UK Payment System Regulator Market Reviews: Initial Concerns

Introduction

The UK Payment System Regulator (PSR) is currently in the process of conducting two market reviews related to card payments. One of the two regards consumer cross-border interchange fees between the United Kingdom and the European Economic Area (EEA),[1] while the other relates to card scheme and processing fees.[2] This brief raises some initial concerns regarding the two reviews.

The most significant concern these market reviews raise is the implied “market” under investigation. By focusing narrowly on two very specific aspects of the overall payment system, the reviews almost by definition rule out a full analysis of the ecosystem. This is most unfortunate. Decades of research shows categorically that payment systems are highly complex multi-sided markets that have evolved over many decades—and continue to evolve—into a delicately balanced, technologically advanced ecosystem.

Payment systems and the thousands of banks that interoperate over them have invested tens of billions of dollars into their development. These investments, and associated innovations in technologies and the rules governing the systems, have been driven by a decades-long process of dynamic competition. That process has involved not only the main payment-system operators, but also many other businesses involved in payments processing. As a result, billions of consumers are now able to use payment cards and millions of merchants accept them. The system’s economic benefits unquestionably far outweigh the costs.

While it is always possible to conceive of models against which extant payment systems may appear “imperfect,” that does not necessarily mean there is any “market failure”; models are not reality. By considering only very narrow questions relating to specific aspects of the operations of payment systems, the PSR is likely to make inappropriate conclusions.

This brief begins with a description of some of the primary benefits that payment-card systems deliver. Section II offers a description of the economics of payment systems. Section III discusses some common misconceptions regarding payment systems, which have arisen due to misunderstanding the economics that underpins them and failing to appreciate the history and nature of the dynamic competition that explains the existing market structure. Section IV considers the market reviews in the context of the PSR’s overall remit. Section v draws some conclusions.

I. The Benefits of Payment-Card Systems

The PSR acknowledges that payment cards “are critical to the smooth running of the UK economy as they enable people to pay for their purchases and merchants to accept payments for goods and services.”[3] But it is worth spelling out why payment cards are so critical. In no small part, this comes down to the numerous inherent advantages that payment cards and their associated systems have over other types of payment, such as cash and checks. These include: [4]

- They enable consumers to spend more than they have in their wallet at the time of the purchase, which in turn reduces the amount of cash that they need to withdraw from the bank.

- Credit cards enable consumers to spend more than they have in their bank accounts at the time of the purchase. Because credit-card issuers typically charge no interest if the statement balance is paid by the due date (usually a month after issuance), cardholders are able to smooth their consumption patterns at much lower cost than if they were required to hold cash in their account or use an overdraft facility.

- By increasing the ability of consumers to spend, payment cards benefit merchants, who sell more goods and services.

- Merchants also benefit from reduced costs associated with handling cash, including the need for float and the risk of theft.

Payment cards have been essential to the development of e-commerce and were literally a lifeline during the COVID-19 pandemic, both for consumers and for businesses (especially smaller businesses), when millions of people were unable to leave their homes and primarily purchased essential goods through online merchants.

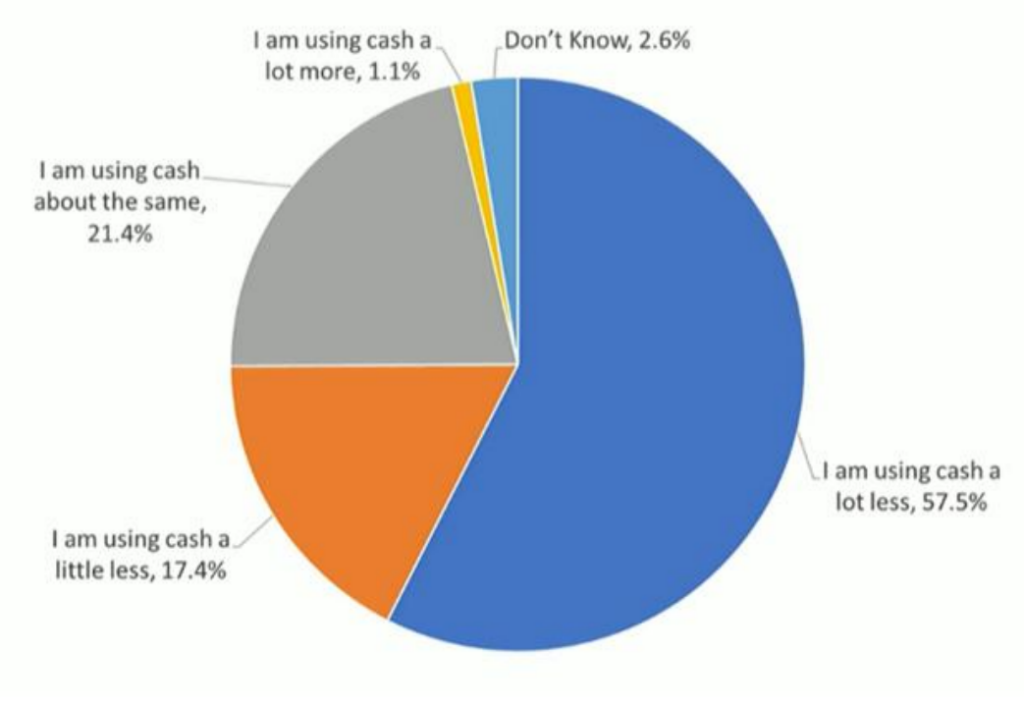

Figure I: Use of Cash in the UK Since COVID-19

SOURCE: PSR[5]

Despite these benefits, merchants have for decades complained about the prohibitive cost of processing card transactions. As explained below, these complaints reflect a misunderstanding of the nature and benefits of card-payment systems.

II. The Economics of Payment Systems

A proper economic assessment of any payment system must account for the fact that both merchants and consumers must perceive benefits for such systems to be successful. If too few merchants accept a particular form of payment, consumers will have little reason to possess it and issuers will have little incentive to issue it. Likewise, if too few consumers possess a form of payment, merchants will have little reason to accept it.

Conceptually, economists describe such situations as “two-sided markets”: consumers are on one side, merchants on the other, and the payment system acts as the platform facilitating interactions between them.7F[6] Other examples of two-sided markets include newspapers, shopping malls, social-networking sites, and search engines.

The challenge for any two-sided market platform is to attract and retain sufficient participants on one side of the market to persuade participants on the other side to adopt and stay on the platform, thereby making the system self-sustaining and maximising the joint net benefits of the platform to all participants.8F[7] To achieve this, platforms must allocate the costs and benefits of the system among the various parties, which is typically done by charging different fees to the different sets of participants on each side of the market in such a way as to create an equitable and efficient balancing.9F[8] Often this means that participants on one side will pay a larger share of the overall costs than participants on the other side.

