and that there is still robust competition for consumers.

III. Downstream Competitive Benefits of Cloud Computing

RFI Question #4 asks: “What are the effects of those practices on competition, including on cloud providers who do not operate at multiple layers?”

The biggest impact of competition on prices within the cloud-computing sector may not be observed directly by consumers; rather, it manifests in generating the infrastructure and platforms that allow other businesses to compete. This includes not only the various types of SaaS that people usually associate with cloud computing, such as Zoom and Dropbox, but also general online products and services that have become feasible due to the lower cost of cloud computing.

Every industry has been affected by cloud computing, as many large-scale enterprises are adopting cloud-based technologies to effectively manage and reduce their expenses.[37] As noted above, for the 2009-2016 period, Byrne, Corrado, & Sichel find that prices fell annually by 7% for computing power, 12% for database services, and 17% for storage.[38]

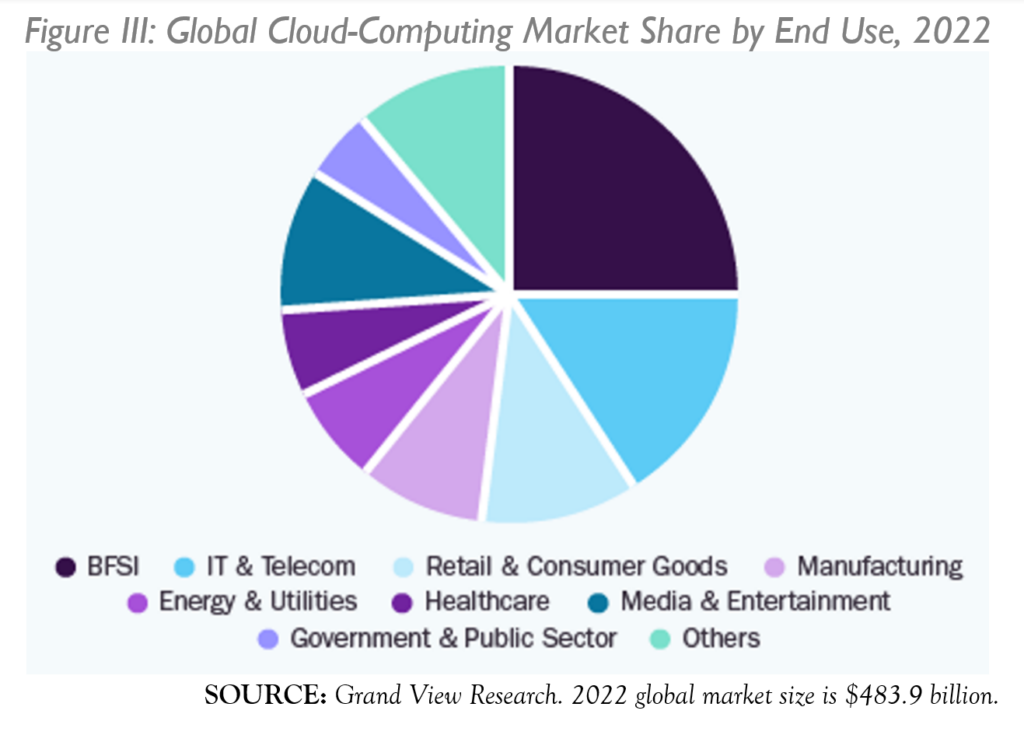

These cost reductions enhance competition in many sectors, not just “tech” sectors. For example, according to Grand View Research, the banking, financial services, and insurance (BFSI) sector has the largest share of cloud computing by end-use (see Figure 3 below).[39] As of 2017, a large BFSI company like JP Morgan Chase required 40,000 IT employees and an annual budget of more than $9 billion.[40] As companies moved more of those IT services to the cloud, they have saved money and opened new possibilities.

Cloud computing has also enabled such advances as mobile banking, digital wallets, and payment services. Services like Apple Pay, Google Pay, and PayPal allow users to make secure transactions with their smartphones, eliminating the need for physical credit cards or cash. By leveraging cloud computing, mobile-payment services can benefit from increased scalability, flexibility, security, and accessibility, ensuring the smooth and secure operation of payment transactions while providing a seamless user experience. These options and the competitive pressures they unleash are now feasible, given the drastic drop in cloud prices.

