ICLE Comments to European Commission on Competition in Virtual Worlds

Executive Summary

We welcome the opportunity to comment on the European Commission’s call for contributions on competition in “Virtual Worlds”.[1] The International Center for Law & Economics (“ICLE”) is a nonprofit, nonpartisan global research and policy center founded with the goal of building the intellectual foundations for sensible, economically grounded policy. ICLE promotes the use of law & economics methodologies to inform public-policy debates and has longstanding expertise in the evaluation of competition law and policy. ICLE’s interest is to ensure that competition law remains grounded in clear rules, established precedent, a record of evidence, and sound economic analysis.

The metaverse is an exciting and rapidly evolving set of virtual worlds. As with any new technology, concerns about the potential risks and negative consequences that the metaverse may bring have moved policymakers to explore how best to regulate this new space.

From the outset, it is important to recognize that simply because the metaverse is new does not mean that competition in this space is unregulated or somehow ineffective. Existing regulations may not explicitly or exclusively target metaverse ecosystems, but a vast regulatory apparatus already covers most aspects of business in virtual worlds. This includes European competition law, the Digital Markets Act (“DMA”), the General Data Protection Act (“GDPR), the Digital Services Act (“DSA”), and many more. Before it intervenes in this space, the commission should carefully consider whether there are any metaverse-specific problems not already addressed by these legal provisions.

This sense that competition intervention would be premature is reinforced by three important factors.

The first is that competition appears particularly intense in this space (Section I). There are currently multiple firms vying to offer compelling virtual worlds. At the time of writing, however, none appears close to dominating the market. In turn, this intense competition will encourage platforms to design services that meet consumers’ demands, notably in terms of safety and privacy. Nor does the market appear likely to fall into the hands of one of the big tech firms that command a sizeable share of more traditional internet services. Meta notoriously has poured more than $3.99 billion into its metaverse offerings during the first quarter of 2023, in addition to $13.72 billion the previous calendar year.[2] Despite these vast investments and a strategic focus on metaverse services, the company has, thus far, struggled to achieve meaningful traction in the space.[3]

Second, the commission’s primary concern appears to be that metaverses will become insufficiently “open and interoperable”.[4] But to the extent that these ecosystems do, indeed, become closed and proprietary, there is no reason to believe this to be a problem. Closed and proprietary ecosystems have several features that may be attractive to consumers and developers (Section II). These include improved product safety, performance, and ease of development. This is certainly not to say that closed ecosystems are always better than more open ones, but rather that it would be wrong to assume that one model or the other is optimal. Instead, the proper balance depends on tradeoffs that markets are better placed to decide.

Finally, timing is of the essence (Section III). Intervening so early in a fledgling industry’s life cycle is like shooting a moving target from a mile away. New rules or competition interventions might end up being irrelevant. Worse, by signaling that metaverses will be subject to heightened regulatory scrutiny for the foreseeable future, the commission may chill investment from the very firms is purports to support. In short, the commission should resist the urge to intervene so long as the industry is not fully mature.

I. Competing for Consumer Trust

The Commission is right to assume, in its call for contributions, that the extent to which metaverse services compete with each other (and continue to do so in the future) will largely determine whether they fulfil consumers’ expectations and meet the safety and trustworthiness requirements to which the commission aspires. As even the left-leaning Lessig put it:

Markets regulate behavior in cyberspace too. Prices structures often constrain access, and if they do not, then busy signals do. (America Online (AOL) learned this lesson when it shifted from an hourly to a flat-rate pricing plan.) Some sites on the web charge for access, as on-line services like AOL have for some time. Advertisers reward popular sites; online services drop unpopular forums. These behaviors are all a function of market constraints and market opportunity, and they all reflect the regulatory role of the market.[5]

Indeed, in a previous call for contributions, the Commission implicitly recognized the important role that competition plays, although it frames the subject primarily in terms of the problems that would arise if competition ceased to operate:

There is a risk of having a small number of big players becoming future gatekeepers of virtual worlds, creating market entry barriers and shutting out EU start-ups and SMEs from this emerging market. Such a closed ecosystem with the prevalence of proprietary systems can negatively affect the protection of personal information and data, the cybersecurity and the freedom and openness of virtual worlds at the same time.[6]

It is thus necessary to ask whether there is robust competition in the market for metaverse services. The short answer is a resounding yes.

A. Competition Without Tipping

While there is no precise definition of what constitutes a metaverse—much less a precise definition of the relevant market—available data suggests the space is highly competitive. This is evident in the fact that even a major global firm like Meta—having invested billions of dollars in its metaverse branch (and having rebranded the company accordingly)—has struggled to gain traction.[7]

Other major players in the space include the likes of Roblox, Fortnite, and Minecraft, which all have somewhere between 70 and 200 million active users.[8] This likely explains why Meta’s much-anticipated virtual world struggled to gain meaningful traction with consumers, stalling at around 300,000 active users.[9] Alongside these traditional players, there are also several decentralized platforms that are underpinned by blockchain technology. While these platforms have attracted massive investments, they are largely peripheral in terms of active users, with numbers often only in the low thousands.[10]

There are several inferences that can be drawn from these limited datasets. For one, it is clear that the metaverse industry is not yet fully mature. There are still multiple paradigms competing for consumer attention: game-based platforms versus social-network platforms; traditional platforms versus blockchain platforms, etc. In the terminology developed by David Teece, the metaverse industry has not yet reached a “paradigmatic” stage. It is fair to assume there is still significant scope for the entry of differentiated firms.[11]

It is also worth noting that metaverse competition does not appear to exhibit the same sort of network effects and tipping that is sometimes associated with more traditional social networks.[12] Despite competing for nearly a decade, no single metaverse project appears to be running away with the market.[13] This lack of tipping might be because these projects are highly differentiated.[14] It may also be due to the ease of multi-homing among them.[15]

More broadly, it is far from clear that competition will lead to a single metaverse for all uses. Different types of metaverse services may benefit from different user interfaces, graphics, and physics engines. This cuts in favor of multiple metaverses coexisting, rather than all services coordinating within a single ecosystem. Competition therefore appears likely lead to the emergence of multiple differentiated metaverses, rather than a single winner.

