Quack Attack: De Facto Rate Regulation in Telecommunications

If it looks like a duck, walks like a duck and quacks like a duck, then it just may be a duck.

—Walter Reuther

Executive Summary

Rate regulation can take many forms. Rates may be regulated through overt price controls, such as price ceilings or price floors; through less-overt rules governing the pace of price changes; or through quality mandates or restrictions. Some rate regulations can provide short-run benefits to certain groups of consumers or producers, but often result in shortages or surpluses that diminish overall welfare. In the long run, rate regulation often distorts investment incentives, leading to a misallocation of investment (e.g., to under- or over-investment).

For these reasons, since the late 1970s, direct rate regulation generally has fallen out of favor across most sectors of the economy, although there are some—such as insurance and utilities—where it remains commonplace. Nevertheless, elected officials and other policymakers frequently come under pressure from constituents and stakeholders to “do something” about the price of goods and services in the ostensibly “deregulated” sectors of the economy, such as when consumers characterize short-term price disruptions as “price gouging.” In some cases, firms may seek regulations to “stabilize” prices, while in others, rate regulation may be seen as a means to “increase access” to crucial goods and services.

Because the costs of overt rate regulations are so well-known, price controls are often buried under layers of bureaucracy or wrapped in with other policies and programs, such that policymakers can plausibly claim that their proposals do not directly regulate rates. While not explicit price controls, these programs amount to de facto rate regulation. It’s a regulatory version of the Duck Test.

Rate regulation—in any form and whatever the imagined benefits—is not a costless endeavor. Costs and risk do not disappear under rate regulation. Instead, they are shifted in one direction or another—typically with costs borne by consumers through some mix of suppressed or misdirected investment, sluggish improvements in quality, and reduced innovation.

This issue brief gives an overview, with a particular focus on the telecommunications sector, of the consequences of different types of overt rate regulation—price ceilings and prices floors—as well as how quality regulations can amount to rate regulation. Price controls, such as price ceilings and price floors, are government interventions in the market that aim to regulate the prices of goods and services. While they may have some short-term benefits, they can also lead to long-term consequences that are not always positive. We examine, in particular, four telecommunications programs in which de facto rate regulation is a key component.

- The National Telecommunications and Information Administration’s (NTIA) notice of funding opportunity under the Broadband Equity, Access, and Deployment Program (BEAD), which requires each program participant to include a “middle-class affordability plan to ensure that all consumers have access to affordable high-speed internet”;

- The U.S. Agriculture Department’s (USDA) ReConnect Loan and Grant Program, which gives preference to applicants who agree to abide by “net neutrality” and who provide a “low-cost” option to consumers;

- New York State’s Affordable Broadband Act, which requires internet service providers (ISPs) to offer all qualifying low-income households at least two internet-access plans: a $15-a-month plan with download speeds of at least 25 megabits-per-second, or a $20-a-month plan with download speeds of at least 200 megabits-per-second; and

- The Federal Communications Commission’s (FCC) 2015 Open Internet Order’s “net neutrality” and “zero rating” provisions.

In each of these examples, policymakers have gone to extraordinary lengths to avoid characterizing the programs’ pricing provisions as direct rate regulation. No matter how the policies are characterized, however, the consequences remain. When regulation is used to set prices on one side of the multi-sided broadband market at below-market rates, there will be upward pricing pressure on another side of the market. Ultimately, consumers who are not subject to the regulated rates will face higher prices, in turn putting pressure on policymakers to impose yet another layer of imprecise and complex regulation and even deeper constraints on investment.

Government policy may well be able to help accelerate broadband deployment to the unserved portions of the country where it is most needed. This issue brief concludes that the way to achieve that goal is not by imposing price controls on broadband providers. Instead, broadband access can best be expanded by removing costly, government-erected barriers to buildout and/or by subsidizing and educating consumers, where needed.

I. Introduction

Since the deregulation of railroads, airlines, and trucking in the late 1970s, direct rate regulation has generally, except in a few outlier examples like insurance and utilities, fallen out of favor with elected officials and policymakers. To be sure, there are times when experts and activists have called for price controls in response to short-term price disruptions they characterize as “price gouging.” Because of a widespread skepticism of explicit price controls, rate-regulation efforts are instead often described as efforts to “stabilize” prices or “increase access” to goods and services. In many cases, the price controls are buried under layers of bureaucracy or bundled with other policies and programs, such that policymakers can plausibly claim that their proposals do not amount to regulating rates.

For example, the Wall Street Journal recently reported that 50 members of Congress sent a letter to President Joe Biden urging his administration “to pursue all possible strategies to end corporate price gouging in the real estate sector and ensure that renters and people experiencing homelessness across this country are stably housed this winter.”[1] Proposals include directing the Federal Housing Finance Agency (FHFA) to establish “anti-price gouging protections” and “just cause eviction standards” in rental properties with government-backed mortgages. Another proposal would have the Federal Trade Commission (FTC) issue new regulations defining “excessive” rent increases as an unfair trade practice. A third proposal would condition grants from the U.S. Department of Housing and Urban Development (HUD) on localities mitigating housing cost burdens and “adopting anti-rent-gouging measures.” None of these proposals amount to direct rent controls, but they would, in tandem, establish de facto rent regulation.

Efforts by policymakers to control prices, while distancing themselves from explicit rate regulation, have targeted myriad industries, including telecommunications services. For example, under former Chair Tom Wheeler, the Federal Communications Commission (FCC) voted to enact the 2015 Open Internet Order (OIO), which categorized internet service providers (ISPs) as “common carriers” under Title II of the Communications Act of 1934, thereby subjecting them to, among other things, net-neutrality principles. While rate regulation is among the defining features of most Title II services,[2] Wheeler nonetheless promised at the time to forebear from applying such regulations, stating flatly that “we are not trying to regulate rates.”[3]

But this assurance proved a small consolation. While the agency decided to waive “the vast majority of rules adopted under Title II,” it also made clear that the commission would “retain adequate authority to” rescind such forbearance in the future.[4] In his dissent from the OIO, Commissioner Ajit Pai noted the forbearance merely meant that “the FCC will not impose rules ‘for now.’”[5] Thus, while stopping short of imposing explicit rate regulation immediately, the OIO dangled the threat of rate regulation in the future.