And banking is just one industry. Every industry has experienced the effects of cloud computing increasing competition in those downstream industries. For a recent example, American Airlines in May 2022 transitioned its customer-facing applications from an internal server to IBM Cloud. Again, for decades, companies have had to manage their own IT processes. The move by American was intended to enhance the airline’s digital self-service tools and offer customers improved access. By leveraging the open and flexible IBM cloud platform, American was able to modernize its technology stack, embrace DevOps principles, and achieve greater agility in its operations.[41]

This ease is especially important for startups. According to one IT-industry advocacy group, “cloud hosting and computing services, like AWS, Azure, Google Cloud, or others”[42] is one of the three most popular categories of services used by startups, alongside code repositories (like Github) and communication and collaboration tools (like Zoom or Slack). By their numbers, 69% of startups are using “cloud computing and database services,” because these “have lowered barriers for startups by enabling them to innovate without needing to worry about building the hardware physical infrastructure themselves.”[43] Whether the number is 60% or 80%, the important thing to recognize is that cloud providers now provide options to startups in the most remote parts of the country on par with those in Silicon Valley.

One aspect of the market’s evolution that may get lost in the discussions about price and exit is the increased security benefits that cloud computing can provide for downstream firms—especially for smaller startups without the means for a dedicated IT team. Oracle conducted a survey of “341 CEOs and CIOs, at firms between 500 to 10,000 employees, making between 100M to 999M dollars in revenue annually in a variety of industries, and located across the United States.”[44] They found that that 66% of the C-suite officials selected “security” as one of the “biggest benefits of cloud computing for your organization today,” while only 41% chose “cost reduction.”[45] Any policy proposals that seek changes in the cloud-computing market must take the potential impacts to security seriously.

VII. Cloud Computing and Artificial Intelligence

Among the downfield services that have received considerable attention are artificial intelligence (AI) and machine learning (ML). Training large AI and language models requires an expensive, upfront training period. The costs are often not released to the public, but we can make rough calculations.

A cutting-edge GPU such as the popular Nvidia A100, released in 2020, costs about $10,000.[46] Meta’s largest language model used 2,048 Nvidia A100s. If Meta bought GPUs specifically for training this model, the cost would be more than $20 million and the training would take about 21 days. If it instead used dedicated prices from AWS, the cost would be over $2.4 million.[47] Cloud computing allows for the cost of GPUs to be split across many users. Training large models are a perfect use case for renting processing power, since it is a large training cost that companies do not need every day.

While $2 million to $20 million is a large investment, it is not beyond the capabilities of many large tech companies. For a comparison, Meta has spent more than $30 billion on the Metaverse.[48] And the returns to innovation in this space are large. OpenAI’s ChatGPT reached 100 million active users just two months after its release, making it the fast-growing user base ever.[49] And that came from a relatively unknown company.

Much of the attention around AI involves the big companies (OpenAI, Google, Meta, Microsoft). But the cloud increases the availability of AI models for smaller companies, thereby increasing competition in the AI space, just as it previously did in teleconferencing, mobile payments, and IT services. For example, Amazon’s Bedrock is a marketplace for “generative AI applications with foundation models (FMs)” that “makes FMs from leading AI startups and Amazon available via an API, so you can choose from a wide range of FMs to find the model that is best suited for your use case.”[50]

Similarly, Microsoft’s Azure provides tools for customers to use AI models for their unique situations by, for example, offering models to help with quality control in manufacturing.[51] Azure also offers large-scale language models—including ChatGPT, as well as others—for use on the pay-as-you-go model, similar to other cloud services.[52]

Cloud computing may allow AI to flourish, but AI also affects the cloud-computing markets. One concern in AI is the limit of suitable AI chips. For years, there have been news stories about chip shortages and their impact on car production, computer availability, and more. That supply constraint could have a major impact on cloud computing. As noted above, computing prices are rising both on the cloud and off.

In response to rising prices, as well the development of AI and ML, demand has grown for new types of chips within cloud computing. Many are transitioning from traditional CPU chips to specialized chips, such as graphics processing units (GPUs), which were traditionally used for graphics cards but are increasingly used for AI and ML. For example, Google’s AI Infrastructure is built around Google’s Tensor Processing Units (TPUs) and cloud GPUs.[53] Amazon introduced a new type of chip, known as Trainium, which was specifically engineered to train machine-learning algorithms and to compete with similar products from Nvidia.

To respond to RFI Question #4, new hardware—such as Google’s TPUs or Amazon’s Trainium—is one way that cloud providers could enhance or secure their position across multiple layers. By offering a better product, they secure their position both in IaaS, as well as in any SaaS that runs on that hardware.

Conclusion

The landscape of the cloud-computing industry is marked by intense competition and rapid innovation, influenced by the increasing demand for IT services. It’s important to acknowledge the dual nature of this competition: cloud providers must not only contend with one other, but also with the established internal IT capabilities of large firms.

Cloud computing is a new entrant to the IT sector. Traditional, on-premises IT infrastructure remains a significant player in this arena, with cloud computing forming one crucial component of the broader IT ecosystem. Firms’ ability to choose, combine, or even switch among services from multiple cloud providers further underscores the industry’s competitive dynamics. As we move forward, the promise of enhanced service offerings, technological innovation, and reduced costs for consumers appear set to continue, fueled by these competitive pressures. We could always imagine some perfect policy remedy that would allow these trends of falling prices, increasing quantity, and increased innovation to be even more extreme. But given what we have seen, it appears the future of cloud computing is bright, and we can eagerly anticipate exciting developments on the horizon.