Take newspapers, which as noted are a classic example of a two-sided market, with consumers on one side, advertisers on the other, and the newspaper acting as the platform in the middle. In essence, advertisers seek to target their adverts to specific consumers, while consumers are mainly interested in reading news, opinions, and other content. A newspaper thus provides content that appeals to consumers so that they read the paper. By attracting readers who might also view advertisements, the newspaper is able to sell advertisements, which help to cover the costs of producing and distributing the newspaper.

In the case of payment-card systems, the larger the number of holders of cards from a particular system (e.g., Visa, Mastercard, or American Express), the larger will be the number of merchants willing to accept cards on that system. Meanwhile, the larger the number of merchants that accept cards on a particular system, the larger will be the number of consumers who wish to hold cards on that system.

Maintaining such a system is challenging and expensive. In no small part, this is because payments are subject to counterparty risks—in particular, risks of default (non-payment), fraud, and theft. This problem so bedevilled early payment cards that many floundered within a few years.[9] The systems that succeeded did so because they figured out how to encourage adoption by both sides of the market and to limit counterparty risk. This entailed the introduction of effective security systems, setting appropriate liability rules, and charging fees that covered all the costs of operating the system. Perhaps most importantly, the systems that flourished were those that realised merchants had stronger incentives than consumers to bear the costs of the system, due to the significant benefits they receive, and introduced fee structures that reflected those incentives.

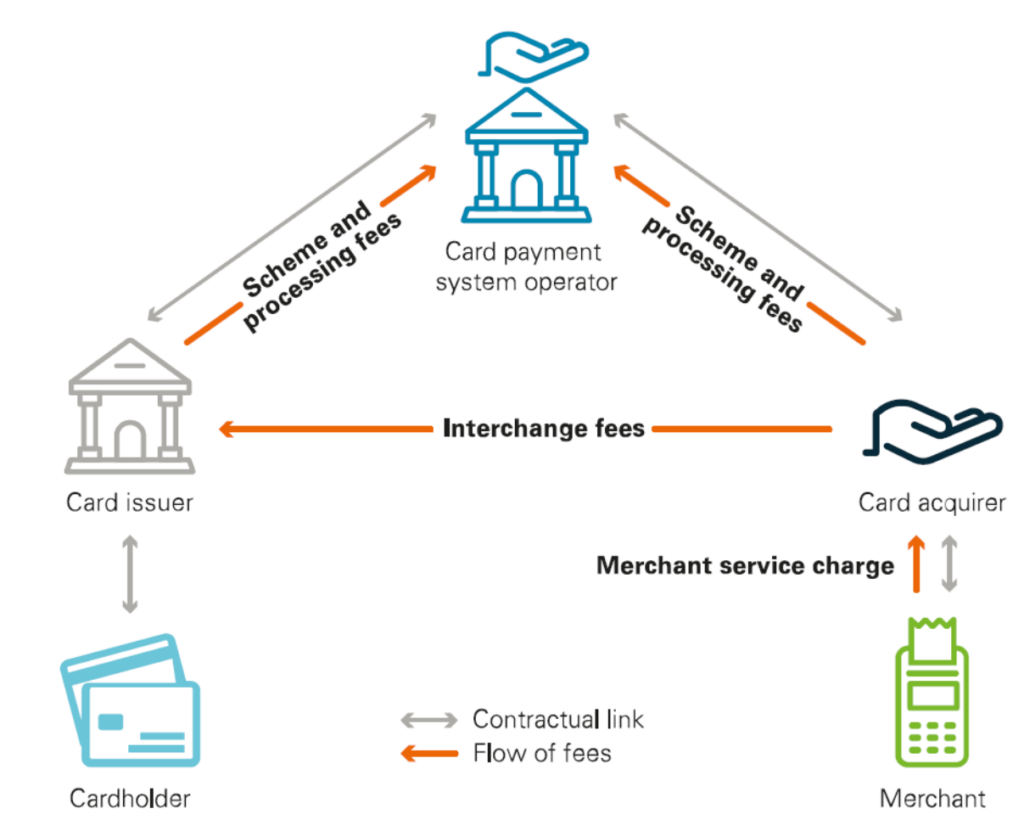

In three-party card systems, the merchants’ transaction fee is charged directly by the system operator. In four-party systems, merchants pay acquirers a “merchant service charge” (MSC), which includes the acquirer’s processing costs and the “interchange fee.” The default interchange fee is a charge made by the system operator that is paid to the issuer (in the form of a deduction from the amount sent by the issuer to the acquirer when settling the transaction).[10] In addition, the system operator charges fees to both acquirers and issuers, called “scheme” and “processing” fees, that cover the system costs. Figure II, which is taken from the PSR, provides a simplified schematic of the four-party card system. In practice, there are often other parties involved, including payment gateways and payment processors.[11]

Figure II: Simplified Schematic of Four-Party Card Payment System

SOURCE: PSR[12]

As discussed below, the various three- and four-party payment systems have been engaged in a decades-long process of dynamic competition in which each has sought—and continues to seek—to discover how to maximise value to their merchants and consumers. Card-payment systems also compete with other payment methods, including legacy methods such as cash and cheques, as well as the many methods that have emerged more recently, such as online transfers of various kinds. This has involved considerable investment in innovative products, including more effective ways to encourage participation, as well as the identification and prevention of fraud and theft.

Payment-card systems seek to optimise interchange fees to maximise the benefits of the system to participants on both sides of the market. Revenue from these fees thus covers a wide range of things, including: system operations, card issuance, customer service, fraud prevention and resolution, rewards, fraud-protection cover, and car-rental insurance (where these are offered). Moreover, these services are today often offered for free to cardholders (no annual fee) or even at a negative price, such as when rewards are provided. Finance charges on revolving balances also generate substantial revenue, much of which covers the costs of underwriting, servicing, and charge-offs on credit balances.

Similarly, many banks provide free current accounts to those who maintain positive balances (and in some cases even fee-free overdraft facilities up to a limit). The costs of such accounts are covered by other charges, including debit-card interchange fees.

III. Misunderstanding the Economics of Payment Systems

While it may seem iniquitous for a platform to charge one side of the market more than the other, it is often efficient and ultimately socially beneficial.[13] In the case of payment systems, if the operator sets the price too high for some consumers, they will be unwilling to use the platform; similarly, if the operator sets the price too high for some merchants, they will not be willing to use the platform.

