Deterrence in Merger Review: Likely Effects of Recent U.S. Policy Changes

I. Introduction

From the outset of the Biden administration, the Federal Trade Commission (“FTC”) and the Department of Justice (“DOJ”) indicated their intention to step up merger enforcement. For example, the FTC declared: “Too many deals that should have died in the boardroom get proposed because merging parties are willing to take the risk that they can ‘get their deal done’ . . . .”[1]

Late last year, the FTC and the DOJ released new merger guidelines that lowered the bar for challenging mergers,[2] while abandoning principles that had made the merger review process reasonably predictable.[3] The FTC also proposed new regulations that would greatly increase the burden of merger notification under the Hart-Scott-Rodino Act (“HSR”). Pending changes in the regulations would “greatly increase the time and resources required.”[4]

We use a model of costly and uncertain merger review to identify likely impacts of the recent and ongoing policy changes by the FTC and the DOJ. Merging parties in our model decide whether to begin the review process and, if they do, whether to go to court if their merger is challenged. In making both decisions, the merging parties maximize expected profits in the face of uncertainty about what actions the agency or court will take.

As the FTC observed, merging parties can bet on longshots, proposing mergers they think are likely to be challenged. A longshot can be a good bet if merger profitability is sufficiently great. But it is equally true that merging parties can pass on profitable mergers that they think are likely to go unchallenged. The cost of the review process can be too great with a non-trivial probability of a challenge and low merger profitability.

The FTC and the DOJ indicated that a significant number of anticompetitive mergers have slipped through the review process, and we reflect that in a base case. We then incorporate policy changes that the agencies have implemented or have proposed. These policy changes (1) increase the likelihood of a merger challenge, (2) increase uncertainty associated with challenge decisions, and (3) increase the cost of merger notification.

II. The Model

The model begins with a pool of potential mergers that require notification and that are neither obviously anticompetitive nor obviously procompetitive. These mergers are close enough to the margin that potential merging firms are uncertain about the decision the agency or court would make. The pool is characterized by a joint distribution of competitive impact and merger profit as reckoned by the merging firms.[5] We assume that they are negatively related, so mergers with more adverse impact tend to be more profitable.[6]

Merging parties maximize expected incremental profit from merging by making two decisions — whether to propose the merger, and whether to go to court if the merger is challenged. The parties know the profitability of the merger and the costs of going through each stage of the regulatory process. The merging parties assess the competitive impact of the merger as x. A positive x signifies a “good” merger, and a negative value signifies a “bad” merger.

The agency or court decides in favor of the merging parties if, and only if, x + ε > t. The merging parties know x and t, but only the enforcement agency or court knows ε. The merging parties treat ε as noise, a random variable drawn from a known distribution.

The model has five decision points. First, potential merging parties determine whether to notify the merger and begin the review process. Second, the enforcement agency decides whether to initiate a substantial investigation by making a second request for information under the provisions of HSR.

Third, the agency decides whether to challenge the merger after investigation. Fourth, the parties decide whether to abandon the merger or allow a court to decide its fate. In the past, most merger challenges were resolved by agreed-upon remedies, but the U.S. agencies now prefer to litigate.[7] Finally, a court decides the legality of the merger after considering the evidence.

The model abstracts from real-world complexity, especially the varying terms of merger agreements in which the merging parties pledge to use their best efforts to get the merger consummated. Because many mergers are abandoned when challenged, the model allows that. The model does not allow abandonment of a proposed merger as an alternative to responding to a second request because merger agreements typically do not allow that.

Merging firms know a proposed merger’s profit, the cost of each stage of the merger review process, the decision thresholds employed by the agencies and courts, and the distribution of ε. Thus, they can look ahead to the probabilities of favorable decisions at each future stage and reason back to determine whether, at the first and fourth decision points, they do better by abandoning the merger or moving forward in the merger review process.

The pool of potential mergers is generated by essentially the same process. Every possible merger is evaluated both as to profitability and as to the probabilities of favorable outcomes in the regulatory process. The parties then settle on best-choice mergers. The least profitable of the best-choice mergers are deterred by the costs of the regulatory process, perhaps even without being notified under HSR.