[1] Bill Whyman, Secrets From Cloud Computing’s First Stage: An Action Agenda for Government and Industry, Information Technology and Innovation Foundation (Jun. 1, 2021), https://itif.org/publications/2021/06/01/secrets-cloud-computings-first-stage-action-agenda-government-and-industry.

[2] Glenn Solomon, The Cloud Is Still a Multibillion-Dollar Opportunity. Here’s Why, Forbes (Jan. 4, 2023)m https://www.forbes.com/sites/glennsolomon/2023/01/04/the-cloud-is-still-a-multibillion-dollar-opportunity-heres-why.

[3] Press Release, Gartner Says Worldwide IaaS Public Cloud Services Market Grew 41.4% in 2021, Gartner (Jun. 2, 2022), https://www.gartner.com/en/newsroom/press-releases/2022-06-02-gartner-says-worldwide-iaas-public-cloud-services-market-grew-41-percent-in-2021.

[4] Id.

[5] Id.

[6] Cloud Spending Growth Rate Slows But Q4 Still Up By $10 Billion from 2021; Microsoft Gains Market Share, Synergy Research Group (Feb. 6, 2023), https://www.srgresearch.com/articles/cloud-spending-growth-rate-slows-but-q4-still-up-by-10-billion-from-2021-microsoft-gains-market-share.

[7] Felix Richter, Big Three Dominate the Global Cloud Market, Statista (Apr. 28, 2023), https://www.statista.com/chart/18819/worldwide-market-share-of-leading-cloud-infrastructure-service-providers.

[8] U.S. Department of Justice & FTC, Horizontal Merger Guidelines § 5.3 (2010).

[9] Cloud Computing Market Size, Share & Trends Analysis Report By Service (SaaS, IaaS), By End-use (BFSI, Manufacturing), By Deployment (Private, Public), By Enterprise Size (Large, SMEs), And Segment Forecasts, 2023 – 2030, Grand View Research, https://www.grandviewresearch.com/industry-analysis/cloud-computing-industry (last visited Jun. 18, 2023).

[10] Minjau Song, Trend and Developments in Cloud Computing and On-Premise IT Solutions, Alliance for Digital Innovation (Dec. 2021), available at https://alliance4digitalinnovation.org/wp-content/uploads/2021/12/Brattle-Cloud-Computing-Whitepaper_Dec-2021-2.pdf, at 17.

[11] Press Release, Gartner Forecasts Worldwide Public Cloud End-User Spending to Reach Nearly $600 Billion in 2023, Gartner (Apr. 19, 2023), https://www.gartner.com/en/newsroom/press-releases/2023-04-19-gartner-forecasts-worldwide-public-cloud-end-user-spending-to-reach-nearly-600-billion-in-2023.

[12] Bowen Wang, Amazon EC2 – 15 Years of Optimizing and Saving Your IT Costs, Amazon (Aug. 17, 2021), https://aws.amazon.com/blogs/aws-cost-management/amazon-ec2-15th-years-of-optimizing-and-saving-your-it-costs.

[13] Alexia Tsotsis, Amazon Slashes AWS S3 Prices Up to 19%, TechCrunch (Nov. 1, 2010), https://techcrunch.com/2010/11/01/aws-s3-2.

[14] Amazon S3 pricing, Amazon, https://aws.amazon.com/s3/pricing (last visited Jun. 15, 2023).

[15] Consumer Price Index for All Urban Consumers: All Items in U.S. City Average, FRED, https://fred.stlouisfed.org/series/CPIAUCSL (last accessed Jun. 15, 2023).

[16] Cloud Storage price, Google, https://cloud.google.com/storage/pricing (last visited Jun. 15, 2023).

[17] David Byrne et al., The Rise of Cloud Computing: Minding Your P’s Q’s and K’s, National Bureau of Economic Research (Working Paper 25188 2018).

[18] Id. at 22.

[19] Id. at 22.

[20] Id at 20.

[21] Press Release, Liftr Insights Data Highlights Increases in AWS Prices While Microsoft Azure Prices Have Been Decreasing, Liftr Insights (Feb. 7, 2023), https://liftrinsights.com/news-releases/aws-and-azure-cloud-pricing-moving-in-different-directions-as-shown-by-liftr-insights-data.

[22] Id.

[23] Id.

[24] Andrew Lohn & Micah Musser, AI and Compute: How Much Longer Can Computing Power Drive Artificial Intelligence Progress, Center for Security and Emerging Technology (Jan. 2022), https://cset.georgetown.edu/publication/ai-and-compute.