Since one side of the market is typically more price sensitive than the other side, joint net benefits are maximised when participants on the less price-sensitive side of the market incur a greater proportion of the system costs. This enables overall greater participation in the system, thereby achieving greater economies of scale. In the case of card-payment systems, the relatively large benefits merchants receive from accepting cards makes them less price sensitive than consumers, so it makes sense for them to pay a larger share of the transaction fees. This was true even when cards were a tiny fraction of payments and there were few, if any, competing cards for consumers to choose among. This demonstrates that it is not due to any perception among merchants that they lack choice.

The ineluctable benefits of such cross-market subsidies have, unfortunately, often been misconstrued as harmful by regulators, especially in markets where there are few competitors. In many cases, what seems to have happened is that the economies of scale entailed in the development and maintenance of certain systems has meant that only a small number of competing firms can operate efficiently. Regulators typically assume axiomatically, however, that the largest firms in markets with only a small number of competitors have a dominant position that has been created and is reinforced by those firms’ anticompetitive conduct. They thus automatically view all such conduct with suspicion.

Globally, there are many card-payment systems, although most of these operate only at a national level.[14] In the UK, as the PSR notes, two payment systems, Mastercard and Visa, represent the vast majority of consumer-debit and credit-card transactions.[15] But as the history shows, these large market shares were acquired through the development of technologies and rules that limited fraud and other counterparty risk, as well as by improving the efficiency and efficacy of payments, thereby creating enormous benefits to both consumers and merchants. While all markets are imperfect when compared to theoretical models of “perfect competition,” there is simply no evidence of “market failure” that might justify regulatory intervention.

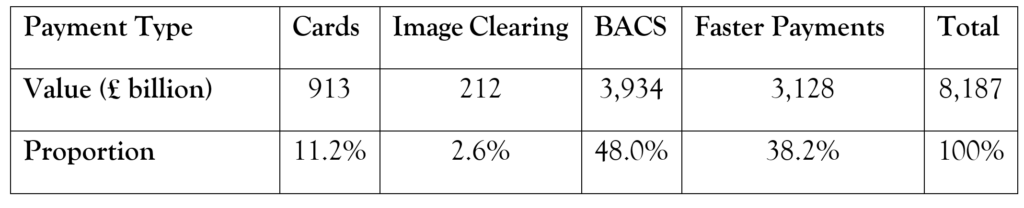

It is also worth noting that, while card payments represent a large proportion of retail payments in the UK, they represent a relatively small fraction of all payments. Table 1 shows the value of payments made using various non-cash methods over the year from November 2021 to October 2022. This excludes higher-value payments settled directly over CHAPS, which accounted for more than £90 trillion in value.[16] As can be seen, the vast majority of payments were made over BACS and the Faster Payments systems, while cards (debit and credit) accounted for only about 11 per cent.

Table 1: Transaction Values of Selected UK Payments Systems, November 2021-October 2022

SOURCES: PayUK[17] and UK Finance[18]

A. A Brief History of Payment-Card Systems

While merchant-specific charge cards had existed since the early 20th Century, the first multi-merchant payment-card systems in the United States were Diners Club and American Express. These were and in most cases are three-party cards; that is, they operate a closed ecosystem in which they have direct relationships with both merchants and cardholders (Amex now also acts as a third-party provider).[19]

Diners Club began in 1950 as a limited-purpose card that could be used at restaurants.[20] Starting with restaurants in New York City, the card gradually expanded to other cities and other hospitality services before becoming fully multipurpose. In 1953, Diners Club became the first international payment card, with acceptance in the UK, Canada, Cuba, and Mexico. International expansion continued gradually and, by 1967, Diners Club had a presence in 130 countries.

The American Express Card started as an alternative to Travellers’ Cheques, which were an already-popular payment product.[21] From an initial presence in the United States and Canada, American Express expanded its card issuance internationally in 1972.

While numerous banks experimented with their own credit cards, the first truly successful such card venture was BankAmericard, which began in 1958.[22] Initially a three-party card operated exclusively by Bank of America, in 1966, Bank of America began issuing licenses to other banks.[23] In 1970, National BankAmericard became a separate company owned by its member banks and, in 1976, it was rebranded as Visa.[24]

The precursors to Mastercard were regional associations of U.S. banks that had developed in response to restrictions on branch banking in 15 states, which meant that banks could only operate as individual units.[25] In 1966, several of these regional associations formed the Interbank Card Association (ICA), which established the authorisation, clearing, and settlement rules for all the banks in the ICA.[26] In 1969, ICA rebranded its cards as Interbank: the Master Charge card and, in 1979, the ICA became MasterCard.

The history of credit cards in the UK is similar. Finders Services was the first payment-card operator in the nation, launching its charge card here in 1951.[27] In 1962, Finders Services merged with Diners Club, becoming the UK’s first international payment card.[28] Amex followed in 1963.[29] Then, in 1966, Barclays became the first international licensee of BankAmericard, initially launching the Barclaycard as a charge card.[30] The following year, the Bank of England issued the first license to operate a credit card to Barclays and Barclaycard became the UK’s first credit card.[31] Barclaycard became a founding member of International BankAmericard Inc (IBANCO) when that was formed in 1974.[32] In 1977, IBANCO was rebranded Visa.[33] From 1981, Visa International was reorganised into five semi-autonomous international divisions, with their own boards and operational regulations, but subject to framework rules set at headquarters.[34]

The history of Mastercard in the UK is intertwined with Eurocard, which was founded in 1964 in Sweden and moved its corporate base to Belgium in 1965, from where it operated a pan-European not-for-profit association of card-issuing banks.[35] In 1968, Eurocard and the Interbank Card Association formed a strategic alliance. In 1971, Lloyds Bank, Midland Bank, National Westminster Bank, and (slightly later) Royal Bank of Scotland/Williams and Glyn formed a joint venture, the Joint Credit Card Company (JCCC), which launched the Access credit card in 1972.[36] In 1973, Access purchased a 15% share of Eurocard and, the following year, joined the Interbank Card Association.[37] In 1992, MasterCard merged with Europay International (which itself was a merger of Eurocard and Eurocheque).[38] In 1996, MasterCard purchased Access.[39]

B. Dynamic Competition in Payment Systems

This brief history of the evolution of payment-card systems over the past 70 years shows how those systems gradually expanded. Underpinning that expansion was a process of dynamic competition, with payment networks continuously innovating ways to increase their security, scale, and efficiency. Among the major technological innovations have been:

- The plastic card (previously, cards had used card stock).

- Electronic systems for authentication, clearing, and settling transactions.

- The magnetic stripe (magstripe) and associated data standards, which enabled more secure authentication.

- The personal identification number (PIN), which was initially developed to enable the use of cards to withdraw cash directly from bank accounts using cash machines.

- The EMV Chip—developed by a consortium of card networks that initially comprised Eurocard, MasterCard and Visa (EMVCo)—stores card information using public-key encryption technology and sends a one-time token to the POS machine. EMV chips are more difficult to “skim” than magstripes and, because the card number is not shared with the POS machine, dramatically reduce the potential for hackers to steal and use stored card information from merchants.