Ultimately, competition in the metaverse industry is strong and there is little sense these markets are about to tip towards a single firm in the year future.

B. Competing for Consumer Trust

As alluded to in the previous subsection, the world’s largest and most successful metaverse entrants to date are traditional videogaming platforms that have various marketplaces and currencies attached.[16] In other words, decentralized virtual worlds built upon blockchain technology remain marginal.

This has important policy implications. The primary legal issues raised by metaverses are the same as those encountered on other digital marketplaces. This includes issues like minor fraud, scams, and children buying content without their parents’ authorization.[17] To the extent these harms are not adequately deterred by existing laws, metaverse platforms themselves have important incentives to police them. In turn, these incentives may be compounded by strong competition among platforms.

Metaverses are generally multi-sided platforms that bring together distinct groups of users, including consumers and content creators. In order to maximize the value of their ecosystems, platforms have an incentive to balance the interests of these distinct groups.[18] In practice, this will often mean offering consumers various forms of protection against fraud and scams and actively policing platforms’ marketplaces. As David Evans puts it:

But as with any community, there are numerous opportunities for people and businesses to create negative externalities, or engage in other bad behavior, that can reduce economic efficiency and, in the extreme, lead to the tragedy of the commons. Multi-sided platforms, acting selfishly to maximize their own profits, often develop governance mechanisms to reduce harmful behavior. They also develop rules to manage many of the same kinds of problems that beset communities subject to public laws and regulations. They enforce these rules through the exercise of property rights and, most importantly, through the “Bouncer’s Right” to exclude agents from some quantum of the platform, including prohibiting some agents from the platform entirely…[19]

While there is little economic research to suggest that competition directly increases hosts’ incentive to policy their platforms, it stands to reason that doing so effectively can help platforms to expand the appeal of their ecosystems. This is particularly important for metaverse services whose userbases remain just a fraction of the size they could ultimately reach. While 100 or 200 million users already comprises a vast ecosystem, it pales in comparison to the sometimes billions of users that “traditional” online platforms attract.

The bottom line is that the market for metaverses is growing. This likely compounds platforms’ incentives to weed out undesirable behavior, thereby complementing government efforts to achieve the same goal.

II. Opening Platforms or Opening Pandora’s Box?

In its call for contributions, the commission seems concerned that the metaverse competition may lead to closed ecosystems that may be less beneficial to consumers than more open ones. But if this is indeed the commission’s fear, it is largely unfounded.

There are many benefits to closed ecosystems. Choosing the optimal degree of openness entails tradeoffs. At the very least, this suggests that policymakers should be careful not to assume that opening platforms up will systematically provide net benefits to consumers.

A. Antitrust Enforcement and Regulatory Initiatives

To understand why open (and weakly propertized) platforms are not always better for consumers, it is worth looking at past competition enforcement in the online space. Recent interventions by competition authorities have generally attempted (or are attempting) to move platforms toward more openness and less propertization. For their part, these platforms are already tremendously open (as the “platform” terminology implies) and attempt to achieve a delicate balance between centralization and decentralization.

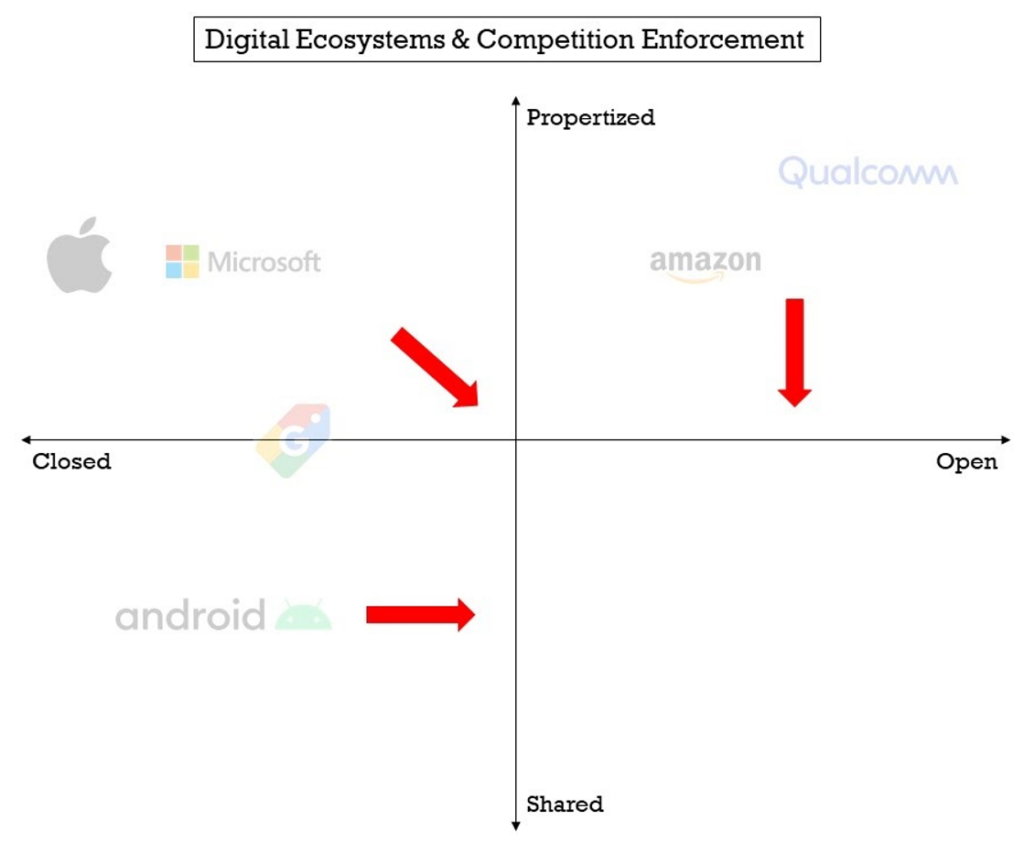

Figure I: Directional Movement of Antitrust Intervention

The Microsoft cases and the Apple investigation both sought or seek to bring more openness and less propertization to those respective platforms. Microsoft was made to share proprietary data with third parties (less propertization) and to open its platform to rival media players and web browsers (more openness).[20] The same applies to Apple. Plaintiffs in private antitrust litigation brought in the United States[21] and government enforcement actions in Europe[22] are seeking to limit the fees that Apple can extract from downstream rivals (less propertization), as well as to ensure that it cannot exclude rival mobile-payments solutions from its platform (more openness).