[25] Ron Miller, Why Dropbox Decided to Drop AWS and Build Its Own Infrastructure and Network, TechCrunch (Sep. 15, 2017), https://techcrunch.com/2017/09/15/why-dropbox-decided-to-drop-aws-and-build-its-own-infrastructure-and-network.

[26] Press Release, Dropbox Announces Fourth Quarter and Fiscall 2022 Results, Dropbox (Feb. 16, 2023), https://dropbox.gcs-web.com/news-releases/news-release-details/dropbox-announces-fourth-quarter-and-fiscal-2022-results.

[27] See, e.g., Shirsha Datta, What Led Netflix to Shut Their Own Data Centers and Migrate to AWS?, Medium (Sep. 22, 2020), https://shirshadatta2000.medium.com/what-led-netflix-to-shut-their-own-data-centers-and-migrate-to-aws-bb38b9e4b965; Vaishnavi Katgaonkar, How Does Netflix Work?, Medium (Sep. 9, 2020), https://medium.com/@katgaonkarvaishnavi10/how-does-netflix-work-425e0fd06055; Netflix on AWS, Amazon, https://aws.amazon.com/solutions/case-studies/innovators/netflix (last visited Jun. 15, 2023).

[28] Catie Keck, A Look Under the Hood of the Most Successful Streaming Service on the Planet, The Verge (Nov. 17, 2021), https://www.theverge.com/22787426/netflix-cdn-open-connect.

[29] Yevgeniy Sverdlik, AWS Finds Way to Move a Lot of Data to Cloud Faster – by Putting It on a Shipping Truck, DataCenter Knowledge (Oct. 7, 2015), https://www.datacenterknowledge.com/archives/2015/10/07/aws-speeds-up-data-migration-to-cloud-using-shipping-trucks.

[30] Amazon, supra note 14.

[31] Bandwidth Pricing, Azure, https://azure.microsoft.com/en-us/pricing/details/bandwidth (last visited Jun. 15, 2023).

[32] All Network Pricing, Google Cloud, https://cloud.google.com/vpc/network-pricing (last visited June 15, 2023).

[33] 1 gibibyte (GiB) equals 1.074 gigabytes (GB).

[34] Google Cloud, supra note 32.

[35] Amazon, supra note 14.

[36] 2023 State of the Cloud Report, Flexera, https://info.flexera.com/CM-REPORT-State-of-the-Cloud#view-report (last visited Jun. 15, 2023).

[37] Grand View Research, supra 9.

[38] Byrne et al., supra 17.

[39] Grand View Research, supra 9.

[40] Kim S. Nash, J.P. Morgan Chase Names New CIO as Dana Deasy Exits, Wall Street Journal (Sep. 7, 2017), https://www.wsj.com/articles/j-p-morgan-chase-names-new-cio-as-dana-deasy-exits-1504822667.

[41] Id.

[42] Tools To Compete: Lower Costs, More Resources, and the Symbiosis of the Tech Ecosystem, CCIA Research Center and Engine (Jan. 25, 2023), https://research.ccianet.org/reports/tools-to-compete, at 6.

[43] Id. at 16.

[44] Security in the Age of AI, Oracle, available at https://www.oracle.com/a/ocom/docs/data-security-report.pdf, at 3 (last visited June 15, 2023),

[45] Id. at 6.

[46] Jonathan Vanian, ChatGPT And Generative AI Are Booming, but the Costs Can Be Extraordinary, CNBC (Mar. 13, 2023), https://www.cnbc.com/2023/03/13/chatgpt-and-generative-ai-are-booming-but-at-a-very-expensive-price.html.

[47] Id.

[48] Jyoti Mann, Meta Has Spent $36 Billion Building the Metaverse but Still Has Little to Show for It, While Tech Sensations Such as the iPhone, Xbox, and Amazon Echo Cost Way Less, Business Insider (Oct. 29, 2022), https://www.businessinsider.com/meta-lost-30-billion-on-metaverse-rivals-spent-far-less-2022-10.

[49] Krystal Hu, ChatGPT Sets Record for Fastest-Growing User Base – Analyst Note, Reuters (Feb. 2, 2023), https://www.reuters.com/technology/chatgpt-sets-record-fastest-growing-user-base-analyst-note-2023-02-01.

[50] Amazon Bedrock, Amazon, https://aws.amazon.com/bedrock (last visited Jun. 15, 2023).

[51] Azure AI, Microsoft, https://azure.microsoft.com/en-us/solutions/ai/#overview (last visited Jun. 15, 2023).

[52] Price Details, Microsoft, https://azure.microsoft.com/en-us/pricing/details/cognitive-services/openai-service/#pricing (last visited Jun. 15, 2023).

[53] AI Infrastructure, Google Cloud, https://cloud.google.com/ai-infrastructure (last visited Jun. 15, 2023)