- Contactless Tokens (cEMV), which are similar to the tokens produced by EMV Chips and enable similar protections for contactless transactions, whether using a card or a mobile phone.

- Address verification (AVS), which is mainly used during card-not-present (CNP) transactions, such as telephone and online sales.

- The card verification code (CVC/CVV), which is a three- or four-digit number unique to the card that is not held in merchant databases, and which is also primarily used during CNP transactions.

- Two-factor authentication (2FA) entails the use of at least two independent proofs that the card user is legitimate, such as the CVV and a one-time password. 2FA is most commonly used for CNP transactions but is also sometimes used as a second line of defense for point-of-sale (POS) transactions identified as unusual.

- Machine-learning-based systems that identify potentially fraudulent transactions by comparing transactions in real time with cardholders’ spending patterns, enabling issuers to block transactions.

- 3D-Secure (3DS), which is an authentication system developed by EMVCo primarily for online transactions. It is a two-stage process: stage one involves using the information sent in the first (authorization) message to check against a cardholder’s profile; if the proposed payment fits the profile, it is permitted, and if not, then the cardholder is asked to complete 2FA on the transaction.[40]

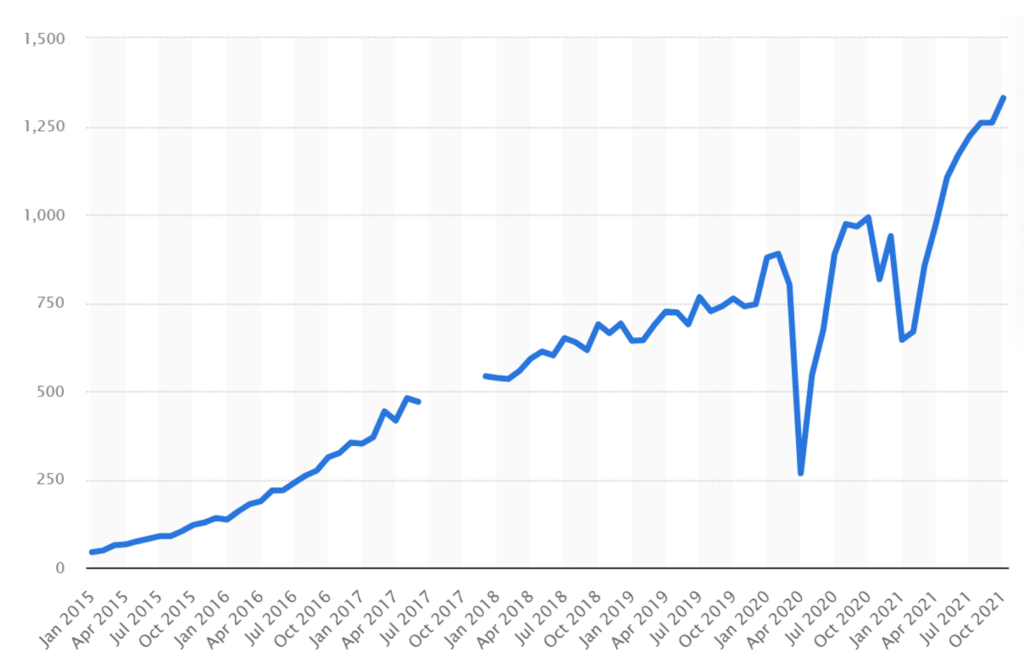

We are now so used to making payments with cards that it is difficult to imagine just how important these innovations have been, let alone the scale of investment that went into them (and the many others, including those that were rejected or discarded). With that in mind, it is worth noting the dramatic impact of the introduction of one of the more recent innovations: contactless cEMV tokens. Over the past decade, these have facilitated a veritable revolution in contactless payments made using cards and cell phones. As Figure III shows, the number of contactless payments in the UK grew from almost nothing to more 1.2 billion by the end of 2021, representing about half of all card-payment-system transactions.

Figure III: Number of Contactless Payment Transactions, UK, 2015-2021 (Millions)

SOURCE: Statista[41]

Contactless payments dramatically reduce the time needed to complete a transaction at checkout, relative to cash or chip and PIN, with clear benefits for both merchants and consumers.[42] During the COVID pandemic, the ability to transact without touching a terminal or signing a payment-authorization slip also reduced the cost and difficulty of complying with rules intended to limit exposure through contact.[43] In addition, cEMV has gradually been integrated into public-transport systems, enabling riders on buses and trains in London, and increasingly across the UK, to use their payment card or mobile phone to tap in and out, eliminating the need for cash or additional transactions.[44]

There have also been many important innovations in incentive systems, the most notable being:

- Merchant liability for non-authenticated fraudulent transactions above a certain minimum amount, which incentivises merchants to undertake authentication.

- Prohibiting merchants who accept cards from a payment system from discriminating against that system by imposing surcharges on payments made using that system.

- Guaranteeing zero liability for card users who have been subject to fraud on certain conditions (such as that the card user has notified the issuer that their card has been stolen).

- Various forms of insurance, including purchase protection, return protection, extended warranty protection, cell-phone protection, price protection, rental-car liability protection, and travel insurance.

- Rewards, including cashback and merchant-specific rewards (often on co-branded cards)

By offering these incentives, card issuers encourage adoption and use by cardholders. In addition, merchant-specific rewards encourage loyalty to that merchant. And, importantly, these incentives and technological innovations have been made possible by the system of fees, including most notably the interchange fee but also the scheme fees, processing fees, and acquiring fees.

Furthermore, there have been important business-model innovations over time that have improved the scale efficiency, responsiveness, and effectiveness of the systems. As noted, Visa and Mastercard initially deployed quite different ownership and management models. BankAmericard initially adopted a franchise model and then, from 1970, National BankAmericard/Visa operated as a joint-venture company, thereby overcoming conflicts of interest that arose from one bank acting as an issuer and an acquirer, while also setting the rules of the system for other issuers and acquirers.[45] By contrast, Mastercard and Eurocard both began as non-profit associations, which enabled them rapidly to scale, including by absorbing Access (which until then had operated as a profit-sharing joint venture), but this resulted in management challenges. The merger of Mastercard and Europay International in 1992 addressed some of those problems by creating a more streamlined structure and a more coherent global brand. Then, in 2006, MasterCard reorganised as a for-profit company and listed on the New York Stock Exchange through an initial public offering, enabling more centralised decision-making. In 2008, Visa also listed on the NYSE.

In short, the two largest global-payment systems emerged, survived, and thrived first and foremost by identifying and implementing superior solutions to the challenges of building and maintaining payment systems locally, nationally, regionally, and eventually, globally.