Such threats amount to de facto rate regulation, in which agencies hold out the potential use of onerous rules in the future to shape providers’ pricing policies today. Tim Wu—credited with coining the term “net neutrality” and a recently departed senior advisor to President Joe Biden—has explicitly endorsed the use of threats by regulatory agencies as a means to obtain favored policy outcomes:

The use of threats instead of law can be a useful choice—not simply a procedural end run. My argument is that the merits of any regulative modality cannot be determined without reference to the state of the industry being regulated. Threat regimes, I suggest, are important and are best justified when the industry is undergoing rapid change—under conditions of “high uncertainty.” Highly informal regimes are most useful, that is, when the agency faces a problem in an environment in which facts are highly unclear and evolving. Examples include periods surrounding a newly invented technology or business model, or a practice about which little is known. Conversely, in mature, settled industries, use of informal procedures is much harder to justify.[6]

In 2017, under then-Chairman Pai, the FCC reclassified broadband under Title I of the Communications Act. In a 2018 article referencing the repeal of the 2015 rules, Gigi Sohn lamented that removing ISPs from Title II’s purview meant losing the “power to constrain ‘unjust and unreasonable’ prices, terms, and practices by [broadband] providers.”[7] More recently, standing as a nominee to the FCC, Sohn was asked during a 2021 confirmation hearing before the U.S. Senate Commerce Committee if she would support the agency’s regulation of broadband rates.[8] She responded: “No. That was an easy one.” Around the same time, FCC Chair Jessica Rosenworcel said in written comments that she did not plan to regulate broadband rates directly or indirectly.[9] Her comments indicated that the agency’s 2015 net-neutrality rules “expressly eschew future use of prescriptive, industry-wide rate regulation” and that she “supported this approach in the past and would do so again in the future.”

Nonetheless, policymakers’ interest in imposing controls on broadband rates continues unabated. In 2021, for example, President Biden’s American Jobs Plan called on Congress to reduce broadband prices:

President Biden believes that building out broadband infrastructure isn’t enough. We also must ensure that every American who wants to can afford high-quality and reliable broadband internet. While the President recognizes that individual subsidies to cover internet costs may be needed in the short term, he believes continually providing subsidies to cover the cost of overpriced internet service is not the right long-term solution for consumers or taxpayers. Americans pay too much for the internet—much more than people in many other countries—and the President is committed to working with Congress to find a solution to reduce internet prices for all Americans.[10]

But even in those cases in which rate regulation is imposed, proponents are careful to avoid calling it rate regulation. In defending the State of New York’s 2021 Affordable Broadband Act, for example, the state claimed that the law’s pricing provisions did not amount to rate regulation because they specified a price ceiling, rather than a specific price.[11]

This brief first provides an overview of the problems inherent in rate regulation, de facto or otherwise. It then identifies several instances of rate regulation being covertly introduced into broadband policy, and the dangers this poses to deployment.

II. A Primer on Rate Regulation

In a competitive market, prices allow for the successful coordination of supply and demand, and the market price reflects both consumer demand and the costs of production. Of course, for those on the demand side of the equation, the price of a good or service is a cost to them, and they would prefer falling prices to rising prices. For suppliers, the price represents the revenue from selling the good or service and they would prefer rising prices to falling prices.

Because of this inherent tension, there is a natural inclination on the part of both consumers and producers to seek the government’s intervention in the competitive process to halt or slow price changes. The most obvious way the government can intervene is through rate regulation, such as price controls. Price controls can be divided into two categories: price ceilings that set a maximum price that sellers can charge and price floors that set the minimum price that consumers can pay. It is well-known and widely accepted that price controls can make both consumers and sellers worse off.[12] Consequently, policymakers may pitch policies that control prices under another name (e.g., “second generation rent relief”) or introduce policies that are not explicit price controls, but have substantially the same effects as price controls (e.g., quality-of-service mandates).

A. Price Ceilings

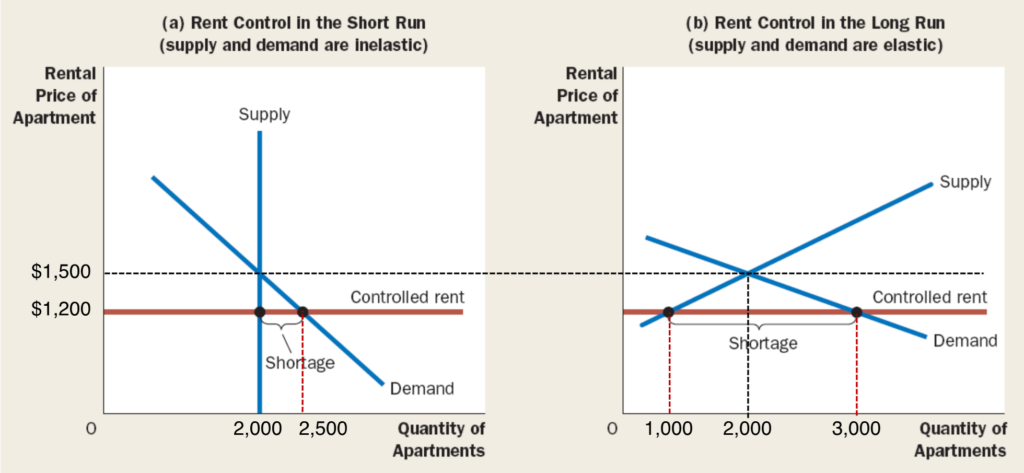

The most well-known example of a price ceiling is rent control—so well-known, in fact, that just about every introductory microeconomics textbook discusses the topic. Consider the market for apartment rentals shown in Figure I, which is based on an example from Gregory Mankiw’s widely used economics textbook.[13] In a competitive market, the price of apartments would be $1,500 and 2,500 apartments would be rented out.

Figure I: Rent Control in the Short Run and in the Long Run

SOURCE: Mankiw

At the market price, however, tenant advocates would complain of a housing “affordability crisis”—that apartment rents are too high. They argue that if prices were lower, more people could afford apartments. As a result, the government imposes a price ceiling, mandating that apartment rents cannot be any higher than $1,200. But at this price, in the short run, Panel (a) shows the number of apartments demanded (2,500) exceeds the quantity supplied (2,000). Because of this excess demand of 500 apartments, some people who want to rent an apartment would be unable to do so. In other words, there is a shortage of apartments.

In this example, the price ceiling makes the housing “crisis” worse, because fewer people are able to rent apartments than before the rent control was imposed. Some renters are better off because they are paying lower rents, but others are worse off because they cannot rent an apartment—even if they are willing to pay the market price.