III. Calibration of the Base Case

The cost of HSR notification has been estimated at $100,000;[8] a rough estimate for second-request compliance is $1 million; and a rough estimate for trial cost is $5 million. To calibrate the model, we must scale these costs to merger profitability. With the most profitable mergers excluded from our pool of marginal mergers, we arbitrarily assume that the maximum profit from merging is $10 million. With profit scaled to the interval [0, 1], this yields costs of 0.01, 0.1, and 0.5 for HSR notification, second-request compliance, and trial.

To reflect the fact that antitrust law prohibits only mergers that substantially lessen competition, t should be slightly negative at the trial stage, and we assume that the agency attempts to mimic the court in making challenge decisions. And t should be substantially positive at the second-request stage to avoid missing anticompetitive mergers. Thus, t is set at –0.1 for the trial and challenge decisions and 0.3 for the second-request decision.

The results are not sensitive to the distribution of ε, and we assume a rather flat distribution.[9] Because the merging parties learn about the agency’s thinking from the review process, we assume that the standard deviation of ε at the challenge stage is half that at the second-request and trial stages.

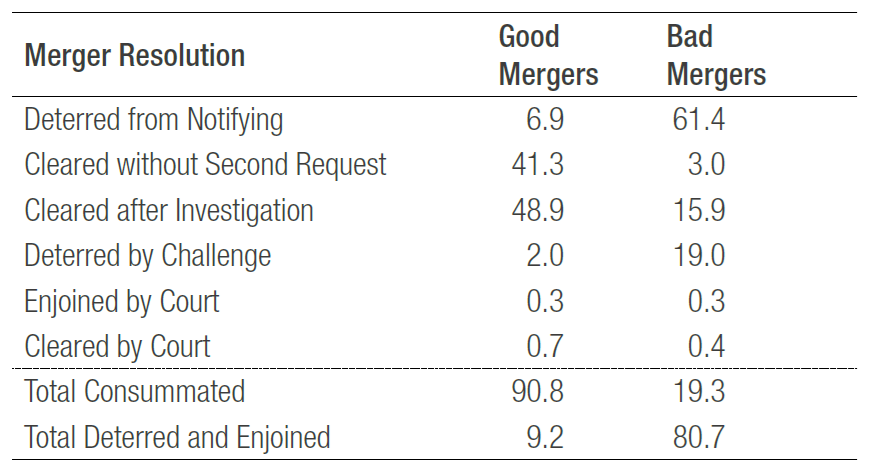

As can be seen in Table 1, the foregoing assumptions make the base case consistent with the belief currently held by the FTC and the DOJ that a significant number of anticompetitive mergers were being consummated. Of the mergers evaluated as bad by the merging firms, 19.3 percent are consummated. Deterrence does work tolerably well; 61.4 percent of the bad mergers are never proposed, and 19.0 percent are abandoned when challenged.

TABLE 1: Base Case Outcomes

IV. The Impact of the New Policies

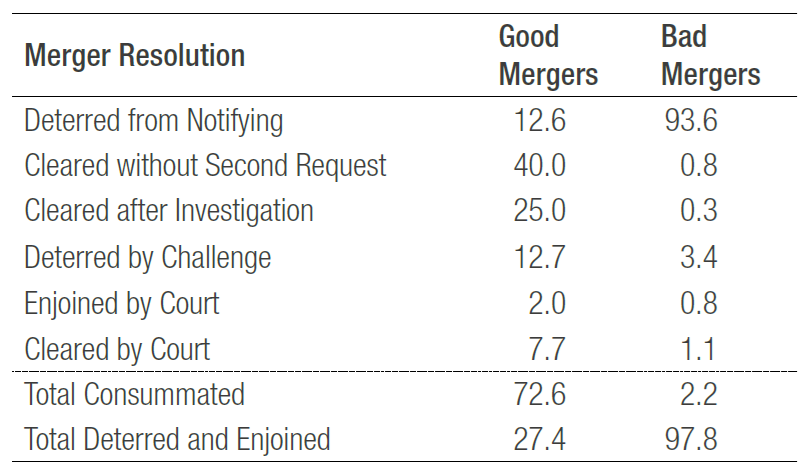

The U.S. enforcement agencies have adopted an aggressive enforcement posture, which we model as increasing the challenge decision threshold from –0.1 to 0.2. Table 2 presents the distribution of outcomes with just this change in policy.