The large market share of these two firms operating at a global level is clearly not a consequence of some pre-existing market structure. On the contrary, the structure of the market for payments is a consequence of dynamic competition in technology, incentives, and business models.

C. The Ongoing Process of Dynamic Competition

This dynamic competition continues, with innovative technologies and new global players emerging and deploying different business models. For example, PayPal offers users the ability to pay for services and goods purchased online and provides them with some of the same protections offered by credit cards, such as fraud monitoring and purchase protection.[46] PayPal operates a dual model in which users may fund payments either using their payment card or by making an ACH transfer to their PayPal account.[47] PayPal also offers users the ability to “buy-now-pay-later” (BNPL) at some merchants, with options either to make four bi-weekly payments with zero interest, or to spread the payment over a longer period (6, 12, 18, or 24 months), paying an interest rate that currently ranges from 0% to 29.99%, depending on the user’s credit score.[48]

In the past decade, several standalone BNPLs have entered the market, including Afterpay, Affirm, Flexpay, Klarna, Sezzle, Splitit, and Zip.[49] In 2021, merchant-payment-gateway provider Square purchased Afterpay, enabling the use of BNPL for in-store purchases in the United States.[50] In the UK, Square has partnered with BNPL provider ClearPay, enabling it to provide a similar offering.[51] Meanwhile, Stripe, another gateway provider, has partnered with several BNPL companies, enabling it to make similar offerings in several countries, including the UK.[52]

When offering zero-interest payment solutions to consumers, BNPLs typically charge the retailer a transaction fee of between 2% and 8%, depending on the consumer’s credit score and the type of merchant.[53] In the United States, Square/Afterpay charges the purchaser a standard rate of 6% plus a transaction fee of 30c.[54] By contrast, when offering longer-term payment solutions, the merchant pays a transaction fee and the consumer pays the interest.[55]

In addition to consumer-oriented BNPLs, there are business-to-business BNPLs. For example, in the UK, Funding Circle’s Flexipay (not to be confused with Flexpay or Payflex, a South African BNPL) offers loans of between £2,000 and £250,000, with the ability to spread payments over three months at an interest rate of 3% (as of the time of writing).[56]

Another example is real-time payments (RTP) systems, such as the UK’s Faster Payment System, which enable users to make near-instant peer-to-peer payments online and using mobile apps.[57] RTP systems typically do not replicate the fraud-protection and other counter-party risk offerings of traditional payment cards, nor do they enable consumers to defer payment, so they are likely less attractive than payment cards for making payments to merchants—especially when those merchants are unfamiliar and/or the size of the payment is large.[58] While the UK’s Confirmation of Payee system has somewhat reduced problems—such as, as the PSR notes,[59] automated push payment (APP) fraud—APP fraud remains very high, leading the PSR to propose that payment-service providers (PSPs) guarantee refunds for fraudulent payments in excess of £100.[60] Such a requirement would impose considerable additional costs on PSPs. By effectively transferring a considerable proportion of liability to those PSPs, it also would reduce payors’ incentives to undertake due diligence on payees. This, in turn, might lead PSPs to introduce more extensive screening of payments, which could well lead to overinclusive restrictions that harm smaller, less well-known but nonetheless legitimate payees.

At the same time, card issuers and payment systems continue to invest in improved methods for verifying the identity of persons making transactions, including most notably the development and deployment of a range of biometric technologies.[61] Meanwhile, many payment-card issuers are partnering with BNPL operators to provide alternative payment options for cardholders.[62]

IV. The Market Reviews in the Context of the PSR’s Remit

Unfortunately, there is no evidence that the PSR intends to investigate the broader market for payments in the UK, of which payment cards represent only about 11%.[63] Instead, it has proposed to undertake two discrete reviews of very specific and narrow aspects of payments card systems’ operations, seemingly without any intention to consider the implications on the wider ecosystem. This seems doomed to draw inappropriate conclusions.

This section outlines the PSR’s remit and then discusses the two market reviews in the context of that remit, taking into consideration the foregoing discussion of the nature of payment systems and the dynamic competition that has driven their evolution.

A. The PSR’s Remit

Section 49 of the Financial Services (Banking Reform) Act 2013 (FSBRA) states that “In discharging its general functions relating to payment systems the Payment Systems Regulator must, so far as is reasonably possible, act in a way which advances one or more of its payment systems objectives.”[64] It then lists three objectives: (a) the competition objective, (b) the innovation objective, and (c) the service-user objective, which are defined in the subsequent sections.[65]

Section 50 (1) of the FSBRA states that: “The competition objective is to promote effective competition in—(a) the market for payment systems, and (b) the markets for services provided by payment systems, in the interests of those who use, or are likely to use, services provided by payment systems.”

Section 50 (2) of the FSBRA states that: “The reference in subsection (1) to promoting effective competition includes, in particular, promoting effective competition— (a) between different operators of payment systems, (b) between different payment service providers, and (c) between different infrastructure providers.”

Section 50 (3) of the FSBRA states that:

The matters to which the Payment Systems Regulator may have regard in considering the effectiveness of competition in a market mentioned in subsection (1) include—

-

the needs of different persons who use, or may use, services provided by payment systems;

-

the ease with which persons who may wish to use those services can do so;

-

the ease with which persons who obtain those services can change the person from whom they obtain them;

-

the needs of different payment service providers or persons who wish to become payment service providers;

-

the ease with which payment service providers, or persons who wish to become payment service providers, can provide services using payment systems;

-

the ease with which payment service providers can change the payment system they use to provide their services;

-

the needs of different infrastructure providers or persons who wish to become infrastructure providers;

-

the ease with which infrastructure providers, or persons who wish to become infrastructure providers, can provide infrastructure for the purposes of operating payment systems;

-

the needs of different operators of payment systems;

-

the ease with which operators of payment systems can change the infrastructure used to operate the payment systems;

-

the level and structure of fees, charges or other costs associated with participation in payment systems;

-

the ease with which new entrants can enter the market;

-

how far competition is contributing to the development of efficient and effective infrastructure for the purposes of operating payment systems;

-

how far competition is encouraging innovation.

Section 51 (1) of the FSBRA states that: “The innovation objective is to promote the development of, and innovation in, payment systems in the interests of those who use, or are likely to use, services provided by payment systems, with a view to improving the quality, efficiency and economy of payment systems.” While Section 51 (2) states that: “The reference in subsection (1) to promoting the development of, and innovation in, payment systems includes, in particular, a reference to promoting the development of, and innovation in, infrastructure to be used for the purposes of operating payment systems.”

Section 52 of the FSBRA states that: “The service-user objective is to ensure that payment systems are operated and developed in a way that takes account of, and promotes, the interests of those who use, or are likely to use, services provided by payment systems.”