Rent-control advocates might argue that there would be no shortage of apartments because apartments don’t just disappear. But they do, just not in the most obvious ways. In the short run, property owners may be more selective regarding to whom they will rent apartments. In the medium term, property owners might convert their apartments to short-term rentals (e.g., listing them on a service like Airbnb). In the somewhat longer term, property owner will reduce their maintenance investments or might convert their apartment buildings to condominiums or sell their rental house to an owner-occupier. Ultimately, developers may decide to invest in an area that is not subject to rent control, thereby reducing the construction of new rental housing. Thus, as shown in Panel (b), in the long run, rent control shifts the supply curve, further reducing the supply of housing and increasing the shortage to 1,000 apartments.

This is not just a theory. There are plenty of real-world examples of this phenomenon playing out. Some nonetheless advocate for a modified version of rent control, sometimes called “second generation” rent control.[14] Rather than regulating the price of apartments, the newer iterations of rent control cap the rate at which prices can rise (e.g., rents can rise no higher than the rate of inflation, plus 3%). Second-generation rent control still results in shortages and all the other consequences, but draws out these effects over a longer time period.

B. Price Floors

The most well-known form of price-floor regulation is the minimum wage, but there are many industries that are also subject to regulated price floors in the United States. Some states impose floors on the price of milk and alcoholic beverages. For decades, many U.S. agricultural products have been subject to price floors. Until the late 1970s and early 1980s, airline fares and stock-broker charges were subject to price-floor regulation.

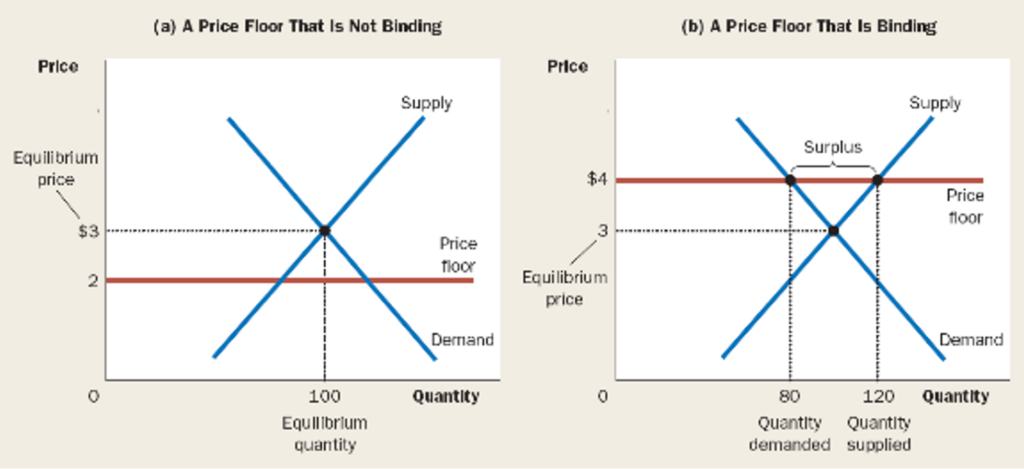

Consider the market for wheat shown in Figure II, also adapted from Mankiw’s textbook.[15] In a competitive market, the price of wheat would be $3 and 100 bushels of wheat would be sold. At the market price, however, farmers would complain that the price is “too low.” They argue that, without assistance, their family farms would go under.

Figure II: Rent Market with a Price Floor

SOURCE: Mankiw

As a result, the government imposes a price floor, mandating that wheat cannot be bought for less than $4 per bushel. But at this price, the amount of wheat grown (120) exceeds the quantity demanded (80). Because of this excess supply of 40 bushels, there is a surplus of wheat and some farmers who want to sell wheat at the regulated price would be unable to do so. This introduces another problem for policymakers: price floors do not help suppliers who cannot sell their products at the regulated price.

To solve this problem, policymakers often turn to another set of policies. In some cases, the government promises to purchase any surplus. In one notable example, there is a cave in Missouri that contains 1.4 billion pounds of cheese purchased under such a program.[16] In other cases, the government replaces the price-floor regulation with a subsidy that promises to pay the difference between the market price and a “target price.”[17]

While a price ceiling can lead to “under” investment, a price floor can encourage “over” investment. For example, if a wheat farmer knows the minimum price that a bushel of wheat will fetch and that all the wheat grown will be purchased by someone, then the farmer has incentive to invest in wheat production rather than some other alternative.

Firms often respond to price floors in nonobvious ways. Baby boomers and their parents can tell stories of the luxurious accommodations enjoyed by those who flew coach in the 1960s and 1970s. Planes had spacious seating and some larger planes had a piano lounge onboard—features that were due, in a large part, to rate regulation that set a price floor on airline tickets. Because airlines faced no price competition, they competed for customers by offering superior service. In other words, they responded to price-floor regulations by “over” investing in service and amenities.[18]

In jurisdictions with high minimum wages, firms respond by using less labor. For example, restaurants may switch from table service to counter service, or they may replace some counter service with self-service electronic kiosks. Restaurants that maintain table service may assign more tables to each server. As the perceived level of service declines, consumers may substitute dining at-home for dining out.

C. Not-Quite Rate Regulations

Because the effects of explicit rate regulation are so well-known and so obvious, policymakers who seek to regulate prices often attempt to do so in less-obvious ways. One already-discussed way is the regulation of price changes, rather than the prices themselves. For example, many rent-control price ceiling programs limit the rate at which rents can increase from year-to-year, a policy described as “rent stabilization.”[19] Many jurisdictions with minimum wage price-floor programs mandate an increase in the minimum wage in-line with the inflation rate.[20]