A more aggressive challenge posture greatly enhances the deterrence of bad mergers. The fraction of bad mergers nonetheless consummated decreases from 19.3 percent all the way down to 2.2 percent. But the fraction of good mergers that are not consummated increases from 9.2 to 27.4 percent. In a merger review process with costs and noise, tightening enforcement necessarily deters both good and bad mergers. An aggressive challenge posture also proves costly in that the number of trials increases by more than 500 percent.

TABLE 2: Outcomes with an Aggressive Challenge Policy

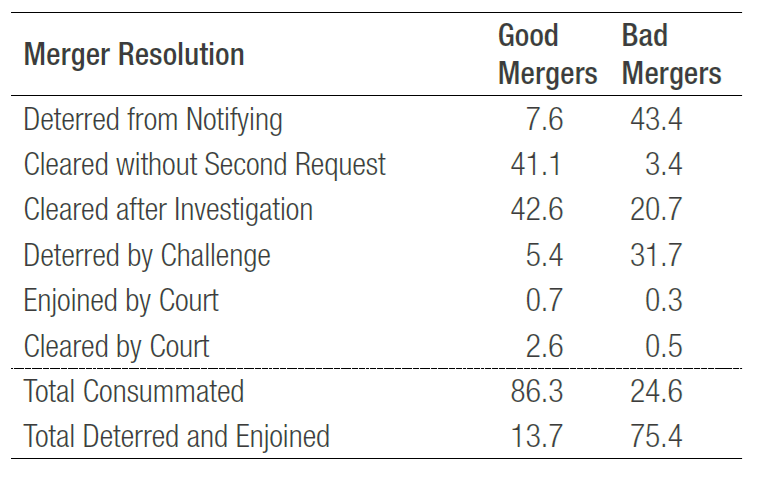

In our view, the new Merger Guidelines increase uncertainty about which mergers are challenged, which is modeled as doubling the standard deviation of the noise at the challenge stage. Table 3 presents the distribution of outcomes under the new Merger Guidelines but no change in enforcement. Increasing the noisiness of merger challenge decisions undermines deterrence: The fraction of bad mergers deterred or enjoined decreases from 80.7 to 75.4 percent.

TABLE 3: Outcomes with More Noise in Challenge Decisions

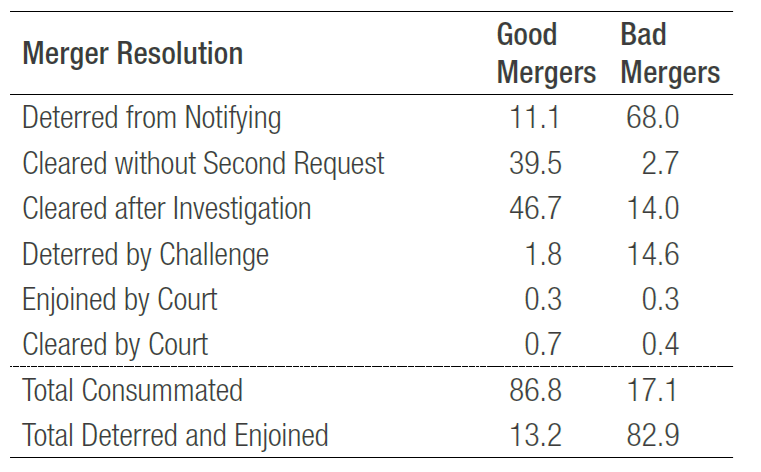

The FTC proposes far a more onerous merger notification process, which the U.S. Chamber of Commerce estimated will quadruple the cost.[10] Factoring in some additional delay costs because the more onerous process will take longer, we assume that the cost quintuples. Table 4 presents the distribution of outcomes with the higher notification cost, with no other policy changes. The deterrence effect is clear. The fraction of the good mergers never proposed increases from 6.9 to 11.1 percent.