The various cases that were brought by EU and U.S. authorities against Qualcomm broadly sought to limit the extent to which it was monetizing its intellectual property.[23] The European Union’s Amazon investigation centers on the ways in which the company uses data from third-party sellers (and, ultimately, the distribution of revenue between those sellers and Amazon).[24] In both cases, authorities are ultimately trying to limit the extent to which firms can propertize their assets.

Finally, both of the EU’s Google cases sought to bring more openness to the company’s main platform. The Google Shopping decision sanctioned Google for purportedly placing its services more favorably than those of its rivals.[25] The separate Android decision sought to facilitate rival search engines’ and browsers’ access to the Android ecosystem. The same appears to be true of ongoing litigation brought by state attorneys general in the United States.[26]

Much of the same can be said of the numerous regulatory initiatives pertaining to digital markets. Indeed, draft regulations being contemplated around the globe mimic the features of the antitrust/competition interventions discussed above. For instance, it is widely accepted that Europe’s DMA effectively transposes and streamlines the enforcement of the theories harm described above.[27] Similarly, several scholars have argued that the proposed American Innovation and Choice Online Act (“AICOA”) in the United States largely mimics European competition policy.[28] The legislation would ultimately require firms to open up their platforms, most notably by forcing them to treat rival services as they would their own and to make their services more interoperable with those rivals.[29]

What is striking about these decisions and investigations is the extent to which authorities are pushing back against the very features that distinguish the platforms they are investigating. Closed (or relatively closed) platforms are forced to open up, and firms with highly propertized assets are made to share them (or, at the very least, monetize them less aggressively).

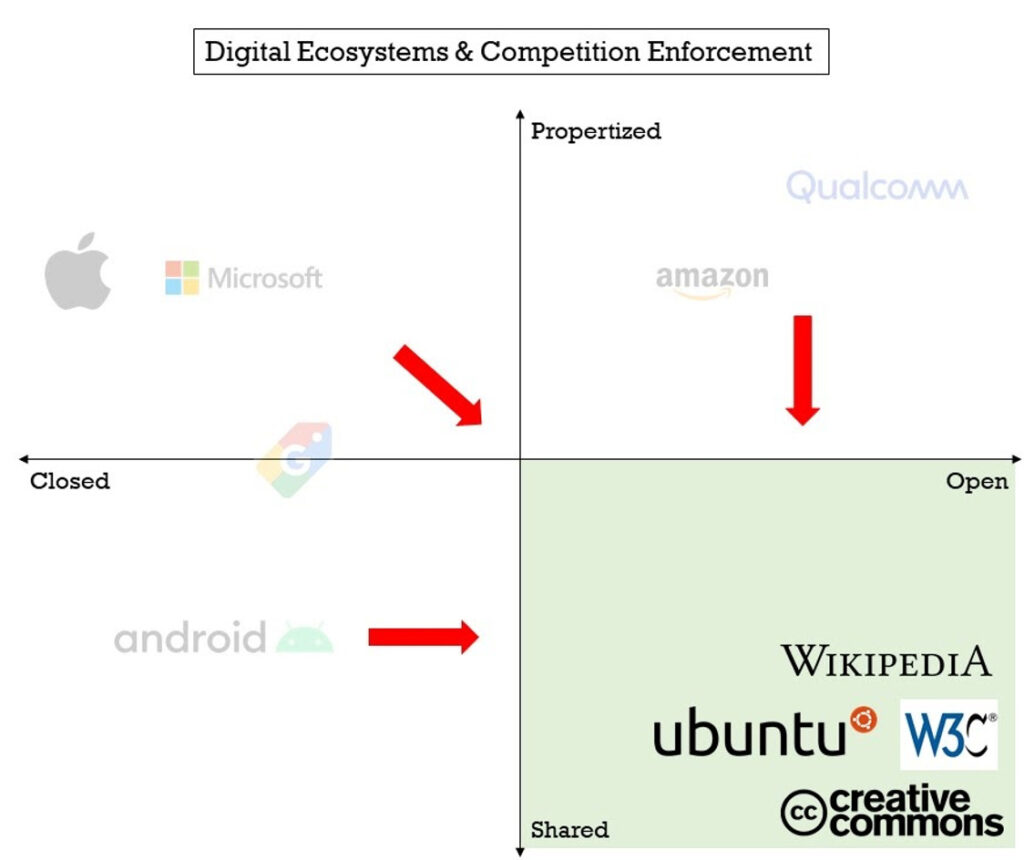

B. The Empty Quadrant

All of this would not be very interesting if it weren’t for a final piece of the puzzle: the model of open and shared platforms that authorities apparently favor has traditionally struggled to gain traction with consumers. Indeed, there seem to be vanishingly few successful consumer-oriented products and services in this space.