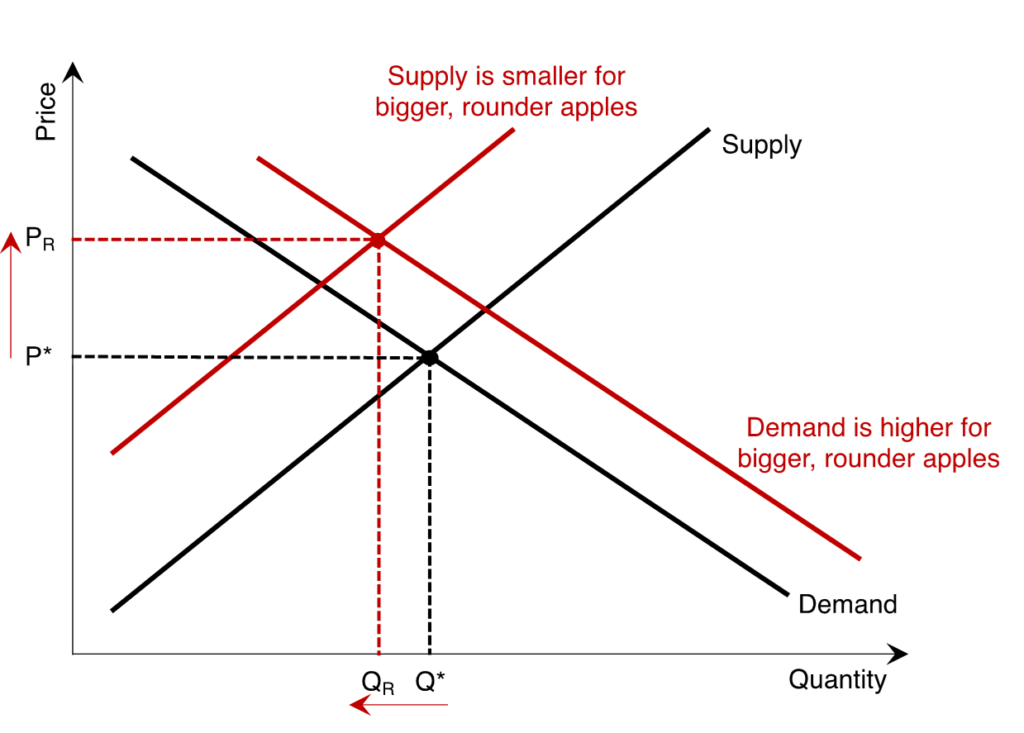

Another way in which officials can effectively—but not explicitly—regulate rates is through quality mandates. For example, some agricultural products are subject to “marketing orders,” which are legal cartels than can dictate the price and quality of produce.[21] Consider an apple market subject to a marketing order that specifies fresh apples must be of a certain shape and size, such that only large, round apples can be sold as fresh produce.

Presumably, consumers prefer large apples to small apples and prefer round apples to misshapen apples. Thus, as shown in Figure III, the order that only large, round apples can be sold as fresh has the effect of increasing/shifting the demand curve. Consumers would be willing to pay more for the seemingly better fruit, and they’d be willing to buy more. But the order also increases the cost to apple growers. They have to find a way to dispose of their smaller or misshapen apples, perhaps by making apple sauce or juicing the fruit. They also incur higher costs of managing their crop to produce more of the higher-quality fruit. This has the effect of decreasing/shifting the supply curve for fresh fruit. Growers will supply less fruit at a higher cost.

Figure III: Market with a Quality Mandate

Combining the effects from both the shift in supply and the shift in demand shows that the marketing order unambiguously results in a higher price for apples. What is not known, however, is whether more or fewer apples are sold. That will depend on the elasticities of demand and supply. Because the order results in a higher price, however, it has created a de facto price floor without explicitly setting one. Consumers are not aware that they are paying a higher price because they do not know what type of fruit would be available, and at what price, absent the quality restrictions.

III. Recent Attempts at De Facto Rate Regulation in Broadband

The FCC obviously has a long history of explicit rate regulation since its inception in 1934.[22] Among its founding mandates, the commission was charged with ensuring that rates were fair, that service was reliable and efficient, and that access to telecommunications services was available to all Americans.[23] During this time, the FCC governed telephone-service rates through a system of rate-of-return regulation, in which rates were set based on the cost of providing service and the company’s desired return on investment.[24] In the latter half of the 20th century, and especially since Congress passed a major overhaul of the Communications Act in 1996, a more deregulatory approach to telecommunications has prevailed.

This made sense in the 1990s, and has only made more sense over time, as different communications modalities have been developed, and competition has flourished throughout the market. The reality of the competitive market is acknowledged by regulators across the political spectrum, as we noted above. Both potential and current FCC commissioners note that rate regulation of the broadband industry is undesirable.[25]

At the same time, however, current and potential FCC commissioners—along with other regulators at adjacent agencies—have shaped federal policy in ways that effectively amount to de facto rate regulation. Rate regulation by design and rate regulation in effect arrive at the same damaging economic consequences for consumers and the economy as a whole, however. As such, it is worth reviewing some of the recent efforts to enact de facto rate regulation.

A. BEAD: Middle-Class Affordability Mandate

The National Telecommunications and Information Administration’s (NTIA) notice of funding opportunity under the Broadband Equity, Access, and Deployment (BEAD) program requires each participating U.S. state or territory to include a “middle-class affordability plan to ensure that all consumers have access to affordable high-speed internet” (emphasis in original).[26] The notice provides several examples of how this could be achieved, including:

- Require providers to offer low-cost, high-speed plans to all middle-class households using the BEAD-funded network; and

- Provide consumer subsidies to defray subscription costs for households not eligible for the Affordable Connectivity Benefit or other federal subsidies.

Despite the Infrastructure Investment and Jobs Act’s (IIJA) explicit prohibition of price regulation, the NTIA’s approval process appears to envision exactly this. The first example provided above is clear rate regulation. It specifies a price (“low-cost”); a quantity (“all middle-class households”); and imposes a quality mandate (“high-speed”). Toward these ends, the notice provides an example of a “low-cost” plan that would be acceptable to NTIA:

- Costs $30 per month or less, inclusive of all taxes, fees, and charges, with no additional non-recurring costs or fees to the consumer;

- Allows the end user to apply the Affordable Connectivity Benefit subsidy to the service price;

- Provides download speeds of at least 100 Mbps and upload speeds of at least 20 Mbps, or the fastest speeds the infrastructure is capable of if less than 100 Mbps/20 Mbps;

- Provides typical latency measurements of no more than 100 milliseconds; and

- Is not subject to data caps, surcharges, or usage-based throttling.[27]

The notice states that the focus of this portion of the program is to foster broadband access, rather than broadband adoption. But broadband access alone may not be sufficient to drive greater rates of broadband adoption. A report by the U.S. Government Accountability Office concluded that “even where broadband service is available … an adoption gap may persist due to the affordability of broadband and lack of digital skills.”[28] The GAO report notes that nearly one-third of those with access to broadband do not subscribe to it.[29] Brian Whitacre and his co-authors found that, while the reduced levels of broadband access in rural areas explained 38% of the rural-urban broadband-adoption gap in 2011, differences in other general characteristics—such as income and education—explain “roughly half of the gap.”[30]

A policy bulletin published by the Phoenix Center for Advanced Legal & Economic Public Policy Studies notes that the NTIA did not conclude that broadband was unaffordable for middle-class households.[31] George Ford, the bulletin’s author, collected data on broadband adoption by income level. The data indicate that, in general, internet-adoption rates increase with higher income levels. Higher-income households have higher adoptions rates (97.3%) than middle-income households (92.9%) which in turn have higher adoption rates than lower-income households (78.1%). For each of the 50 states and the District of Columbia, the Phoenix bulletin finds that middle-income internet-adoption rates are, to a statistically significant degree, higher than lower-income adoption rates.