It is thus clear that, in principle, the PSR has a broad remit to investigate the functioning of payment systems. As such, it could undertake a broad review that considers the dynamic competition described earlier in this brief.

B. The Market Reviews

Despite the PSR’s broad remit, it has chosen instead to undertake two very narrow market reviews. There is a grave danger that, in so doing, it will misconstrue the nature of the market for payments.

One is reminded of the rather wonderful 1986 “points of view” TV advertisement for The Guardian newspaper.[66] The ad began with a brief clip, from one angle, of a skinhead apparently running away from something. This was followed by a clip of the skinhead from another angle which shows him apparently trying to steal a besuited gentleman’s briefcase. Then, finally, we were shown an aerial view in which one can see that the skinhead is actually trying to save the other man from being crushed by a pallet of falling bricks. The point being that, if a policeman or other bystander had intervened to stop the skinhead on the presumption that he had committed or was about to commit a crime, based on seeing the situation only from the perspective of the first or second clips, the man in the suit might well have died or been grievously injured. As the advert notes at the end, “It’s only when you get the whole picture you can fully understand what’s going on.”

1. Market review of UK-EEA cross-border interchange fees

In the case of the market review of UK-EEA consumer cross-border interchange fees, the PSR states:

We want to understand the rationale for and the impact of the rises in CNP IF levels for UK-EEA consumer debit and credit CNP transactions. We are concerned that the ability of Mastercard and Visa to increase these fees is an indication that there are market(s) which are not working well and may not support our statutory competition, innovation or service-user objectives.[67]

Here, the PSR seems to have assumed that an increase in prices is prima facie evidence of market failure. But a mere rise in prices does not provide such evidence. The fact is that, following the introduction of the IFR and prior to Brexit, the IFs were set by the EU, not by the market. Since then, domestic rates have been regulated at the same levels,[68] making it more likely that those IFs were (and, within the EEA, still are) not set at a level that reflects an optimal balance for the payments ecosystem.

Where prices for CNP IFs are set by market participants, they are generally higher than for card-present transactions. This is a straightforward consequence of the higher risks of fraud associated with CNP transactions.[69] Meanwhile, in markets where IFs for international transactions are set by market participants, those IFs include a premium to cover additional costs associated with operating the international system, as well as the higher counterparty risks (fraud and default) associated with such transactions. This leads to two conclusions:

- The appropriate prima facie assumption of the PSR, in response to the increase in IFRs for UK-EEA CNP transactions, should have been that it is a sign that the market is working well—e., the very opposite of the assumption that the PSR seems to have made.

- To investigate the appropriateness or otherwise of any IFR, it is necessary to understand fully the market in which it is being applied. In this case, the market is the entire global payments system, since UK-EEU transactions are but a tiny fraction of that system, which as discussed above has evolved over decades. At the very least, it entails a full analysis of both CNP and UK-EEA payments systems, not merely the narrow aspect of (and costs associated with) UK-EEA interchange fees.

2. Market review of card scheme and processing fees.

In the case of the market review of cards’ scheme and processing fees, the PSR states:

We found that scheme and processing fees (which we referred to as ‘scheme fees’ in the market review) paid by acquirers increased significantly over the period 2014 to 2018 as shown in Figure 1.5 We also found that a substantial proportion of these increases are not explained by changes in the volume, value or mix of transactions.[70]

The PSR has decided emphatically to focus narrowly on how Mastercard and Visa set scheme and processing fees:

We will assess the factors that may influence and constrain how Mastercard and Visa set scheme and processing fees, and the impact of this. Such factors may include:

-

The extent of any barriers to entry or network effects involved in setting up and running card payment systems, which alone or in combination may mean that Mastercard and Visa face limited constraints when it comes to setting scheme and processing fees.

-

Whether Mastercard and Visa have a ‘must take’ status for merchants, which may mean that Mastercard and Visa face limited constraints from the ability of merchants (and their acquirers) to exercise choice about their acceptance when setting acquirer scheme and processing fees.[71]

Meanwhile, the PSR has already ruled out any consideration of the wider payments ecosystem, noting:

A number of comments in the consultation asked us to consider extending the market review to charges levied by other participants in the payments ecosystem (other card schemes, and other payment methods, including digital wallets). We agree that constraints from other participants and other payment methods could play an important role in Mastercard’s and Visa’s decisions about card scheme and processing fees. The scope of the market review we proposed in our draft ToR, however, would assess competitive constraints that may arise from other participants than Visa and Mastercard, to the extent this applies. We, therefore, do not think that it is necessary to extend the scope of the market review; and so, our market review will focus on card scheme and processing fees.[72]

This is troubling because, as discussed above, the payment systems in the UK and globally have evolved over many decades in such a way as to balance the two sides of the market: merchants on one side and consumers on the other. The fees charged by payment systems reflect this balance, not only within the card-payments ecosystem but also within the wider payments ecosystem of which card payments are only a relatively small part—about 11% in the UK.[73] Moreover, the scheme fees that appear to be a specific focus of the market review are only a small part of the total fees paid during a transaction. Visa offers the following example: when a consumer purchases a jumper for £30 at a small retailer using a Visa card, the MSC would be around £0.63, of which the scheme fee would be about £0.01.[74] So, the question is: why is the PSR focusing on a fee that makes up only 1.6% of the transaction fee and only 0.03% of the total transaction amount?

By seeking to investigate only a subset of card fees and not all the fees—which would necessitate also considering the effects of any adjustments to such fees on related offerings (such as rewards and cobranded cards, insurance, security upgrades, and new payment modes), let alone the wider payments ecosystem)—the PSR precludes a proper analysis of whether the market is operating efficiently.

In sum, intentionally or otherwise, the statements made by the PSR with respect to the terms of reference (ToR) for both market reviews look very much like the regulator has already decided its conclusions and is now looking for evidence to support its case, while expressly avoiding evidence that might point to other conclusions. They are classic examples of asking the wrong question and therefore getting the wrong answer.

V. Conclusions

Payment systems have developed through a process of dynamic competition that has led to the emergence of extraordinarily complex and finely balanced ecosystems featuring an increasingly wide array of innovative technologies, incentives, and business models. As such, it is a little odd that the PSR should have chosen to undertake several discrete and very narrow reviews, rather than a more comprehensive review.

If the PSR were to undertake a more comprehensive review of payments, which would be more consistent with its remit under the FSBR, it might extend that to the wider payments ecosystem, of which card payments are only a relatively small part—approximately 11% in the UK, if larger payments made over CHAPS are excluded.