There have been numerous attempts to introduce truly open consumer-oriented operating systems in both the mobile and desktop segments. Most have ended in failure. Ubuntu and other flavors of the Linux operating system remain fringe products. There have been attempts to create open-source search engines, but they have not met with success.[30] The picture is similar in the online retail space. Amazon appears to have beaten eBay, despite the latter being more open and less propertized. Indeed, Amazon has historically charged higher fees than eBay and offers sellers much less freedom in the ways in which they may sell their goods.[31]

This theme is repeated in the standardization space. There have been innumerable attempts to impose open, royalty-free standards. At least in the mobile-internet industry, few (if any) of these have taken off. Instead, proprietary standards such as 5G and WiFi have been far more successful. That pattern is repeated in other highly standardized industries, like digital-video formats. Most recently, the proprietary Dolby Vision format seems to be winning the war against the open HDR10+ format.[32]

Figure II: Open and Shared Platforms

This is not to say that there haven’t been any successful examples of open, royalty-free standards. Internet protocols, blockchain, and Wikipedia all come to mind. Nor does it mean that we will not see more decentralized goods in the future. But by and large, firms and consumers have not yet taken to the idea of fully open and shared platforms. Or, at least, those platforms have not yet achieved widespread success in the marketplace (potentially due to supply-side considerations, such as the difficulty of managing open platforms or the potentially lower returns to innovation in weakly propertized ones).[33] And while some “open” projects have achieved tremendous scale, the consumer-facing side of these platforms is often dominated by intermediaries that opt for much more traditional business models (think of Coinbase in the blockchain space, or Android’s use of Linux).

C. Potential Explanations

The preceding section posited a recurring reality: the digital platforms that competition authorities wish to bring into existence are fundamentally different from those that emerge organically. But why have authorities’ ideal platforms, so far, failed to achieve truly meaningful success?

Three potential explanations come to mind. First, “closed” and “propertized” platforms might systematically—and perhaps anticompetitively—thwart their “open” and “shared” rivals. Second, shared platforms might fail to persist (or grow pervasive) because they are much harder to monetize, and there is thus less incentive to invest in them. This is essentially a supply-side explanation. Finally, consumers might opt for relatively closed systems precisely because they prefer these platforms to marginally more open ones—i.e., a demand-side explanation.

In evaluating the first conjecture, the key question is whether successful “closed” and “propertized” platforms overcame their rivals before or after they achieved some measure of market dominance. If success preceded dominance, then anticompetitive foreclosure alone cannot explain the proliferation of the “closed” and “propertized” model.[34]

Many of today’s dominant platforms, however, often overcame open/shared rivals, well before they achieved their current size. It is thus difficult to make the case that the early success of their business models was due to anticompetitive behavior. This is not to say these business models cannot raise antitrust issues, but rather that anticompetitive behavior is not a good explanation for their emergence.

Both the second and the third conjectures essentially ask whether “closed” and “propertized” might be better adapted to their environment than “open” and “shared” rivals.

In that respect, it is not unreasonable to surmise that highly propertized platforms would generally be easier to monetize than shared ones. For example, to monetize open-source platforms often requires relying on complementarities, which tend to be vulnerable to outside competition and free-riding.[35] There is thus a natural incentive for firms to invest and innovate in more propertized environments. In turn, competition enforcement that limits a platform’s ability to propertize their assets may harm innovation.

Similarly, authorities should reflect on whether consumers really want the more “competitive” ecosystems that they are trying to design. The European Commission, for example, has a long track record of seeking to open digital platforms, notably by requiring that platform owners do not preinstall their own web browsers (the Microsoft decisions are perhaps the most salient example). And yet, even after these interventions, new firms have kept using the very business model that the commission reprimanded, rather than the “pro-consumer” model it sought to impose on the industry. For example, Apple tied the Safari browser to its iPhones; Google went to some length to ensure that Chrome was preloaded on devices; and Samsung phones come with Samsung Internet as default.[36] Yet this has not ostensibly steered consumers away from those platforms.

Along similar lines, a sizable share of consumers opt for Apple’s iPhone, which is even more centrally curated than Microsoft Windows ever was (and the same is true of Apple’s MacOS). In other words, it is hard to claim that opening platforms is inherently good for consumers when those same consumers routinely opt for platforms with the very features that policymakers are trying to eliminate.

Finally, it is worth noting that the remedies imposed by competition authorities have been anything but successes. Windows XP N (the version of Windows that came without Windows Media Player) was an unmitigated flop, selling a paltry 1,787 copies.[37] Likewise, the internet-browser “ballot box” imposed by the commission was so irrelevant to consumers that it took months for authorities to notice that Microsoft had removed it, in violation of the commission’s decision.[38]

One potential inference is that consumers do not value competition interventions that make dominant ecosystems marginally more open and less propertized. There are also many reasons why consumers might prefer “closed” systems (at least, relative to the model favored by many policymakers), even when they must pay a premium for them.

Take the example of app stores. Maintaining some control over the apps that can access the store enables platforms to easily weed out bad actors. Similarly, controlling the hardware resources that each app can use may greatly improve device performance. Indeed, it may be that a measure of control facilitates the very innovations that consumers demand. Therefore, “authorities and courts should not underestimate the indispensable role control plays in achieving coordination and coherence in the context of systemic ef?ciencies. Without it, the attempted novelties and strategies might collapse under their own complexity.”[39]

Relatively centralized platforms can eliminate negative externalities that “bad” apps impose on rival apps and consumers.[40] This is especially true when consumers will tend to attribute dips in performance to the overall platform, rather than to a particular app.[41] At the same time, they can take advantage of positive externalities to improve the quality of the overall platform.

And it is surely the case that consumers prefer to make many of their decisions at the inter-platform level, rather than within each platform. In simple terms, users arguably make their most important decision when they choose between an Apple or Android smartphone (or a Mac and a PC, etc.). In doing so, they can select their preferred app suite with one simple decision. They might thus purchase an iPhone because they like the secure App Store, or an Android smartphone because they like the Chrome Browser and Google Search. Absent false information at the time of the initial platform decision, this decision will effectively incorporate expectations about subsequent constraints.[42]

Furthermore, forcing users to make too many “within-platform” choices may undermine a product’s attractiveness. Indeed, it is difficult to create a high-quality reputation if each user’s experience is fundamentally different.[43] In short, contrary to what antitrust authorities appear to believe, closed platforms might give most users exactly what they desire.

All of this suggests that consumers and firms often gravitate spontaneously toward both closed and highly propertized platforms, the opposite of what the commission and other competition authorities tend to favor. The reasons for this trend are still misunderstood, and mostly ignored. Too often it is simply assumed that consumers benefit from more openness, and that shared/open platforms are the natural order of things. Instead, what some regard as “market failures” may in fact be features that explain the rapid emergence of the digital economy.