The Phoenix bulletin concludes that broadband currently is “affordable” to middle-class households and that “no direct intervention is required” to ensure affordability to the middle class. These observations, however, invite questions regarding how NTIA intends to administer the BEAD program.

- How will the agency distinguish broadband access from broadband adoption? A nearly 93% adoption rate among middle-income households suggests that somewhere close to 100% of these households have broadband access.

- Does “all middle-class households” literally mean all? Even among the highest-income households, broadband adoption is less than 100%. Is NTIA’s objective to reach 100% of middle-income households, or the same level as higher-income households?

- With such high adoption rates among middle-income households, what would be the cost of providing access and/or encouraging adoption by the remaining 4% to 7% of households?

- It seems obvious that some households will not adopt broadband at any price. Should some households pay a negative price for broadband under the BEAD program?

- Does NTIA really intend to encourage states to provide money to households that do not qualify for ACP but already adopt broadband? If so, in what sense does this actually further the goal of spending scarce resources to get the unconnected online?

As John Mayo, Greg Rosston, & Scott Wallsten note:

A substantial portion of the unserved and underserved areas of the country that are the likely targets of the BEAD program, however, are rural, low-population density areas where deployment costs will be high. These high deployment costs may seem to indicate that even “cost-based” rates—normally seen as an attractive competitive benchmark—may be high, violating the IIJA’s “affordability” standard.[32]

The only effective way to reduce broadband price, increase access, and improve quality simultaneously is to increase supply. That would call for prioritizing subsidies to broadband providers before consumers. Although consumer subsidies would increase the demand for broadband, which would have a knock-on effect of potentially attracting long-term investment from providers, it could also increase the price for households who do not receive the subsidy. Direct provider subsidies targeted at hard-to-connect areas could avoid many of the problems that price controls and direct user subsidies can create.[33] Ultimately, however, price controls—even de facto or “backdoor” price controls—would likely slow broadband deployment.

B. ReConnect Loan and Grant Program

In 2018, Congress provided the secretary of U.S. Department of Agriculture authority to establish a pilot project intended to expand broadband deployment in rural areas, known as the ReConnect Loan and Grant Program. According to the Congressional Research Service, as of December 2022, USDA had awarded more than $3 billion of ReConnect funds through three funding rounds.[34]

With its third round of funding in 2021, USDA announced that, for the first time, applicants would receive a preference, in the form of “points,” for agreeing to abide by so-called “net neutrality” rules similar to those that the FCC had eliminated in 2018’s Restoring Internet Freedom Order. The department simultaneously added affordability—providing a “low-cost option”—as a point criteria. In addition, the third round required that projects must provide broadband access at speeds of at least 100/100 Mbps (i.e., 100 Mbps symmetrical speed). Round 4, announced in August 2022, includes the same criteria.

USDA’s third- and fourth-round requirements under the ReConnect program could be characterized as “back-door” rate regulation. They specify pricing as a point criteria (“low-cost option”) and impose a quality mandate (100/100 Mbps). While it does not mandate a low-cost option, the point weighting indicates that pricing is a priority in awarding funds under the program.

This sort of second-generation price control, while it does not create a centrally directed rate schedule, amounts to the same dynamic. These preferences, while potentially more diffuse in the short term, ultimately create the same medium- and long-term dynamics that drive up prices, and reduce quality and availability.

C. New York State’s Affordable Broadband Act

In 2021, the State of New York passed the Affordable Broadband Act (ABA).[35] The act requires ISPs to offer all qualifying low-income households at least two internet-access plans: (1) download speeds of at least 25 megabits-per-second for no more than $15-a-month, or (2) download speeds of at least 200 megabits-per-second for no more than $20-a-month. Providers with fewer than 20,000 subscribers may be eligible for exemption from the law. More than one-third of households in the state would be eligible to participate in the program.

Before it went into effect, a group of ISPs obtained an injunction in federal court to block the law.[36] The plaintiffs claimed that the ABA amounted to common-carrier rate regulation, which is preempted by federal law. ISPs are regulated as an “information service” under Title I of the Federal Communications Act of 1934, rather than as Title II common-carrier “telecommunications services.” As such, the plaintiffs claim neither the FCC nor the states can regulate ISPs as common carriers.

New York attempted to dance around this complication by asserting that the ABA merely set a price ceiling.[37] Because ISPs were permitted to charge any price below the ceiling, “the ABA does not ‘rate regulate’ broadband services,” the state argued.[38] The court shut down that line of reasoning, citing several earlier decisions that conclude “‘[p]rice ceilings’ regulate rates.”[39] The matter is currently on appeal before the 2nd U.S. Circuit Court of Appeals, where oral arguments were heard in January 2023.[40]

D. Net Neutrality and Zero Rating

The FCC’s 2015 Open Internet Order (“OIO”),[41] although explicitly forbearing from rate regulation,[42] was a regulatory scheme that imposed many of the same effects. Further, with prohibitions on practices like “zero rating,” the regulation walks right up to the line of explicit rate regulation, if not over it.

At an abstract level, the OIO was predicated on the idea that it was possible to impose some common-carriage obligations on broadband providers but to leave out rate regulation. Fundamentally, the OIO failed to take account of the economics that drive ISP investment and pricing, for both edge providers and consumers. In short, in a condition of scarcity—such as limited bandwidth and limited infrastructure to increase bandwidth—there will always be some form of rationing; it will be accomplished either through prices or through regulatory intervention. Even if a regulator disavows explicit rate regulation, intervention into providers’ business models and technical decisions will inevitably shape pricing in much the same way as explicit price regulation does, through the “hydraulic effect” of regulation.[43]

Generally speaking, the OIO imposed a form of “negative” rate regulation that short circuited the normal course of rationing among broadband providers and their customers. It prohibited providers from applying anything other than a zero price to edge providers.[44] It outright prohibited “paid prioritization”—that is, seeking payments for network utilization from edge providers like Google, Facebook, and Netflix—while casting suspicion on other pricing schemes under the Internet Conduct Standard.[45] Thus, on one hand, the OIO did explicitly regulate rates by imposing a zero price, and, on the other, implemented a de facto rate-regulation scheme by subjecting providers to regulatory scrutiny if they sought novel business relationships with partners.