TABLE 4: Outcomes with Higher Notification Cost

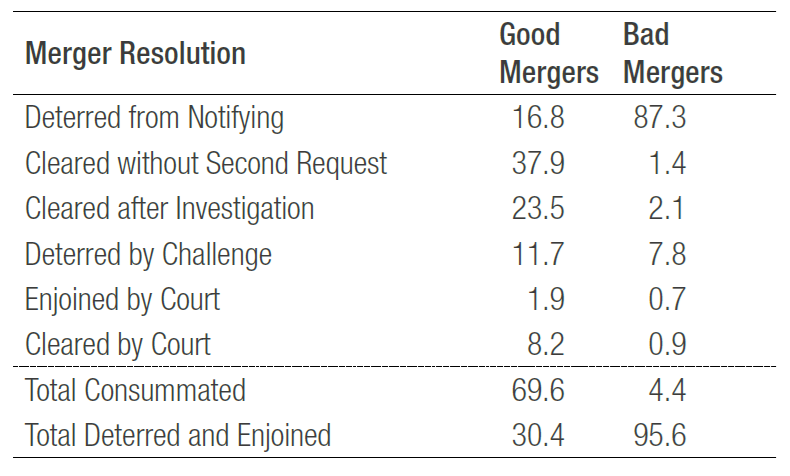

The impact of all three policy changes together is shown in Table 5. The three policy changes substantially reduce the fraction of bad mergers consummated, from 19.3 percent down to 4.4 percent, but an even greater reduction is achieved by more aggressive enforcement alone. Increased uncertainty associated with merger challenges makes some longshots attractive, and some pay off. More aggressive enforcement alone also deters only 9.2 percent of the good mergers, whereas all three policy changes deters 30.4 percent.

TABLE 5: Outcomes with All Policy Changes

V. Conclusion

While the merger policy changes of the FTC and the DOJ can be expected to deter many anticompetitive mergers, the cost are likely to be steep. Of the additional mergers deterred, most are viewed as procompetitive by the merging parties. In 2021, the two Republican FTC commissioners argued that the Democrat majority was using “bureaucratic red tape to weigh down all” mergers.[11] Had they not resigned, they likely would made similar comments when new merger guidelines were released and new HSR regulations were proposed. The model explains why they would have been right.

[1] Fed. Trade Comm’n, Statement of the Commission on Use of Prior Approval Provisions in Merger Orders (Oct. 25, 2021).

[2] Gregory J. Werden, The Risk Concept in the New Merger Guidelines: Treating a Proposed Merger Like Schrödinger’s Cat, Antitrust, Spring 2024, at 30.

[3] Gregory J. Werden, Market Delineation under the New Merger Guidelines: Gerrymandering Redux, in The 2023 U.S. Merger Guidelines: A Review 173 (2024).

[4] Richard B. Brosnick & Carlos M. de la Cruz III, First Major Overhaul of HSR Act Will Greatly Increase Time and Resources Required to Complete HSR Filing, Ackerman Practice Update (Jan. 10, 2024).

[5] To generate a pool of marginal mergers, the distribution of impact and profit is truncated by confining impact to the interval [–0.5, 0.5] and profit to the interval [0, 1].

[6] The results presented assume a truncated normal distribution and are insensitive to its parameters. The results presented assume a correlation of – 0.5 between impact and profit before truncation and a standard deviation of 0.5 before truncation for both impact and profit. These standard deviations make the marginal distributions rather flat, so truncation lops off fat tails.

[7] See Leon Greenfield et al. Fix-It-First: Navigating a Seismic Shift in US Antitrust Agency Approaches to Merger Remedies, Wilmer Hale Client Alert (Apr. 20, 2023).

[8] U.S. Chamber of Commerce, Comments on HSR Proposed Rulemaking (Sept. 27, 2023).

[9] A completely flat distribution is called a uniform distribution. We instead assume a normal distribution but with a standard deviation potentially as high that with a uniform distribution.

[10] U.S. Chamber of Commerce, Comments on HSR Proposed Rulemaking (Sept. 27, 2023).

[11] Christine S. Wilson & Noah Joshua Philips, Dissenting Statement Regarding the Statement of the Commission on the Prior Approval Provisions in Merger Orders (Oct. 29, 2021).