When considering potential policy reforms targeting the metaverse, policymakers would be wrong to assume openness (notably, in the form of interoperability) and weak propertization are always objectively superior. Instead, these platform designs entail important tradeoffs. Closed metaverse ecosystems may lead to higher consumer safety and better performance, while interoperable systems may reduce the frictions consumers face when moving from one service to another. There is little reason to believe policymakers are in a better position to weigh these tradeoffs than consumers, who vote with their virtual feet.

III. Conclusion: Competition Intervention Would be Premature

A final important argument against intervening today is that the metaverse industry is nowhere near mature. Tomorrow’s competition-related challenges and market failures might not be the same as today’s. This makes it exceedingly difficult for policymakers to design appropriate remedies and increases the risk that intervention might harm innovation.

As of 2023, the entire metaverse industry (both hardware and software) is estimated to be worth somewhere in the vicinity of $80 billion, and projections suggest this could grow by a factor of 10 by 2030.[44] Growth projections of this sort are notoriously unreliable. But in this case, they do suggest there is some consensus that the industry is not fully fledged.

Along similar lines, it remains unclear what types of metaverse services will gain the most traction with consumers, what sorts of hardware consumers will use to access these services, and what technologies will underpin the most successful metaverse platforms. In fact, it is still an open question whether the metaverse industry will foster any services that achieve widespread consumer adoption in the foreseeable future.[45] In other words, it is not exactly clear what metaverse products and services the Commission should focus on in the first place.

Given these uncertainties, competition intervention in the metaverse appears premature. Intervening so early in the industry’s life cycle is like aiming at a moving target. Ensuing remedies might end up being irrelevant before they have any influence on the products that firms develop. More worryingly, acting now signals that the metaverse industry will be subject to heightened regulatory scrutiny for the foreseeable future. In turn, this may deter large platforms from investing in the European market. It also may funnel venture-capital investments away from the European continent.

Competition intervention in burgeoning industries is no free lunch. The best evidence concerning these potential costs comes from the GDPR. While privacy regulation is obviously not the same as competition law, the evidence concerning the GDPR suggests that heavy-handed intervention may, at least in some instances, slow down innovation and reduce competition.

The most-cited empirical evidence concerning the effects of the GDPR comes from a paper by Garrett Johnson and co-authors, who link the GDPR to widespread increases to market concentration, particularly in the short-term:

We show that websites’ vendor use falls after the European Union’s (EU’s) General Data Protection Regulation (GDPR), but that market concentration also increases among technology vendors that provide support services to websites…. The week after the GDPR’s enforcement, website use of web technology vendors falls by 15% for EU residents. Websites are relatively more likely to retain top vendors, which increases the concentration of the vendor market by 17%. Increased concentration predominantly arises among vendors that use personal data, such as cookies, and from the increased relative shares of Facebook and Google-owned vendors, but not from website consent requests. Although the aggregate changes in vendor use and vendor concentration dissipate by the end of 2018, we find that the GDPR impact persists in the advertising vendor category most scrutinized by regulators.[46]

Along similar lines, an NBER working paper by Jian Jia and co-authors finds that enactment of the GDPR markedly reduced venture-capital investments in Europe:

Our findings indicate a negative differential effect on EU ventures after the rollout of GDPR relative to their US counterparts. These negative effects manifest in the overall number of financing rounds, the overall dollar amount raised across rounds, and in the dollar amount raised per individual round. Specifically, our findings suggest a $3.38 million decrease in the aggregate dollars raised by EU ventures per state per crude industry category per week, a 17.6% reduction in the number of weekly venture deals, and a 39.6% decrease in the amount raised in an average deal following the rollout of GDPR.[47]

In another paper, Samuel Goldberg and co-authors find that the GDPR led to a roughly 12% reduction in website pageviews and e-commerce revenue in Europe.[48] Finally, Rebecca Janssen and her co-authors show that the GDPR decreased the number of apps offered on Google’s Play Store between 2016 and 2019:

Using data on 4.1 million apps at the Google Play Store from 2016 to 2019, we document that GDPR induced the exit of about a third of available apps; and in the quarters following implementation, entry of new apps fell by half.[49]

Of course, the body of evidence concerning the GDPR’s effects is not entirely unambiguous. For example, Rajkumar Vekatesean and co-authors find that the GDPR had mixed effects on the returns of different types of firms.[50] Other papers also show similarly mixed effects.[51]

Ultimately, the empirical literature concerning the effects of the GDPR shows that regulation—in this case, privacy protection—is no free lunch. Of course, this does not mean that competition intervention targeting the metaverse would necessarily have these same effects. But in the absence of a clear market failure to solve, it is unclear why policymakers should run such a risk in the first place.

In the end, competition intervention in the metaverse is unlikely to be costless. The metaverse is still in its infancy, regulation could deter essential innovation, and the commission has thus far failed to identify any serious market failures that warrant public intervention. The result is that the commission’s call for contributions appears premature or, in other words, that the commission is putting the meta-cart before the meta-horse.

[1] Competition in Virtual Worlds and Generative AI – Calls for contributions, European Commission (Jan. 9, 2024) https://competition-policy.ec.europa.eu/document/download/e727c66a-af77-4014-962a-7c9a36800e2f_en?filename=20240109_call-for-contributions_virtual-worlds_and_generative-AI.pdf (hereafter, “Call for Contributions”).

[2] Jonathan Vaian, Meta’s Reality Labs Records $3.99 Billion Quarterly Loss as Zuckerberg Pumps More Cash into Metaverse, CNBC (Apr. 26, 2023), https://www.cnbc.com/2023/04/26/metas-reality-labs-unit-records-3point99-billion-first-quarter-loss-.html.