Despite stating—in the final ToR for the market review of card schemes and processing fees—that it does not intend to extend the market review, it left a window open by stating: “We expect our thinking to develop over the course of the market review, including the possibility that further issues or areas of analysis are added (if they relate to potential harm to competition, innovation or service users) or some issues are dropped.”[75] One can only hope that such thinking extends to a fuller examination of the payments ecosystem. If the PSR were to adopt such an approach, it might also drop the even more absurdly narrow market review of UK-EEA consumer cross-border interchange fees, a fuller (proper) review of which would entail looking not only at payments in the UK, but also internationally.

[1] Market Review of UK-EEA Consumer Cross-Border Interchange Fees, Payment System Regulator (Jun. 21, 2022), https://www.psr.org.uk/publications/market-reviews/mr22-2-1-market-review-of-uk-eea-consumer-cross-border-interchange-fees.

[2] Market Review of Card Scheme and Processing Fees, Payment System Regulator (Jun. 21, 2022), https://www.psr.org.uk/publications/market-reviews/mr22-1-1-market-review-of-card-scheme-and-processing-fees.

[3] Id.

[4] Todd J. Zywicki, The Economics of Credit Cards, 3 Chap. L. Rev. 79, 7 (2000), available at https://digitalcommons.chapman.edu/chapman-law-review/vol3/iss1/6.

[5] Snapshot of Payments in the UK Over Time, Payment Systems Regulator (Jan. 2, 2022), available at https://www.psr.org.uk/media/20ob5wee/payments-over-time.pdf.

[6] William F. Baxter, Bank Interchange of Transactional Paper: Legal and Economic Perspectives, 26 J. L. & Econ. 541 (1983); Jean-Charles Rochet & Jean Tirole, Two-Sided Markets: A Progress Report, 37 Rand J. Econ. 645 (2006); see also, Todd J. Zywicki, The Economics of Payment Card Interchange Fees and the Limits of Regulation, International Center for Law & Economics, ICLE Financial Regulatory Program White Paper Series (Jun. 2, 2010), available at http://laweconcenter.org/images/articles/zywicki_interchange.pdf.

[7] Bruno Jullien, Alessandro Pavan, & Marc Rysman, Two-Sided Markets, Pricing, and Network Effects, 4 Handbook of Indus. Org. 485-592 (2021).

[8] Thomas Eisenmann, Geoffrey Parker, & Marshall W. Van Alstyne, Strategies for Two-Sided Markets, Harv. Bus. Rev. (Oct. 2006), https://hbr.org/2006/10/strategies-for-two-sided-markets.

[9] David L. Stearns, Think of it as Money: A History of the VISA Payment System, 1970–1984, PhD Thesis, University of Edinburgh, at 42–43; Timothy Wolters, Carry Your Credit in Your Pocket: The Early History of the Credit Card at Bank of America and Chase Manhattan, 1 Enterprise & Society 315, (2000).

[10] In some cases, the interchange fee is established bilaterally by agreement between issuers and acquirers. The default interchange fee applies when such agreements are not in place.

[11] See, e.g., UK Payment Processing Companies & Merchant Account Providers, MerchantSavvy, https://www.merchantsavvy.co.uk/payment-processors (last visited Feb. 22, 2023).

[12] PSR, supra note 1, at 13.

[13] Zywicki, supra note 6.

[14] For example, 10 EU members had a domestic card scheme in 2018: Card Payments in Europe- Current Landscape and Future Prospects, European Central Bank (Apr. 2019), https://www.ecb.europa.eu/paym/intro/mip-online/2019/html/1904_card_payments_europe.en.html.

[15] PSR, supra note 2, at 7.

[16] Payment and Settlement Statistics, Bank of England (Feb. 16, 2023), https://www.bankofengland.co.uk/payment-and-settlement/payment-and-settlement-statistics.

[17] BACS Monthly Volumes and Values 1990-2022, Pay.uk (2023), https://newseventsinsights.wearepay.uk/media/iyral1oo/historical-monthly-payment-statistics-1990-to-dec-2022.xls.

[18] Card Spending, UK Finance (Feb. 16, 2023), https://www.ukfinance.org.uk/data-and-research/data/card-spending.

[19] Emily Sherman & Holly Johnson, Understanding Third-Party American Express Cards, credicards.com (Mar. 30, 2022), https://www.creditcards.com/card-advice/american-express-third-party-cards.

[20] Diners Club History, Diners Club International, https://www.dinersclub.com/about-us/history (last visited Feb. 22, 2023).

[21] Who We Are, American Express, https://about.americanexpress.com/our-company/who-we-are/who-we-are/default.aspx (last visited Feb. 22, 2023).

[22] Stearns, supra note 9.

[23] Id.

[24] Id.

[25] Dave Ahern, The Amazing Story of Mastercard: History and Making Money, eB (Nov. 10, 2021), https://einvestingforbeginners.com/the-history-of-mastercard-daah/#:~:text=of%20America%2C%20ironically.-,How%20Did%20Mastercard%20Start%3F,became%20known%20globally%20as%20Visa.

[26] Brand History, Mastercard, https://brand.mastercard.com/brandcenter/more-about-our-brands/brand-history.html (last visited Feb. 22, 2023).

[27] 1963: American Express Comes to Britain, BBC, http://news.bbc.co.uk/onthisday/hi/dates/stories/september/10/newsid_3031000/3031968.stm (last visited Feb. 22, 2023).

[28] Id.

[29] Id.

[30] Stearns, supra note 9, at 120.

[31] BBC, supra note 27.

[32] Stearns, supra note 9, at 120.

[33] Id. at 131.

[34] Id. at 180.

[35] Eurocard (Credit Card), Wikipedia, https://en.wikipedia.org/wiki/Eurocard_(credit_card) (last visited Feb. 22, 2023).

[36] History 1966-72, Access, https://www.accesscreditcard.info/history66-72.aspx (last visited Feb. 22, 2023).

[37] History 1973-77, Access, https://www.accesscreditcard.info/history73-77.aspx (last visited Feb. 22, 2023).

[38] Paul Doocey, MasterCard and Europay Merge to Form a Global Payments Company, BankTech (Jul. 16, 2002), https://www.banktech.com/payments/mastercard-and-europay-merge-to-form-a-global-payments-company/d/d-id/1288945.html.

[39] Sean Brierley, Mastercard and UK Banks Strike 40m Access Deal, MarketingWeek (Apr. 19, 1996), https://www.marketingweek.com/mastercard-and-uk-banks-strike-40m-access-deal.

[40] EMV 3-D Secure, EMVCo, https://www.emvco.com/emv-technologies/3-d-secure (last visited Feb. 22, 2023).

[41] Raynor de Best, Total Number of In-Store Debit or Credit Card Payments that Are Contactless, or Done with NFC, in the United Kingdom (UK) from January 2015 to October 2021, Statista (Jan. 11, 2023), https://www.statista.com/statistics/488054/number-of-contactless-cards-transactions-united-kingdom.