The best example of this latter situation was the commission’s attack on “zero rating.” Zero rating is the practice of a broadband provider not counting data from certain sources against a customer’s data allowance within a given period.[46] In truth, this is a business model very familiar to any casual internet user: edge providers like gaming companies, email hosts, and social-media platforms frequently offer free or low-cost versions of their service in order to attract a critical mass of users.[47]

Zero-rated broadband service works identically. A content provider like Netflix or YouTube will partner with an ISP like T-Mobile or Comcast in order to provide broadband customers with access to the provider’s content without that use counting against their data plan. Zero rating does not mean that other services are blocked; just that those other services will count against a periodic data allowance.[48] Generally speaking, this sort of business arrangement is a boon to consumers, particularly low-income consumers who can only afford the most restrictive data plans.[49]

With the OIO, however, the FCC introduced the vague Internet Conduct Standard, which gave it broad latitude to ban practices like zero rating.[50] The standard prohibited providers from “unreasonably interfer[ing] with or unreasonably disadvantage[ing]” consumers’ access to lawful content, applications, or services, as well as edge providers’ ability to distribute lawful content, applications, or services.[51] In 2016, the FCC sent letters to AT&T and Verizon, suggesting that the two companies’ use of zero rating were likely violations of the OIO.[52]

Even this implicit threat of regulatory proceedings to examine the propriety of zero rating likely had a chilling effect. Indeed, in an analogous context, the U.S. Circuit Court of Appeals for the D.C. Circuit struck down earlier net-neutrality regulations from the FCC on the grounds that they amounted to the application of de facto common-carriage obligations, even though that commission had refrained from applying Title II.[53]

Regulatory presumptions against zero rating and other forms of paid prioritization similarly amount to de facto rate regulation.[54] As multi-sided platforms, broadband providers seek to balance service and pricing across users and edge providers. As regulation restricts broadband providers’ ability to seek agreements with other large service providers, investment and consumers prices will be forced to shift in order to accommodate. In the long run, this will result in price increases, shortages, declines in quality or, most likely, some mix of the three.

IV. Conclusion

Both economics and history demonstrate that rate regulations that cap the price of a product below the market price lead to shortages by increasing the quantity demanded without increasing the quantity supplied. Over time, such price caps can reduce the overall supply, as providers curtail or slow output-improving investments.

Broadband rate regulation—whether in the forms of direct and explicit price controls or back-door de facto policies—will result in slowed broadband investment and deployment. Broadband providers have a wide range of investment opportunities, with expected returns as a key consideration in evaluating these opportunities. Policies like price ceilings, which reduce the returns on deployment investments, will in turn reduce the likelihood that such investments will be made, thereby slowing broadband deployment.

As we noted in an earlier issue brief, broadband providers—like all firms—have limited resources with which to make their investments.[55] While profitability is a necessary precondition for investment, not all profitable investments can be undertaken. Among the universe of potentially profitable projects, firms are likely to give priority to those that promise greater returns on investment relative to those with lower ROI. Thus, any evaluation of broadband deployment and access must examine not only whether a given deployment is likely to be profitable, but also how its expected returns compare to other investment opportunities.

In broadband, returns on investment depend on several factors. Population density, terrain, regulations, and taxes are all important cost factors. The consumer population’s willingness to adopt and pay for broadband are key demand-related factors. In addition to these cost and demand factors, timing factors concerning both investment and adoption affect the ROI of any deployment investment. Generally speaking, the longer it takes for a given deployment to recoup its investment and generate a return, the lower the ROI and, in turn, the lower the likelihood that the investment will be made. Similarly, binding rate regulation—whether explicit or de facto—will reduce the ROI of deployments subject to that regulation.

Not only would existing broadband providers make fewer and less-intensive investments to maintain their networks, but they would also invest less in improving quality:

When it faces a binding price ceiling, a regulated monopolist is unable to capture the full incremental surplus generated by an increase in service quality. Consequently, when the firm bears the full cost of the increased quality, it will deliver less than the surplus-maximizing level of quality. As Spence (1975, p. 420, note 5) observes, “where price is fixed … the firm always sets quality too low.”[56]

Quality suffers under price regulation not just because firms can’t capture the full value of their investments, but also because it is often difficult to account for quality improvements in regulatory-pricing schemes:

The design and enforcement of service quality regulations is challenging for at least three reasons. First, it can be difficult to assess the benefits and the costs of improving service quality. Absent accurate knowledge of the value that consumers place on elevated levels of service quality and the associated costs, it is difficult to identify appropriate service quality standards. It can be particularly challenging to assess the benefits and costs of improved service quality in settings where new products and services are introduced frequently.

Second, the level of service quality that is actually delivered sometimes can be difficult to measure. For example, consumers may value courteous service representatives, and yet the courtesy provided by any particular representative may be difficult to measure precisely. When relevant performance dimensions are difficult to monitor, enforcing desired levels of service quality can be problematic.

Third, it can be difficult to identify the party or parties that bear primary responsibility for realized service quality problems. To illustrate, a customer may lose telephone service because an underground cable is accidentally sliced. This loss of service could be the fault of the telephone company if the company fails to bury the cable at an appropriate depth in the ground or fails to notify appropriate entities of the location of the cable. Alternatively, the loss of service might reflect a lack of due diligence by field workers from other companies who slice a telephone cable that is buried at an appropriate depth and whose location has been clearly identified.[57]

None of these concerns dissipate where regulators use indirect, de facto means to cap prices. Broadband is a classic multi-sided market.[58] If the price on one side of the market is set at below-market rates through rate regulation, then there will be upward pricing pressure on the other side of the market. Ultimately, consumers who are not subject to the regulated rates will face higher prices, which puts pressure on policymakers to impose yet another layer of imprecise and complex regulation and even deeper constraints on investment.

It’s important to understand that rate regulation—in any form and whatever the imagined benefits—is not a costless endeavor. Costs and risk do not disappear under rate regulation. Instead, they are shifted in one direction or another—typically with costs borne by consumers through some mix of suppressed investment, sluggish improvements in quality, and reduced innovation.

Government policy may well be able to help accelerate broadband deployment to the unserved portions of the country where it is most needed. But the way to get there is not by imposing price controls on broadband providers. Instead, broadband access can best be expanded by removing costly, government-erected barriers to buildout and/or by subsidizing and educating consumers where necessary.