[3] Alan Truly, Horizon Worlds Leak: Only 1 in 10 Users Return & Web Launch Is Coming, Mixed News (Mar. 3, 2023), https://mixed-news.com/en/horizon-worlds-leak-only-1-in-10-users-return-web-launch-coming; Kevin Hurler, Hey Fellow Kids: Meta Is Revamping Horizon Worlds to Attract More Teen Users, Gizmodo (Feb. 7, 2023), https://gizmodo.com/meta-metaverse-facebook-horizon-worlds-vr-1850082068; Emma Roth, Meta’s Horizon Worlds VR Platform Is Reportedly Struggling to Keep Users, The Verge (Oct. 15, 2022),

https://www.theverge.com/2022/10/15/23405811/meta-horizon-worlds-losing-users-report; Paul Tassi, Meta’s ‘Horizon Worlds’ Has Somehow Lost 100,000 Players in Eight Months, Forbes, (Oct. 17, 2022), https://www.forbes.com/sites/paultassi/2022/10/17/metas-horizon-worlds-has-somehow-lost-100000-players-in-eight-months/?sh=57242b862a1b.

[4] Call for Contributions, supra note 1. (“6) Do you expect the technology incorporated into Virtual World platforms, enabling technologies of Virtual Worlds and services based on Virtual Worlds to be based mostly on open standards and/or protocols agreed through standard-setting organisations, industry associations or groups of companies, or rather the use of proprietary technology?”).

[5] Less Lawrence Lessig, The Law of the Horse: What Cyberlaw Might Teach, 113 Harv. L. Rev. 508 (1999).

[6] Virtual Worlds (Metaverses) – A Vision for Openness, Safety and Respect, European Commission, https://ec.europa.eu/info/law/better-regulation/have-your-say/initiatives/13757-Virtual-worlds-metaverses-a-vision-for-openness-safety-and-respect/feedback_en?p_id=31962299H.

[7] Catherine Thorbecke, What Metaverse? Meta Says Its Single Largest Investment Is Now in ‘Advancing AI’, CNN Business (Mar. 15, 2023), https://www.cnn.com/2023/03/15/tech/meta-ai-investment-priority/index.html; Ben Marlow, Mark Zuckerberg’s Metaverse Is Shattering into a Million Pieces, The Telegraph (Apr. 23, 2023), https://www.telegraph.co.uk/business/2023/04/21/mark-zuckerbergs-metaverse-shattering-million-pieces; Will Gendron, Meta Has Reportedly Stopped Pitching Advertisers on the Metaverse, BusinessInsider (Apr. 18, 2023), https://www.businessinsider.com/meta-zuckerberg-stopped-pitching-advertisers-metaverse-focus-reels-ai-report-2023-4.

[8] Mansoor Iqbal, Fortnite Usage and Revenue Statistics, Business of Apps (Jan. 9, 2023), https://www.businessofapps.com/data/fortnite-statistics; Matija Ferjan, 76 Little-Known Metaverse Statistics & Facts (2023 Data), Headphones Addict (Feb. 13, 2023), https://headphonesaddict.com/metaverse-statistics.

[9] James Batchelor, Meta’s Flagship Metaverse Horizon Worlds Struggling to Attract and Retain Users, Games Industry (Oct. 17, 2022), https://www.gamesindustry.biz/metas-flagship-metaverse-horizon-worlds-struggling-to-attract-and-retain-users; Ferjan, id.

[10] Richard Lawler, Decentraland’s Billion-Dollar ‘Metaverse’ Reportedly Had 38 Active Users in One Day, The Verge (Oct. 13, 2022), https://www.theverge.com/2022/10/13/23402418/decentraland-metaverse-empty-38-users-dappradar-wallet-data; The Sandbox, DappRadar, https://dappradar.com/multichain/games/the-sandbox (last visited May 3, 2023); Decentraland, DappRadar, https://dappradar.com/multichain/social/decentraland (last visited May 3, 2023).

[11] David J. Teece, Profiting from Technological Innovation: Implications for Integration, Collaboration, Licensing and Public Policy, 15 Research Policy 285-305 (1986), https://www.sciencedirect.com/science/article/abs/pii/0048733386900272.

[12] Geoffrey Manne & Dirk Auer, Antitrust Dystopia and Antitrust Nostalgia: Alarmist Theories of Harm in Digital Markets and Their Origins, 28 Geo. Mason L. Rev. 1279 (2021).

[13] Roblox, Wikipedia, https://en.wikipedia.org/wiki/Roblox (last visited May 3, 2023); Minecraft, Wikipedia, https://en.wikipedia.org/wiki/Minecraft (last visited May 3, 2023); Fortnite, Wikipedia, https://en.wikipedia.org/wiki/Fortnite (last visited May 3, 2023); see Fiza Chowdhury, Minecraft vs Roblox vs Fortnite: Which Is Better?, Metagreats (Feb. 20, 2023), https://www.metagreats.com/minecraft-vs-roblox-vs-fortnite.

[14] Marc Rysman, The Economics of Two-Sided Markets, 13 J. Econ. Perspectives 134 (2009) (“First, if standards can differentiate from each other, they may be able to successfully coexist (Chou and Shy, 1990; Church and Gandal, 1992). Arguably, Apple and Microsoft operating systems have both survived by specializing in different markets: Microsoft in business and Apple in graphics and education. Magazines are an obvious example of platforms that differentiate in many dimensions and hence coexist.”).

[15] Id. at 134 (“Second, tipping is less likely if agents can easily use multiple standards. Corts and Lederman (forthcoming) show that the fixed cost of producing a video game for one more standard have reduced over time relative to the overall fixed costs of producing a game, which has led to increased distribution of games across multiple game systems (for example, PlayStation, Nintendo, and Xbox) and a less-concentrated game system market.”).

[16] What Are Fortnite, Roblox, Minecraft and Among Us? A Parent’s Guide to the Most Popular Online Games Kids Are Playing, FTC Business (Oct. 5, 2021), https://www.ftc.net/blog/what-are-fortnite-roblox-minecraft-and-among-us-a-parents-guide-to-the-most-popular-online-games-kids-are-playing; Jay Peters, Epic Is Merging Its Digital Asset Stores into One Huge Marketplace, The Verge (Mar. 22, 2023), https://www.theverge.com/2023/3/22/23645601/epic-games-fab-asset-marketplace-state-of-unreal-2023-gdc.