[42] David Bounie & Youssouf Camara, Card-Sales Response to Merchant Contactless Payment Acceptance, 119 J. of Banking & Fin. 105938 (Oct. 2020), available at https://www.sciencedirect.com/science/article/abs/pii/S0378426620302004; Emma Marie Fleck & Michael E. Ozlanski, Cash: Never Leave Home with It? 17 The CASE J. 182–201 (2021), available at https://www.emerald.com/insight/content/doi/10.1108/TCJ-06-2019-0055/full/html.

[43] Adrian Buckle, The Impact of Covid-19 on UK Card Payments In 2020, UK Finance (Jun. 16, 2021), https://www.ukfinance.org.uk/news-and-insight/blogs/impact-covid-19-uk-card-payments-2020.

[44] UK’s First Major Rollout of CEMV Outside of London Commences in Oxfordshire, VIX Technology (Nov. 14, 2016), https://vixtechnology.com/press-release/uks-first-major-rollout-of-cemv-outside-of-london-commences-in-oxfordshire; Dan Balaban, UK Transit Agency Plans London-Style Multimodal Contactless System with Fare Capping, Mobility Payments (Sep. 12, 2022), https://www.mobility-payments.com/2022/09/12/uk-agency-plans-london-style-multimodal-contactless-system-with-fare-capping.

[45] Stearns, supra note 9.

[46] Protection You Need, Peace of Mind You Deserve, PayPal, https://www.paypal.com/us/webapps/mpp/paypal-safety-and-security (last visited Feb. 22, 2023).

[47] Add Cards and Banks, PayPal, https://www.paypal.com/us/digital-wallet/ways-to-pay/add-payment-method (last visited Feb. 22, 2023).

[48] Buy Now, Pay Later with PayPal, PayPal, https://www.paypal.com/us/digital-wallet/ways-to-pay/buy-now-pay-later (last visited Feb. 22, 2023).

[49] Erin Gregory, How Does Buy Now Pay Later (BNPL) Work for Businesses?, Techradar (Mar. 4, 2022), https://www.techradar.com/features/how-does-buy-now-pay-later-bnpl-work-for-businesses; Jaros?aw ?ci?lak, Top 10 Buy Now Pay Later Companies to Watch in 2022, Code & Pepper (May 8, 2022), https://codeandpepper.com/buy-now-pay-later-2022.

[50] Square, Inc. Announces Plans to Acquire Afterpay, Strengthening and Enabling Further Integration Between Its Seller and Cash App Ecosystems, Square (Aug. 1, 2021), https://squareup.com/us/en/press/square-announces-plans-to-acquire-afterpay; Bring in More Business with Buy Now, Pay Later, Square, https://squareup.com/us/en/buy-now-pay-later (last visited Feb. 22, 2023).

[51] John Stewart, As Consumers Embrace BNPL, Square Brings It to the U.K. Across All Platforms, Digital Transactions (Aug. 23, 2022), https://www.digitaltransactions.net/as-consumers-embrace-bnpl-square-brings-it-to-the-u-k-across-all-platforms.

[52] Buy Now, Pay Later, Stripe, https://stripe.com/docs/payments/buy-now-pay-later (last visited Feb. 22, 2023).

[53] Id.

[54] Bring in More Business with Buy Now, Pay Later, Square, https://squareup.com/us/en/buy-now-pay-later (last visited Feb. 22, 2023).

[55] Id.

[56] Free Your Cash Flow with Flexipay, Funding Circle, https://www.fundingcircle.com/uk/payments/flexipay (last visited Feb. 22, 2023).

[57] £1 Million Faster Payments Now Possible, Pay.UK (Feb. 10, 2022), https://newseventsinsights.wearepay.uk/media-centre/press-releases/1-million-faster-payments-now-possible.

[58] Julian Morris, Is Pix Really the End of Credit Cards?, Truth on the Market (Sep. 28, 2022), https://truthonthemarket.com/2022/09/28/is-pix-really-the-end-of-credit-cards.

[59] PSR Finalizes Plans for Wider Implementation of Fraud Prevention Tool, Confirmation of Payee, Payment Systems Regulator, https://www.psr.org.uk/news-and-updates/latest-news/news/psr-finalises-plans-for-the-wider-implementation-of-fraud-prevention-tool-confirmation-of-payee/#:~:text=account%20to%20another.-,Confirmation%20of%20Payee,details%20provided%20by%20a%20payer (last visited Feb. 22, 2023).

[60] PSR Sets Out Proposals to Give Greater Protection Against APP Scams, Payment Systems Regulator (Nov. 25, 2022), https://www.psr.org.uk/news-and-updates/latest-news/news/psr-sets-out-proposals-to-give-greater-protection-against-app-scams.

[61] MasterCard Biometric Card Driving Cardholder Security and Convenience, MasterCard, https://www.mastercard.us/en-us/business/overview/safety-and-security/authentication-services/biometrics/biometrics-card.html (last visited Feb. 22, 2023); Fingerprint Authentication Moves from Phones to Payment, Visa, https://usa.visa.com/visa-everywhere/security/biometric-payment-card.html (last visited Feb. 22, 2023).

[62] Kimberly Palmer & Melissa Lambarena, Buy Now, Pay Later Already Comes Standard on Many Credit Cards, Nerdwallet (Dec. 9, 2022), https://www.nerdwallet.com/article/credit-cards/buy-now-pay-later-is-already-standard-on-some-credit-cards.

[63] Supra Section III.

[64] Financial Services (Banking Reform) Act 2013, c. 33, §49 (UK).

[65] Id.

[66] The Guardian, Cannes Lion Award-Winning “Three Little Pigs Advert”, YouTube (Feb. 29, 2012), https://www.youtube.com/watch?v=_SsccRkLLzU.

[67] PSR, supra note 1, at 7.

[68] The Interchange Fee (Amendment) (EU Exit) Regulations 2019, SI 2019/284, https://www.legislation.gov.uk/uksi/2019/284/contents.

[69] Board of Governors of the Federal Reserve System, Changes in U.S. Payments Fraud from 2012 to 2016, Federal Reserve (Oct. 2018), https://www.federalreserve.gov/publications/2018-payment-systems-fraud.htm.

[70] PSR, supra note 2, at 5.

[71] Id. at 10.

[72] Id. at 7.

[73] See Section III above.

[74] Paying with Visa: How Retailers and Consumers Benefit, Visa (Oct. 22, 2020), https://www.visa.co.uk/visa-everywhere/blog/bdp/2020/10/20/what-happens-when-1603211979840.html.

[75] PSR, supra note 1, at 11.