[1] The Editorial Board, Nationwide Rent Control?, Wall St. J. (Jan. 22, 2023), https://www.wsj.com/articles/nationwide-rent-control-congress-democrats-progressives-housing-president-biden-11674233540.

[2] Lawrence J. Spiwak, USTelecom and Its Aftermath, 71 Fed. Comm. L. J. 39 (2018), available at http://www.fclj.org/wp-content/uploads/2018/12/71.1-%E2%80%93-Lawrence-J.-Spiwak.pdf.

[3] FCC Reauthorization: Oversight of the Commission, Hearing Before the Subcommittee on Communications and Technology, Committee on Energy and Commerce, House of Representatives, 114 Cong. 27 (Mar. 19, 2015) (Statement of Tom Wheeler).

[4] Protecting and Promoting the Open Internet, 80 FR 19737 (Apr. 13, 2015) (codified at 47 CFR 1, 47 CFR 8, and 47 CFR 20), https://www.federalregister.gov/documents/2015/04/13/2015-07841/protecting-and-promoting-the-open-internet, (“2015 OIO”) at ¶¶ 51 & 538

[5] Id., Dissenting Statement of Ajit Pai, https://docs.fcc.gov/public/attachments/FCC-15-24A5.pdf.

[6] Tim Wu, Agency Threats, 60 Duke L.J. 1841, 1842 (2011).

[7] Gigi B. Sohn, A Policy Framework for an Open Internet Ecosystem, 2 Geo. L. Tech. Rev. 335 (2018) at 345.

[8] David Shepardson, FCC Nominee Does Not Support U.S. Internet Rate Regulation, Reuters (Dec. 1, 2021), https://www.reuters.com/world/us/fcc-nominee-does-not-support-us-internet-rate-regulation-2021-12-01.

[9] Id.

[10] The White House, Fact Sheet: The American Jobs Plan (Mar. 31, 2021), https://www.whitehouse.gov/briefing-room/statements-releases/2021/03/31/fact-sheet-the-american-jobs-plan (emphasis added).

[11] NY State Telecom. Assoc. v. James, 2:21-cv-2389 (DRH) (AKT), Memorandum and Order, Document 25 (E.D. N.Y. June 11, 2021), https://ecf.nyed.uscourts.gov/doc1/123117827301 (“Memorandum and Order”).

[12] See, for example, N. Gregory Mankiw, PRINCIPLES OF MICROECONOMICS, 4th ed., Thomson South-Western (2007); Paul Krugman & Robin Wells, Economics, 6th ed., MacMillan (2021); Steven A. Greenlaw & David Shapiro, Principles of Microeconomics 2nd ed., OpenStax (2017).

[13] Id., Mankiw.

[14] See, e.g., David L. Mengle, The Effect of Second Generation Rent Control on the Quality of Rental Housing, Fed. Res. Bank of Rich., Working Paper 85-5 (Nov. 1985), https://www.richmondfed.org/-/media/RichmondFedOrg/publications/research/working_papers/1985/pdf/wp85-5.pdf.

[15] Mankiw, supra note 12.

[16] Gitanjali Poonia, Why Does the U.S. Government Have 1.4 Billion Pounds of Cheese Stored in a Cave Underneath Springfield, Missouri?, Deseret News (Feb. 14, 2022), https://www.deseret.com/2022/2/14/22933326/1-4-billion-pounds-of-cheese-stored-in-a-cave-underneath-springfield-missouri-jimmy-carter-reagan.

[17] For example, the U.S. Department of Agriculture’s Price-Loss Coverage program issues payments when the effective price of a covered commodity is less than the respective reference price for that commodity. See, Agriculture Risk Coverage (ARC) & Price Loss Coverage (PLC), USDA (Oct. 2022), https://www.fsa.usda.gov/Assets/USDA-FSA-Public/usdafiles/FactSheets/2022/fsa_arc_plc_factsheet_101922.pdf.

[18] See, Richard H. K. Vietor, Contrived Competition: Regulation and Deregulation in America (1996) at 45 (“Since capacity could no longer serve as a means of differentiation, the trunk carriers had to devise new means of service competition. ‘Capacity wars’ gave way to ‘lounge wars.’”).

[19] See, e.g., Rent Stabilization, Oregon Dept. of Admin. Serv. (n.d.), https://www.oregon.gov/das/OEA/pages/rent-stabilization.aspx.

[20] Dave Kamper & Sebastian Martinez Hickey, Tying Minimum-Wage Increases to Inflation, as 13 States Do, Will Lift Up Low-Wage Workers and Their Families across the Country, Econ. Pol’y Inst. (Sep. 6, 2022), https://www.epi.org/blog/tying-minimum-wage-increases-to-inflation-as-12-states-do-will-lift-up-low-wage-workers-and-their-families-across-the-country.

[21] See, Darren Filson, Edward Keen, Eric Fruits & Thomas Borcherding, Market Power and Cartel Formation: Theory and an Empirical Test, 44 J. L. & Econ. 465 (2001).

[22] Vietor, supra note 17 at ch. 4.

[23] Id.

[24] Id.

[25] Supra notes 13-15

[26] Notice of Funding Opportunity, Broadband Equity, Access, and Deployment Program, NTIA-BEAD-2022, NTIA (May 2022), available at https://broadbandusa.ntia.doc.gov/sites/default/files/2022-05/BEAD%20NOFO.pdf (note that the IIJA itself did not include this requirement, and this is an addition by NTIA as part of the NOFO process; thus, it is unclear the extent to which this represents a valid requirement by NTIA under the BEAD program).

[27] Id.

[28] Broadband: National Strategy Needed to Guide Federal Efforts to Reduce Digital Divide, GAO-22-104611, U.S. Gov’t Accountability Off. (May 31, 2022), https://www.gao.gov/assets/gao-22-104611.pdf, [hereinafter “GAO-22-104611”].

[29] Id. (“According to FCC data, about 31 percent of people nationwide who have access to broadband at speeds of 25/3 Mbps have not subscribed to it ….); see also, How Do Speed, Infrastructure, Access, and Adoption Inform Broadband Policy?, Pew Research Center (Jul. 7, 2022), https://www.pewtrusts.org/en/research-and-analysis/fact-sheets/2022/07/how-do-speed-infrastructure-access-and-adoptioninform-broadband-policy (“nearly 1 in 4 Americans do not subscribe to a home broadband connection, even where one is available”).

[30] Brian Whitacre, Sharon Strover, & Roberto Gallardo, How Much Does Broadband Infrastructure Matter? Decomposing the Metro–Non-Metro Adoption Gap with the Help of the National Broadband Map, 32 Gov’t Info. Q. 261 (2015).