[17] Luke Winkie, Inside Roblox’s Criminal Underworld, Where Kids Are Scamming Kids, IGN (Jan. 2, 2023), https://www.ign.com/articles/inside-robloxs-criminal-underworld-where-kids-are-scamming-kids; Fake Minecraft Updates Pose Threat to Users, Tribune (Sept. 11, 2022), https://tribune.com.pk/story/2376087/fake-minecraft-updates-pose-threat-to-users; Ana Diaz, Roblox and the Wild West of Teenage Scammers, Polygon (Aug. 24, 2019) https://www.polygon.com/2019/8/24/20812218/roblox-teenage-developers-controversy-scammers-prison-roleplay; Rebecca Alter, Fortnite Tries Not to Scam Children and Face $520 Million in FTC Fines Challenge, Vulture (Dec. 19, 2022), https://www.vulture.com/2022/12/fortnite-epic-games-ftc-fines-privacy.html; Leonid Grustniy, Swindle Royale: Fortnite Scammers Get Busy, Kaspersky Daily (Dec. 3, 2020), https://www.kaspersky.com/blog/top-four-fortnite-scams/37896.

[18] See, generally, David Evans & Richard Schmalensee, Matchmakers: The New Economics of Multisided Platforms (Harvard Business Review Press, 2016).

[19] David S. Evans, Governing Bad Behaviour By Users of Multi-Sided Platforms, Berkley Technology Law Journal 27:2 (2012), 1201.

[20] See Case COMP/C-3/37.792, Microsoft, OJ L 32 (May 24, 2004). See also, Case COMP/39.530, Microsoft (Tying), OJ C 120 (Apr. 26, 2013).

[21] See Complaint, Epic Games, Inc. v. Apple Inc., 493 F. Supp. 3d 817 (N.D. Cal. 2020) (4:20-cv-05640-YGR).

[22] See European Commission Press Release IP/20/1073, Antitrust: Commission Opens Investigations into Apple’s App Store Rules (Jun. 16, 2020); European Commission Press Release IP/20/1075, Antitrust: Commission Opens Investigation into Apple Practices Regarding Apple Pay (Jun. 16, 2020).

[23] See European Commission Press Release IP/18/421, Antitrust: Commission Fines Qualcomm €997 Million for Abuse of Dominant Market Position (Jan. 24, 2018); Federal Trade Commission v. Qualcomm Inc., 969 F.3d 974 (9th Cir. 2020).

[24] See European Commission Press Release IP/19/4291, Antitrust: Commission Opens Investigation into Possible Anti-Competitive Conduct of Amazon (Jul. 17, 2019).

[25] See Case AT.39740, Google Search (Shopping), 2017 E.R.C. I-379. See also, Case AT.40099 (Google Android), 2018 E.R.C.

[26] See Complaint, United States v. Google, LLC, (2020), https://www.justice.gov/opa/pr/justice-department-sues-monopolist-google-violating-antitrust-laws; see also, Complaint, Colorado et al. v. Google, LLC, (2020), available at https://coag.gov/app/uploads/2020/12/Colorado-et-al.-v.-Google-PUBLIC-REDACTED-Complaint.pdf.

[27] See, e.g., Giorgio Monti, The Digital Markets Act: Institutional Design and Suggestions for Improvement, Tillburg L. & Econ. Ctr., Discussion Paper No. 2021-04 (2021), https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3797730 (“In sum, the DMA is more than an enhanced and simplified application of Article 102 TFEU: while the obligations may be criticised as being based on existing competition concerns, they are forward-looking in trying to create a regulatory environment where gatekeeper power is contained and perhaps even reduced.”) (Emphasis added).

[28] See, e.g., Aurelien Portuese, “Please, Help Yourself”: Toward a Taxonomy of Self-Preferencing, Information Technology & Innovation Foundation (Oct. 25, 2021), available at https://itif.org/sites/default/files/2021-self-preferencing-taxonomy.pdf. (“The latest example of such weaponization of self-preferencing by antitrust populists is provided by Sens. Amy Klobuchar (D-MN) and Chuck Grassley (R-IA). They introduced legislation in October 2021 aimed at prohibiting the practice.2 However, the legislation would ban self-preferencing only for a handful of designated companies—the so-called “covered platforms,” not the thousands of brick-and-mortar sellers that daily self-preference for the benefit of consumers. Mimicking the European Commission’s Digital Markets Act prohibiting self-preferencing, Senate and the House bills would degrade consumers’ experience and undermine competition, since self-preferencing often benefits consumers and constitutes an integral part, rather than an abnormality, of the process of competition.”).

[29] Efforts to saddle platforms with “non-discrimination” constraints are tantamount to mandating openness. See Geoffrey A. Manne, Against the Vertical Discrimination Presumption, Foreword, Concurrences No. 2-2020 (2020) at 2 (“The notion that platforms should be forced to allow complementors to compete on their own terms, free of constraints or competition from platforms is a species of the idea that platforms are most socially valuable when they are most ‘open.’ But mandating openness is not without costs, most importantly in terms of the effective operation of the platform and its own incentives for innovation.”).

[30] See, e.g., Klint Finley, Your Own Private Google: The Quest for an Open Source Search Engine, Wired (Jul. 12, 2021), https://www.wired.com/2012/12/solar-elasticsearch-google.

[31] See Brian Connolly, Selling on Amazon vs. eBay in 2021: Which Is Better?, JungleScout (Jan. 12, 2021), https://www.junglescout.com/blog/amazon-vs-ebay; Crucial Differences Between Amazon and eBay, SaleHOO, https://www.salehoo.com/educate/selling-on-amazon/crucial-differences-between-amazon-and-ebay (last visited Feb. 8, 2021).

[32] See, e.g., Dolby Vision Is Winning the War Against HDR10 +, It Requires a Single Standard, Tech Smart, https://voonze.com/dolby-vision-is-winning-the-war-against-hdr10-it-requires-a-single-standard (last visited June 6, 2022).

[33] On the importance of managers, see, e.g., Nicolai J Foss & Peter G Klein, Why Managers Still Matter, 56 MIT Sloan Mgmt. Rev., 73 (2014) (“In today’s knowledge-based economy, managerial authority is supposedly in decline. But there is still a strong need for someone to define and implement the organizational rules of the game.”).

[34] It is generally agreed upon that anticompetitive foreclosure is possible only when a firm enjoys some degree of market power. Frank H. Easterbrook, Limits of Antitrust, 63 Tex. L. Rev. 1, 20 (1984) (“Firms that lack power cannot injure competition no matter how hard they try. They may injure a few consumers, or a few rivals, or themselves (see (2) below) by selecting ‘anticompetitive’ tactics. When the firms lack market power, though, they cannot persist in deleterious practices. Rival firms will offer the consumers better deals. Rivals’ better offers will stamp out bad practices faster than the judicial process can. For these and other reasons many lower courts have held that proof of market power is an indispensable first step in any case under the Rule of Reason. The Supreme Court has established a market power hurdle in tying cases, despite the nominally per se character of the tying offense, on the same ground offered here: if the defendant lacks market power, other firms can offer the customer a better deal, and there is no need for judicial intervention.”).

[35] See, e.g., Josh Lerner & Jean Tirole, Some Simple Economics of Open Source, 50 J. Indus. Econ. 197 (2002).

[36] See Matthew Miller, Thanks, Samsung: Android’s Best Mobile Browser Now Available to All, ZDNet (Aug. 11, 2017), https://www.zdnet.com/article/thanks-samsung-androids-best-mobile-browser-now-available-to-all.

[37] FACT SHEET: Windows XP N Sales, RegMedia (Jun. 12, 2009), available at https://regmedia.co.uk/2009/06/12/microsoft_windows_xp_n_fact_sheet.pdf.

[38] See Case COMP/39.530, Microsoft (Tying), OJ C 120 (Apr. 26, 2013).

[39] Konstantinos Stylianou, Systemic Efficiencies in Competition Law: Evidence from the ICT Industry, 12 J. Competition L. & Econ. 557 (2016).

[40] See, e.g., Steven Sinofsky, The App Store Debate: A Story of Ecosystems, Medium (Jun. 21, 2020), https://medium.learningbyshipping.com/the-app-store-debate-a-story-of-ecosystems-938424eeef74.

[41] Id.

[42] See, e.g., Benjamin Klein, Market Power in Aftermarkets, 17 Managerial & Decision Econ. 143 (1996).

[43] See, e.g., Simon Hill, What Is Android Fragmentation, and Can Google Ever Fix It?, DigitalTrends (Oct. 31, 2018), https://www.digitaltrends.com/mobile/what-is-android-fragmentation-and-can-google-ever-fix-it.

[44] Metaverse Market Revenue Worldwide from 2022 to 2030, Statista, https://www.statista.com/statistics/1295784/metaverse-market-size (last visited May 3, 2023); Metaverse Market by Component (Hardware, Software (Extended Reality Software, Gaming Engine, 3D Mapping, Modeling & Reconstruction, Metaverse Platform, Financial Platform), and Professional Services), Vertical and Region – Global Forecast to 2027, Markets and Markets (Apr. 27, 2023), https://www.marketsandmarkets.com/Market-Reports/metaverse-market-166893905.html; see also, Press Release, Metaverse Market Size Worth $ 824.53 Billion, Globally, by 2030 at 39.1% CAGR, Verified Market Research (Jul. 13, 2022), https://www.prnewswire.com/news-releases/metaverse-market-size-worth–824-53-billion-globally-by-2030-at-39-1-cagr-verified-market-research-301585725.html.

[45] See, e.g., Megan Farokhmanesh, Will the Metaverse Live Up to the Hype? Game Developers Aren’t Impressed, Wired (Jan. 19, 2023), https://www.wired.com/story/metaverse-video-games-fortnite-zuckerberg; see also Mitch Wagner, The Metaverse Hype Bubble Has Popped. What Now?, Fierce Electronics (Feb. 24, 2023), https://www.fierceelectronics.com/embedded/metaverse-hype-bubble-has-popped-what-now.

[46] Garret A. Johnson, et al., Privacy and Market Concentration: Intended and Unintended Consequences of the GDPR, Forthcoming Management Science 1 (2023).

[47] Jian Jia, et al., The Short-Run Effects of GDPR on Technology Venture Investment, NBER Working Paper 25248, 4 (2018), available at https://www.nber.org/system/files/working_papers/w25248/w25248.pdf.

[48] Samuel G. Goldberg, Garrett A. Johnson, & Scott K. Shriver, Regulating Privacy Online: An Economic Evaluation of GDPR (2021), available at https://www.ftc.gov/system/files/documents/public_events/1588356/johnsongoldbergshriver.pdf.

[49] Rebecca Janßen, Reinhold Kesler, Michael Kummer, & Joel Waldfogel, GDPR and the Lost Generation of Innovative Apps, Nber Working Paper 30028, 2 (2022), available at https://www.nber.org/system/files/working_papers/w30028/w30028.pdf.

[50] Rajkumar Venkatesan, S. Arunachalam & Kiran Pedada, Short Run Effects of Generalized Data Protection Act on Returns from AI Acquisitions, University of Virginia Working Paper 6 (2022), available at: https://conference.nber.org/conf_papers/f161612.pdf. (“On average, GDPR exposure reduces the ROA of firms. We also find that GDPR exposure increases the ROA of firms that make AI acquisitions for improving customer experience, and cybersecurity. Returns on AI investments in innovation and operational efficiencies are unaffected by GDPR.”)

[51] For a detailed discussion of the empirical literature concerning the GDPR, see Garrett Johnson, Economic Research on Privacy Regulation: Lessons From the GDPR And Beyond, NBER Working Paper 30705 (2022), available at https://www.nber.org/system/files/working_papers/w30705/w30705.pdf.