[31] George S. Ford, Middle-Class Affordability of Broadband: An Empirical Look at the Threshold Question, Phoenix Ctr. for Adv. Leg. & Econ. Pub. Pol’y Stud., Pol’y Bull. No. 61 (Oct. 2022), https://phoenix-center.org/PolicyBulletin/PCPB61Final.pdf.

[32] John W. Mayo, Gregory L. Rosston & Scott J. Wallsten, From a Silk Purse to a Sow’s Ear? Implementing the Broadband, Equity, Access and Deployment Act, Geo. U. McDonough Sch. of Bus. Ctr. for Bus. & Pub. Pol’y (Aug. 2022), https://georgetown.app.box.com/s/yonks8t7eclccb0fybxdpy3eqmw1l2da?mc_cid=95d011c7c1&mc_eid=dc30181b39.

[33] Even as a second-best option, user subsidies remain far preferable to price controls, as they at least directionally work within a market framework and encourage providers to deploy where there is genuine need and demand.

[34] Lisa S. Benson, USDA’s ReConnect Program: Expanding Rural Broadband, Cong. Res. Serv., R47017 (Dec. 14, 2022), https://crsreports.congress.gov/product/pdf/R/R47017.

[35] Memorandum and Order, supra note 11.

[36] Id.

[37] Id. (“In Defendant’s words, the ABA concerns ‘Plaintiffs’ pricing practices’ by creating a ‘price regime’ that ‘set[s] a price ceiling,’ which flatly contradicts her simultaneous assertion that ‘the ABA does not “rate regulate” broadband services.’”)

[38] Id.

[39] Id.

[40] Randolph J. May & Seth L. Cooper, Second Circuit Hears Preemption Challenge to New York’s Broadband Rate Regulation Law, FedSoc Blog (Feb. 7, 2023), https://fedsoc.org/commentary/fedsoc-blog/second-circuit-hears-preemption-challenge-to-new-york-s-broadband-rate-regulation-law.

[41] 2015 OIO, supra note 4.

[42] As noted above, however, the FCC still retained the power to impose rate regulation at a future date. This obviously muddies the discussion, as a looming threat of potential rate regulation would likely exert some influence over broadband providers’ decisions.

[43] See Geoffrey A. Manne, The Hydraulic Theory of Disclosure Regulation and Other Costs of Disclosure, 58 Ala. L. Rev. 473 (2007).

[44] The OIO banned paid prioritization outright, but regulated nonlinear pricing mechanisms like sponsored data under the Internet Conduct Standard. See 2015 OIO, supra note 4 at ¶ 151-53. But the order also rejected the “commercially reasonable” standard of the 2010 OIO and replaced it with a more amorphous, and more restrictive, “unreasonable interference or unreasonable disadvantages” standard. Following the commission’s letters expressing its hostility to AT&T’s and Verizon’s zero-rating programs (supra note 52, and accompanying text), it is safe to assume that such pricing schemes stood on extremely thin ice under the 2015 OIO.

[45] See 2015 OIO, supra note 4 at ¶ 151-53.

[46] See 2015 OIO, supra note 4 at ¶ 151; Jeffrey A. Eisenach, The Economics of Zero Rating, NERA (Mar. 2015), available at https://www.nera.com/content/dam/nera/publications/2015/EconomicsofZeroRating.pdf.

[47] See, e.g., Geoffrey A. Manne & Kristian Stout, In the Matter Of: Telecom Regulatory Authority of India’s 9/12/15 Consultation Paper On Differential Pricing For Data Services at 4 and accompanying citations, Int’l Ctr. for L & Econ. (Jan. 4, 2015), available at https://laweconcenter.org/wp-content/uploads/2017/08/icle-india_diff_pricing_comments_2016.pdf.

[48] Id. at 9.

[49] See, Understanding and Appreciating Zero-Rating: The Use and Impact of Free Data in the Mobile Broadband Sector, Multicultural Media, Telecom and Internet Council (May 9, 2016), available at http://mmtconline.org/WhitePapers/MMTC_Zero_Rating_Impact_on_Consumers_May2016.pdf.

[50] 2015 OIO, supra note 4 at ¶ 136.

[51] Id.

[52] See Jeff Dunn, The FCC Thinks AT&T’s Policies ‘Harm Consumers’ – And It’s Warning Verizon, Too, Business Insider (Dec. 2, 2016), http://www.businessinsider.com/fcc-verizon-att-zero-rating-net-neutrality-letter-directv-now-2016-12.

[53] Verizon, 740 F.3d at 657 (“The Commission has provided no basis for concluding that in permitting ‘reasonable’ network management, and in prohibiting merely ‘unreasonable’ discrimination, the Order’s standard of ‘reasonableness’ might be more permissive than the quintessential common carrier standard.”).

[54] See, e.g., Kristian Stout, Geoffrey A. Manne, & Allen Gibby, Policy Comments of the International Center for Law & Economics, Restoring Internet Freedom NPRM, WC Docket No. 17-108 at 36 and associated citations, Int’l Ctr. for L. & Econ. (Jul. 17, 2017), available at https://laweconcenter.org/wp-content/uploads/2017/09/icle-comments_policy_rif_nprm-final.pdf; see also Daniel A. Lyons, Usage-Based Pricing, Zero-Rating, and the Future of Broadband Innovation, 11 Free State Foundation Perspectives 1 (2016), http://works.bepress.com/daniel_lyons/80.

[55] Eric Fruits & Kristian Stout, The Income Conundrum: Intent and Effects Analysis of Digital Discrimination, Int’l Ctr. for L & Econ., Issue Brief 2022-11-14 (Nov. 2022), https://laweconcenter.org/wp-content/uploads/2022/11/The-Income-Conundrum-Intent-and-Effects-Analysis-of-Digital-Discrimination.pdf.

[56] David E. M. Sappington & Dennis L. Weisman, Price Cap Regulation: What Have We Learned from Twenty-Five Years of Experience in the Telecommunications Industry?, 38 J. Regul. Econ. 227 (Sep. 2010), http://bear.warrington.ufl.edu/centers/purc/docs/papers/1012_Sappington_Price_Cap_Regulation.pdf, at 9.

[57] Id. at 10.

[58] Issue Spotlight: Two-Sided Markets, Int’l Ctr. for L & Econ. (Nov. 8, 2022), https://laweconcenter.org/resources/policy-comments-international-center-law-economics-restoring-internet-freedom-nprm.